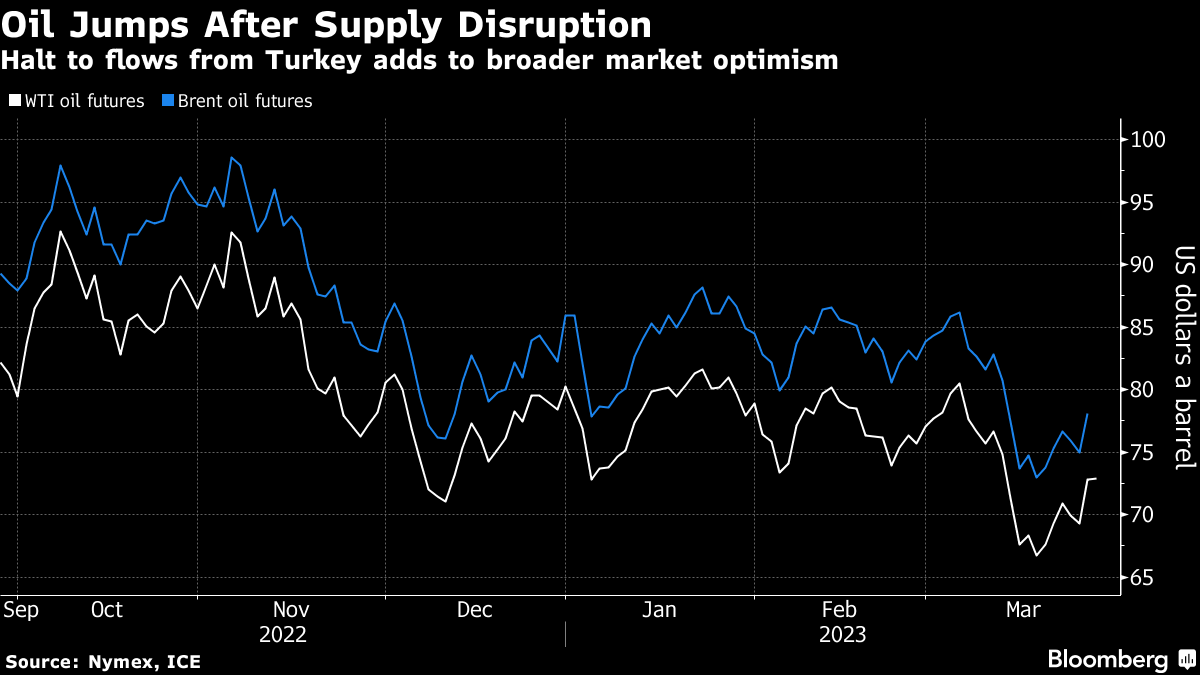

(Bloomberg) -- Oil steadied after its biggest rally of the year as a disagreement between Iraq and its Kurdish region curtailed exports, while fears over a fallout from the banking crisis receded.

West Texas Intermediate futures traded near $73 a barrel after jumping more than 5% on Monday in the steepest surge since October. A legal dispute between Iraq, its semi-autonomous region of Kurdistan and Turkey has halted around 400,000 barrels a day of flows from Ceyhan port.

“The Iraq dispute has given support to prices, but it's ultimately helped push a ball that was already rolling,” said Ole Sloth Hansen, head of commodity strategy at Saxo Bank. “Sentiment in the market has been improving as the banking crisis fades.”

Oil nonetheless remains on track for a fifth monthly decline amid concerns over a potential US recession and resilient Russian energy flows. Most market watchers are still betting that China's recovery will accelerate and boost prices later this year as demand rebounds.

Investors will be watching comments from several US Federal Reserve officials, as well as a key measure of US inflation due this week, for clues on the path forward for monetary policy. Interest-rate hikes have added to bearish sentiment.

The OPEC+ coalition is showing no signs of adjusting oil production when it meets next week, staying the course amid turbulence in financial markets, delegates said. The Joint Ministerial Monitoring Committee, which has the power to call an emergency meeting, convenes Monday.

Energy Daily, Bloomberg's energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.