Paytm operator One97 Communications Ltd.'s share price dropped by over 3% during early trading on Tuesday, after the Enforcement Directorate issued a notice against it for alleged violations amounting to Rs 611 crore.

The ED announced on Monday it had issued the notice to One97 Communications Ltd., its managing director Vijay Shekhar Sharma, and associated entities for “contraventions” of the Foreign Exchange Management Act. The notice comes after the completion of an investigation and precedes the initiation of adjudication proceedings under the law.

In response to the notice, a Paytm spokesperson stated that the company is working to resolve the matter in accordance with laws and regulatory processes.

The show-cause notice has also been issued to Paytm's other subsidiaries, including Little Internet Pvt. and Nearbuy India Pvt., according to the ED statement.

It has been alleged that One97 Communications Ltd. made foreign investments in Singapore, but failed to file the required reports with the Reserve Bank of India for establishing an overseas step-down subsidiary. Additionally, the company allegedly received foreign direct investment from overseas investors, without adhering to the RBI's stipulated pricing guidelines.

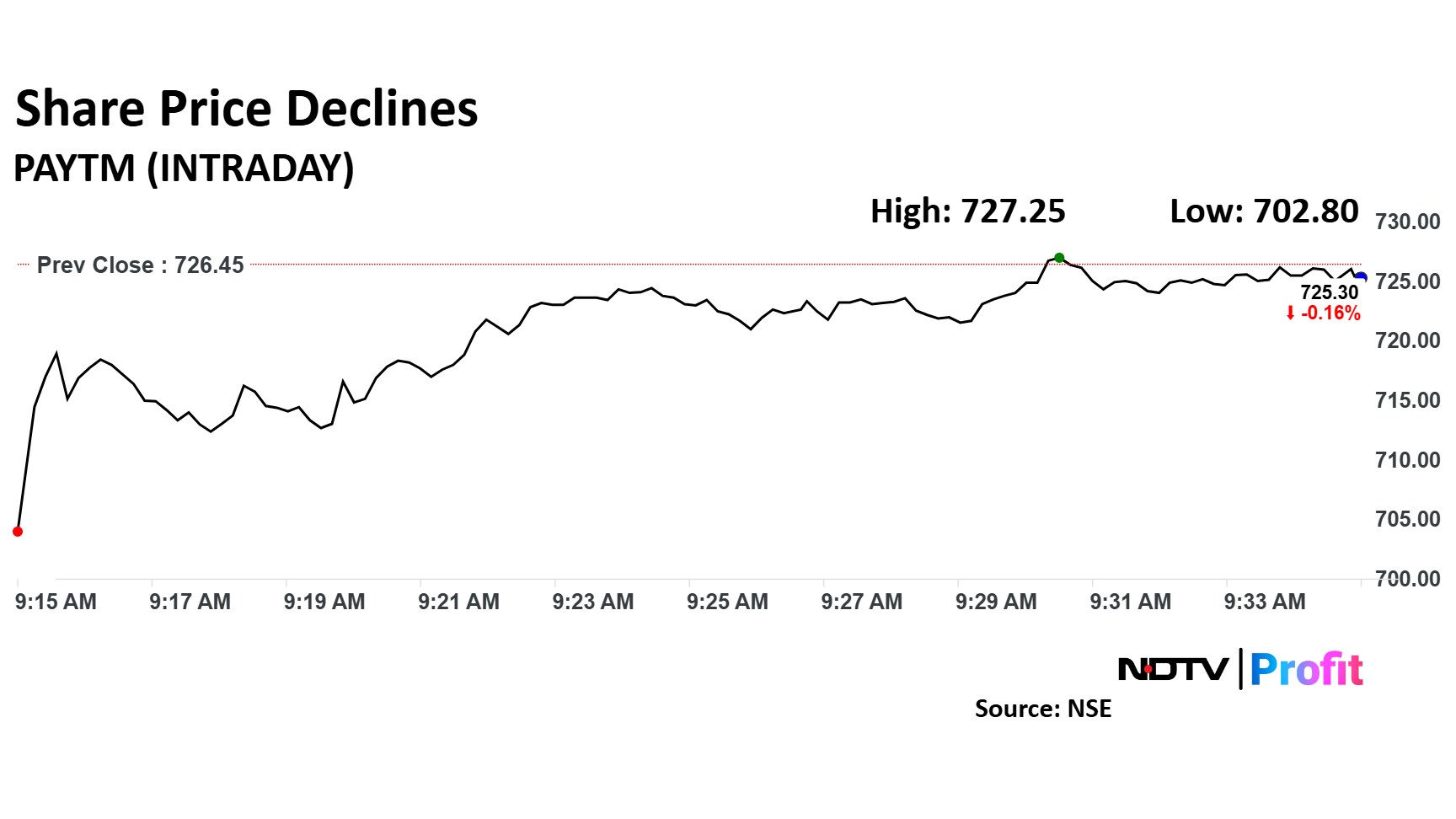

Paytm Share Price Today

The scrip fell as much as 3.26% to Rs 702 apiece. It pared losses to trade 0.44% lower at Rs 723.25 apiece, as of 09:38 a.m. This compares to a 0.33% decline in the NSE Nifty 50.

It has risen 72.94% in the last 12 months. The relative strength index was at 39.

Out of 19 analysts tracking the company, nine maintain a 'buy' rating, six recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 33.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.