(Bloomberg) -- Oil prices rallied with traders betting that China will further ease Covid restrictions and US government data showing crude stockpiles plummeted amid record export demand.

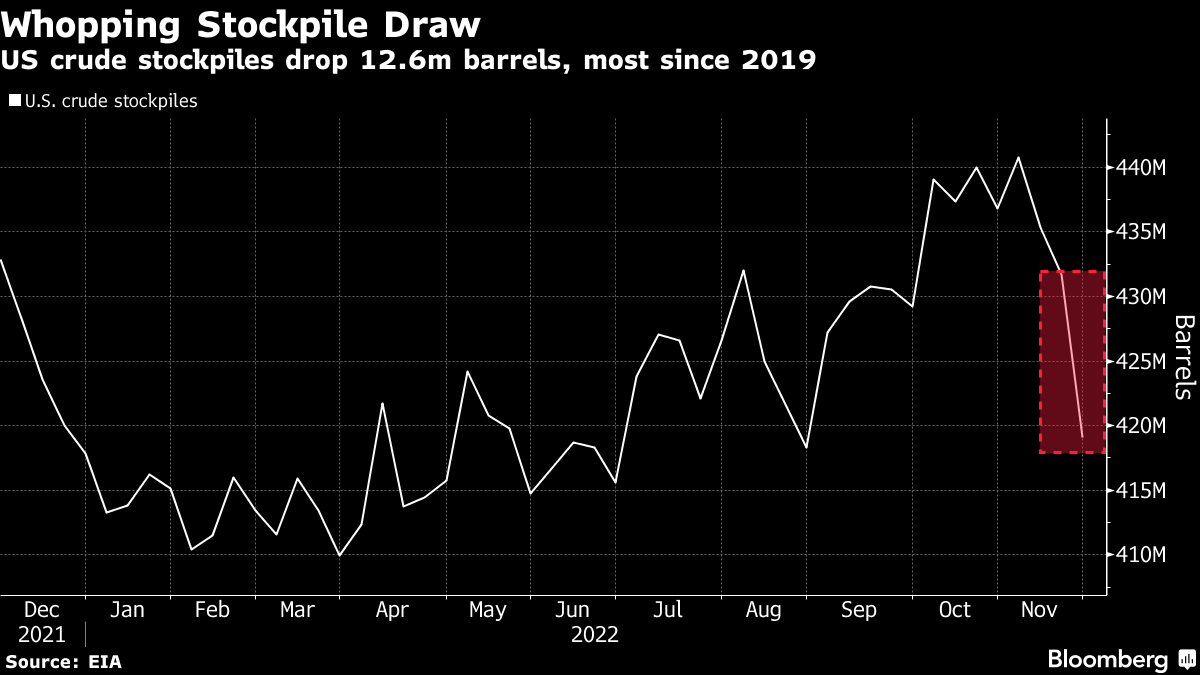

West Texas Intermediate rose 3% to settle above $80 a barrel on Wednesday. The trading session opened higher after China adjusted Covid-19 rules in two major cities, Guangzhou and Zhengzhou, replacing broad lockdowns with more targeted limitations. Supporting the rally, US crude inventories fell by 12.6 million barrels last week, even more than expected, representing the biggest decline since June 2019, according to Energy Information Administration data. The draw coincided with US exports of crude and refined products rising to a record.

“If China's Covid rules are slowly eased and OPEC stays the course, crude prices could rally another 5-10% here,” said Ed Moya, senior market analyst at Oanda Corp.

Markets have experienced intense headline volatility the last few sessions in advance of the meeting this weekend between the Organization of Petroleum Exporting Countries and its allies. Signs of an oversupplied market in recent weeks briefly pushed prices to lows not seen since last year, leading to speculation that the production cartel could cut output further to tighten supplies. While deeper supply cuts may still be discussed, many analysts expect the group will hold production steady.

Traders say that while bullish bets in options markets have shrunk over the past two weeks, the price rally ahead of OPEC could help stall bearish sentiment that gripped the market due to rising Covid cases in China.

Elements, Bloomberg's daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.