Shares of Paytm operator One97 Communications Ltd. continued their fall for the second consecutive session on Friday after the RBI's restriction on Paytm Payments Bank triggered an avalanche of events.

On Friday, SoftBank Group Corp. sold majority of its stake in Paytm before regulatory scrutiny caused the Indian fintech firm's shares to dive, SoftBank Vision Fund Executive Managing Partner Navneet Govil told Bloomberg.

NDTV Profit in an exclusive report said Paytm Payments Bank board member and Independent Director, Manju Agarwal, had resigned with effect from Feb. 1.

Since the Reserve Bank of India imposed restrictions on Paytm Payments Bank, Agarwal didn't see any real future for the bank, according to people with knowledge of the mater told NDTV Profit on condition of anonymity.

Adding to this, a circular said that the Employees Provident Fund Organisation will stop accepting claims linked to Paytm Payments Bank Ltd. accounts from Feb. 23, following the RBI's curbs.

Meanwhile, Paytm E-commerce has changed its name to Pai Platforms and has acquired Bitsila, a seller platform on ONDC, gaining share in the online retail business, reported PTI. The platform supports marquee brands like McDonald's and BigBasket on ONDC.

On Thursday, the stock hit 10% lower circuit limit after RBI Deputy Governor Swaminathan Janakiraman said supervisory action was required on the Paytm Payments Bank to safeguard consumer interests, during the monetary policy meeting on Thursday.

The stock has lost nearly 21% since Jan. 31, when the RBI announced that it had found major supervisory concerns and persistent non-compliance of norms from the company's payment banks.

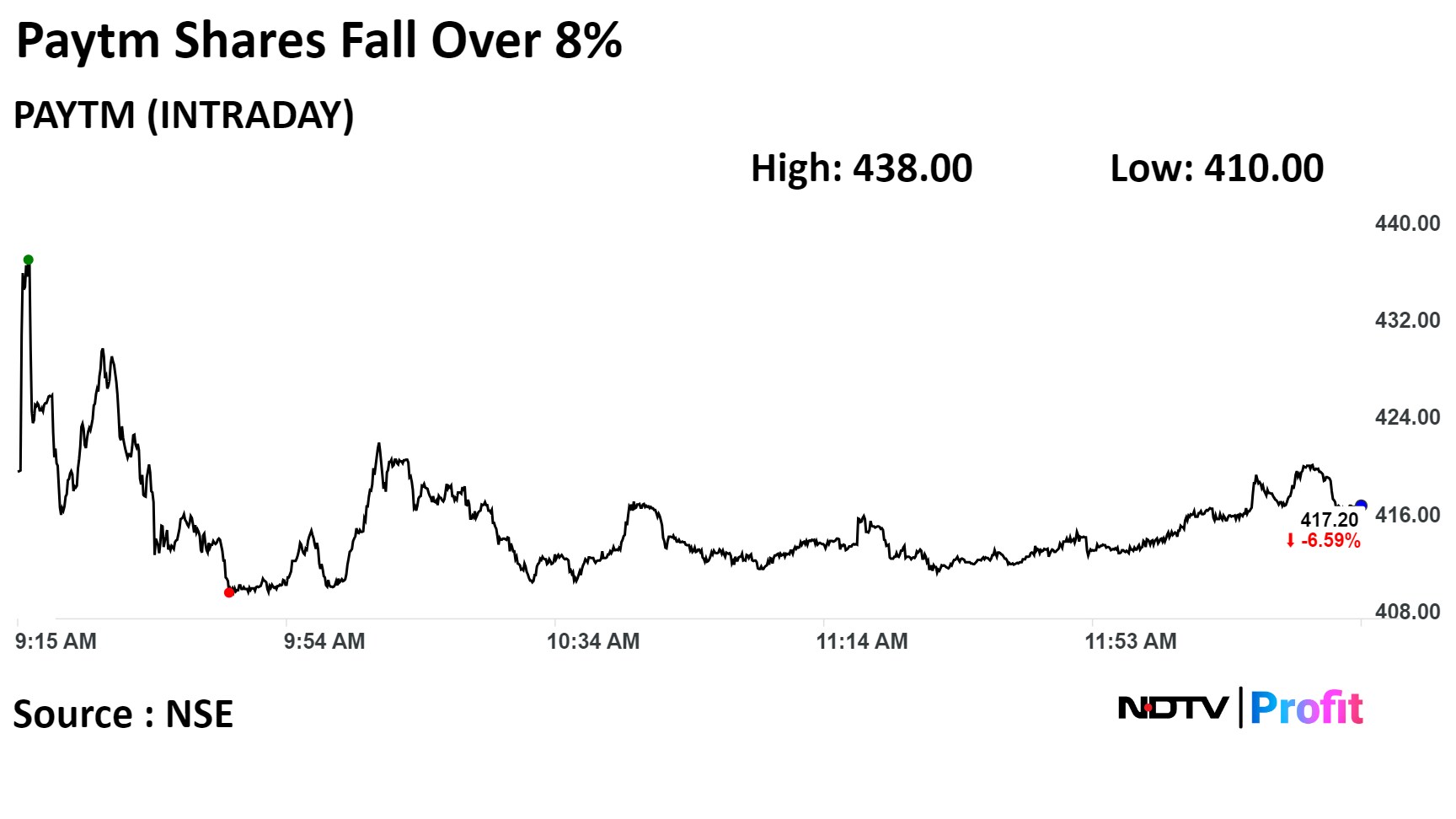

Shares of One97 Communications Ltd. fell as much as 8.21%, the lowest level since Feb. 6., before paring loss to trade 6.41% lower at 12:37 p.m. This compares to a 0.1% advance in the NSE Nifty 50.

The stock has fallen 29.95% in the last 12 months. Total traded volume so far in the day stood at 1.20 times its 30-day average. The relative strength index was at 24.60, indicating that the stock may be oversold.

Of 15 analysts tracking the company, six maintain a 'buy' rating, four suggest a 'hold', and five suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 73.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.