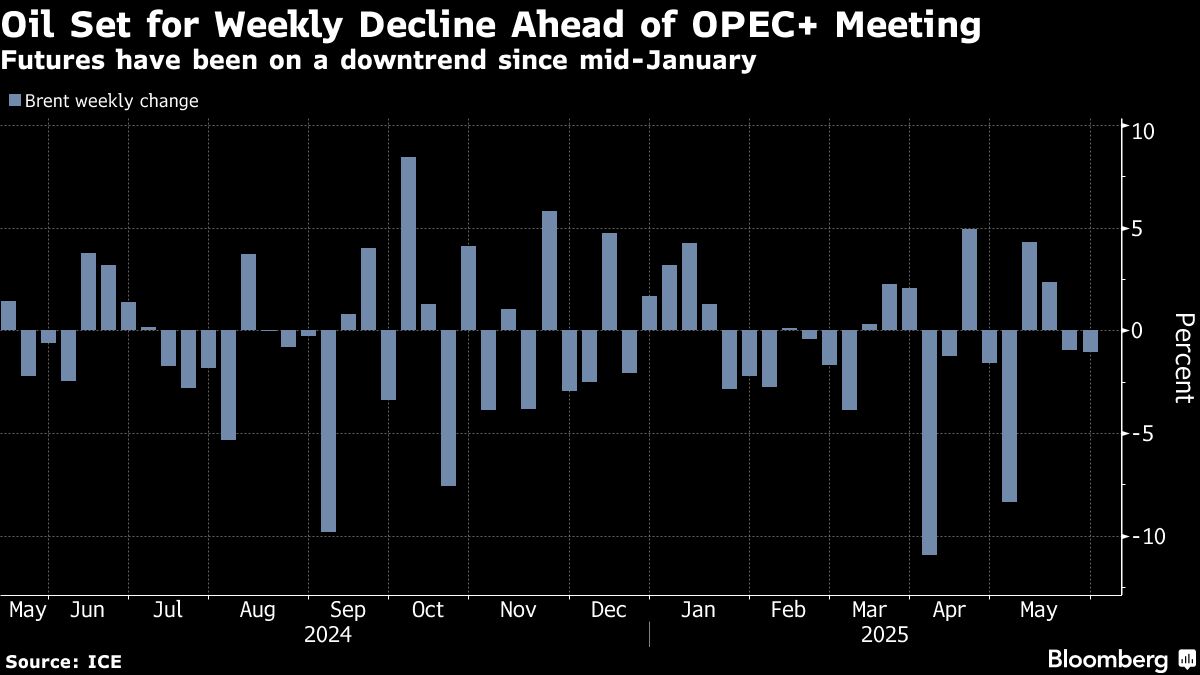

Oil was on track for a second weekly decline ahead of an OPEC+ meeting on output policy that's expected to lead to another supply hike.

Brent dipped below $64 a barrel after dropping 1.2% on Thursday, while West Texas Intermediate traded near $61. A sub-group led by Saudi Arabia is set to meet on Saturday to decide on July production levels, with preliminary talks last week discussing a third consecutive supply increase.

“Investors are eagerly waiting for OPEC's meeting on Saturday to shed light on the scale of the output hike,” said Priyanka Sachdeva, a senior market analyst for brokerage Phillip Nova Pte in Singapore. “Oil markets should brace for more volatility with risks skewed to the downside.”

The revival of idled output by OPEC and its allies at a faster-than-expected pace has raised concerns around a looming glut and helped to drag oil lower. Fears over a global economic slowdown due to President Donald Trump's tariffs and retaliatory measures has also put pressure on prices.

While Trump's sweeping tariffs have rattled global markets, they are now facing legal uncertainties. A US trade court blocked parts of the president's levies this week, deeming them illegal, although a federal appeals court has offered a temporary reprieve from the ruling.

US crude stockpiles, meanwhile, shrunk by 2.8 million barrels last week, the most in about two months, according to data from the Energy Information Administration on Thursday. Gasoline inventories also declined.

Prices:

Brent for July settlement, which expires Friday, was 0.3% lower at $63.94 a barrel as of 1:30 p.m. in Singapore.

The more-active August contract fell 0.3% to $63.14 a barrel.

WTI for July delivery slid 0.3% to $60.74 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.