Oil was steady after advancing Thursday on optimism around easing trade tensions between the US and China following a call between the leaders of the two countries.

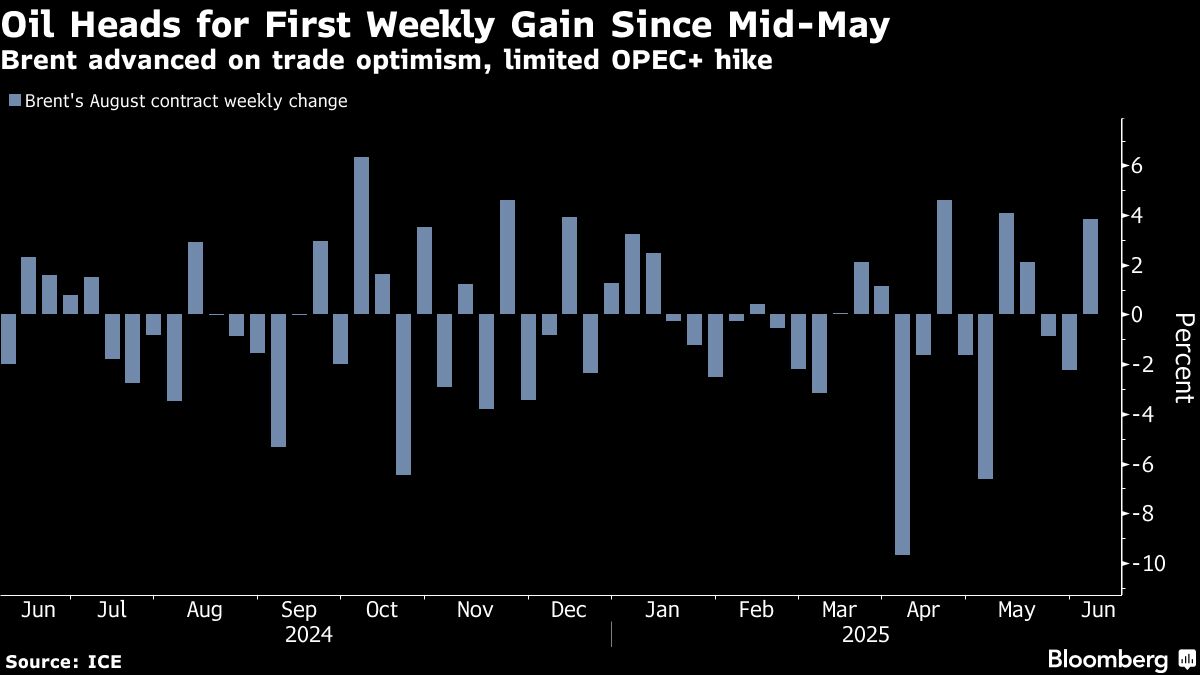

Brent traded around $65 a barrel and was on track for its first weekly gain since mid-May, while West Texas Intermediate was near $63. President Donald Trump and his Chinese counterpart, Xi Jinping, agreed to further trade talks aimed at resolving disputes over tariffs and supplies of rare earth minerals.

Oil has been buffeted in Trump's second term, losing almost a fifth since his inauguration in January, on concerns that US-led tariffs wars will sap demand. Price swings have lessened since mid-May as traders weigh the progress of trade talks, a seasonal uptick in consumption during the summer driving season, geopolitical risks in Iran and Russia and the prospect of OPEC+ returning more barrels to the market.

“Now that macro conditions have calmed down, the chances of a big panic-driven drop are lower,” said Huang Wanzhe, an analyst at Dadi Futures, “With peak demand season coming up against a background of persistent geopolitical risks, the downside for oil seems limited.”

Traders are watching whether Saudi Arabia will push for the cartel to continue with accelerated returns of shuttered-in oil supply in the coming months to regain lost market share. The Organization of the Petroleum Exporting Countries and its allies will next meet to decide on production levels on July 6.

In options markets, investors have ramped up wagers that OPEC+ output hikes will lead to an eventual glut toward the end of this year and into 2026. Open interest in calendar spread options — the difference between West Texas Intermediate crude's value over different delivery months — this week reached a record high, according to CME Group.

Prices:

Brent for August settlement slipped 0.3% to $65.15 a barrel at 12:52 p.m. in Singapore.

WTI for July delivery declined 0.3% to $63.16 a barrel

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.