The shares of Oberoi Realty Ltd. fell over 7% on Tuesday despite the company reporting a 72% jump in net profit. Several brokerages pointed to a slowdown in project velocity and a miss on pre-sales expectations.

The real estate player's profit rose to Rs 618.4 crore in the quarter ended December, according to an exchange filing on Monday. The company's revenue rose 34% to Rs 1,411 crore as compared to Rs 1,053.6 crore in the corresponding quarter of the previous fiscal.

Oberoi Realty's recent performance has sparked mixed reactions from analysts, with some brokerages expressing caution while others remain optimistic about the company's outlook.

Axis Capital maintained a 'Reduce' rating with a target price of Rs 1,805, citing weaker-than-expected bookings of Rs 1,920 crore in Q3, falling short of the Rs 3,000 crore target. Weak bookings for Three Sixty West contributed to the miss.

Similarly, Morgan Stanley kept an 'Equal-weight' rating with a target price of Rs 2,060, noting a 24% miss in pre-sales due to lower Three Sixty West bookings.

UBS maintained a 'Neutral' rating with a target price of Rs 2,230, driven by strong Pokhran Road sales, while Nomura remained bullish with a 'Buy' rating and a target price of Rs 2,500.

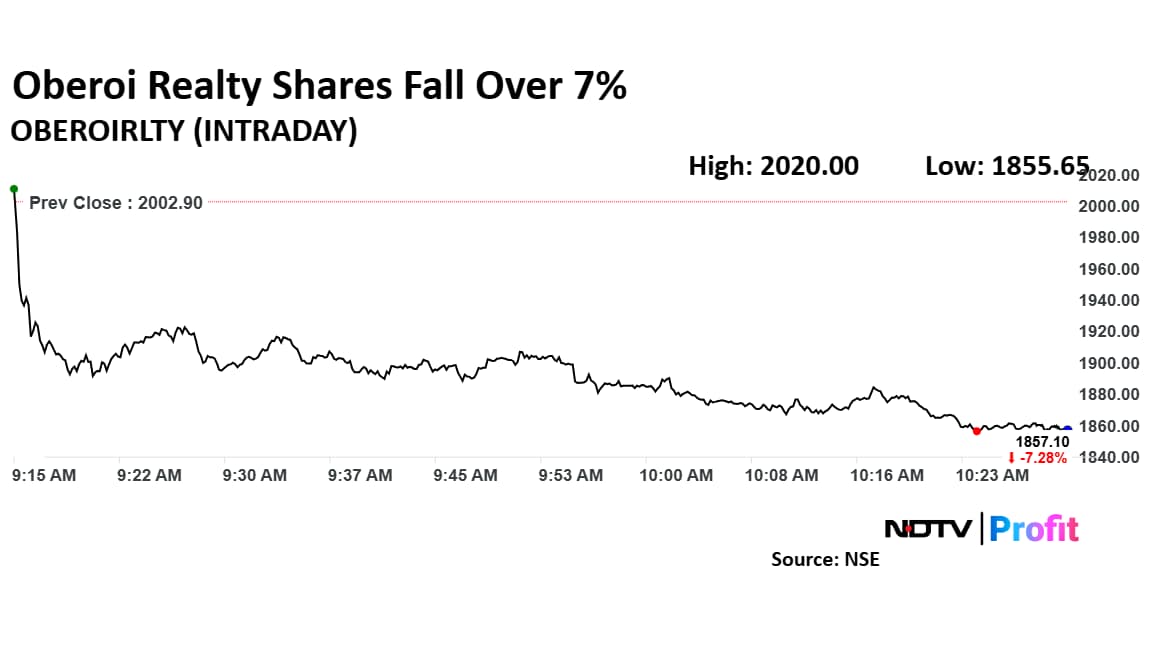

Oberoi Realty Shares Fall Over 7%

The shares of Oberoi Realty fell as much as 7.35% to Rs 1,855.65 apiece, the lowest level since Oct. 11, 2024. It pared losses to trade 7.10% lower at Rs 1,860.70 apiece, as of 10:26 a.m. This compares to a 0.78% decline in the NSE Nifty 50 Index.

It has risen 35.84% in the last 12 months. Total traded volume so far in the day stood at 6.9 times its 30-day average. The relative strength index was at 29.2, indicating it is oversold.

Out of 27 analysts tracking the company, 11 maintain a 'buy' rating, 12 recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.