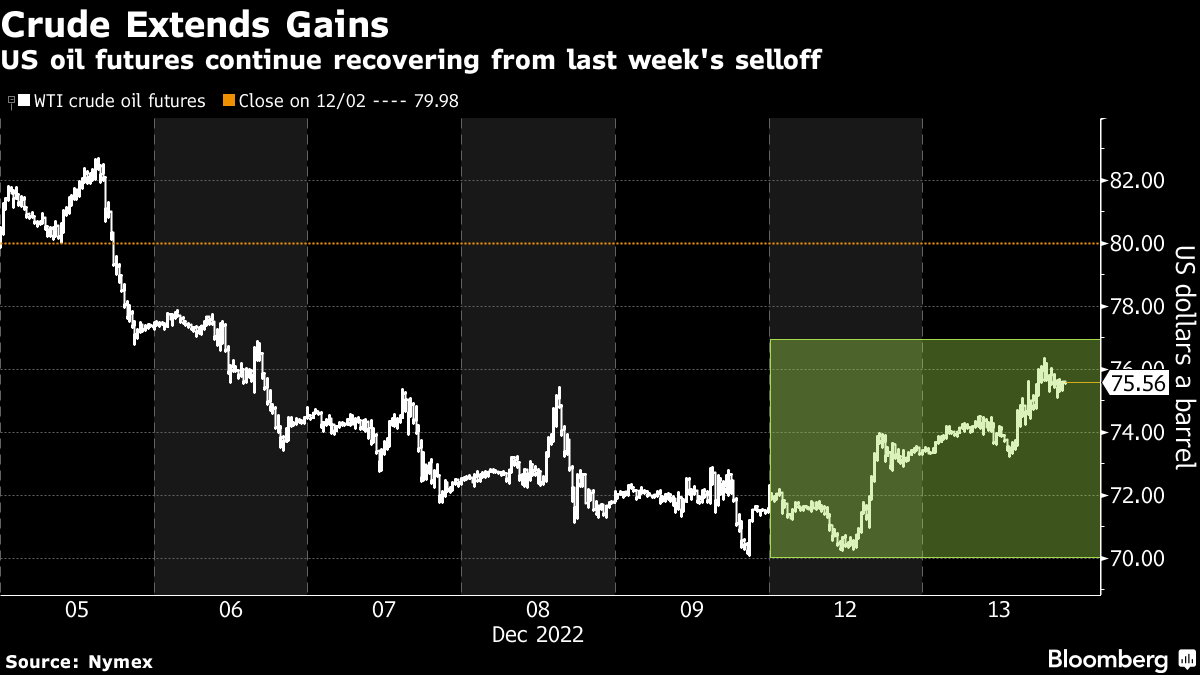

(Bloomberg) -- Oil rallied for a second day after US inflation rose less than expected and bad weather delayed initial efforts to restart a key oil pipeline.

West Texas Intermediate rose 3% to settle above $75 a barrel on Tuesday. US consumer price figures posted a smaller-than-expected gain, making traders more optimistic that the Federal Reserve will ease the pace of interest rate hikes. Compounding bullish sentiment, China's ambassador to the US said the country will continue relaxing its pandemic curbs and will welcome more international travelers soon, lifting demand prospects in the world's top oil importer.

Meanwhile, TC Energy Corp. is targeting a partial restart of the Keystone pipeline beginning Dec. 14th. News that the company still hopes to restart some operations on the major pipeline, which carries 600,000 barrels a day, injected a bearish signal into an otherwise bullish Tuesday market. With some supplies potentially coming back as soon as this week, the WTI prompt spread flipped back into contango, after briefly flirting with backwardation earlier in the session.

Crude is still on track for its first back-to-back quarterly decline since mid-2019 on concerns about the global economic outlook, with thin liquidity in the oil market exacerbating price swings. The bearish market mood has permeated so much that Goldman Sachs, a bank well-known for its bullish forecasts on crude, slashed its Brent averages for the first and second quarter of 2023 to $90 and $95 a barrel, respectively, from $110.

Elements, Bloomberg's daily energy and commodities newsletter, is now available. Sign up here.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.