Shares of Paytm-parent One97 Communications Ltd. fell over 4% after multiple large trades on Tuesday.

Stock worth Rs 2,380 crore changed hands in multiple large trade order. While the buyers and sellers in the trade were not known, NDTV Profit on Monday reported that China's Alibaba Group is to reduce its stake in Paytm.

Alibaba Group affiliate Ant Group-backed Antfin Netherlands Holding BV will float 2.6 crore shares, which represents 4% equity, according to terms viewed by NDTV Profit.

The floor price for each share was set at Rs 809.75, a 6.5% discount to Monday's closing. The Paytm block deal aggregates to Rs 2,065 crore, based on the minimum price. Multinational investment banks Citigroup and Goldman Sachs are the merchants for this deal.

Antfin owned 9.85% equity in Paytm as of March 2025, according to shareholding pattern data on the BSE. In August 2023, the Chinese technology conglomerate divested a nearly 3.6% stake for Rs 2,037 crore.

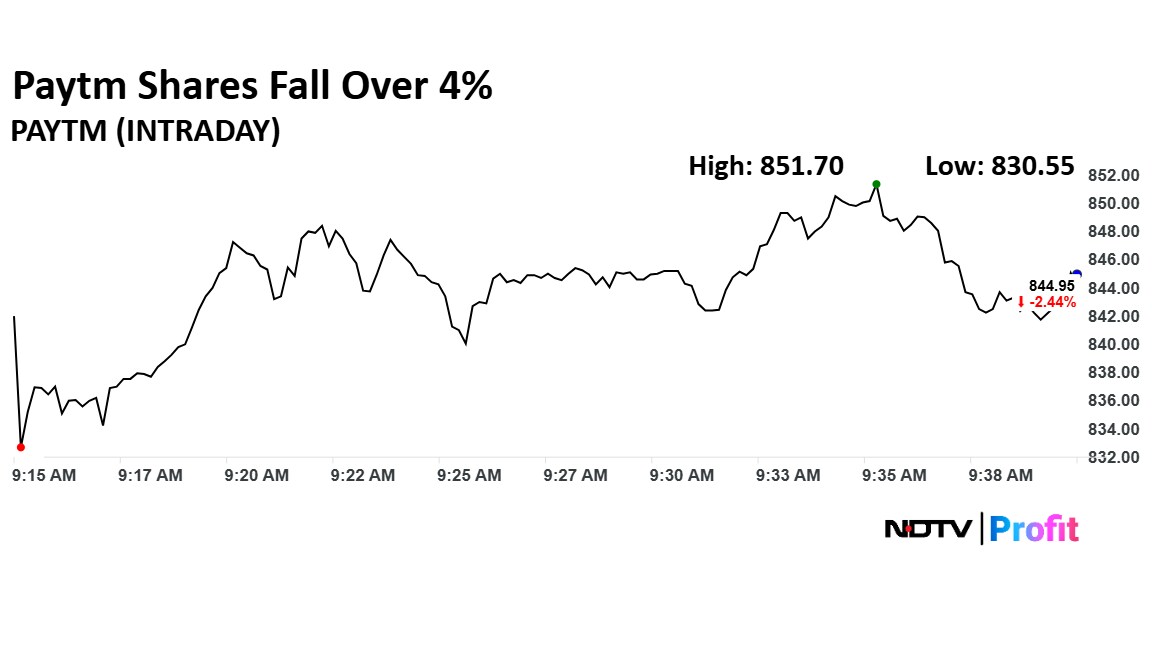

Paytm Share Price Falls

Shares of Paytm fell as much as 4.10% to Rs 830.55 apiece, the lowest level since May 9. It pared losses to trade 2% lower at Rs 849 apiece, as of 9:37 a.m. This compares to a 0.49% decline in the NSE Nifty 50.

The stock has risen 145.24% in the last 12 months and fallen 16.73% year-to-date. Total traded volume so far in the day stood at 72 times its 30-day average. The relative strength index was at 48.16.

Out of 19 analysts tracking the company, nine maintain a 'buy' rating, seven recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 11.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.