NTPC Green Energy Ltd. shares plunged in trade on Thursday after anchor investors offloaded their stake with the first lock-in period coming to an end. The renewable energy arm of the state-owned NTPC Ltd.'s went public a month ago in the largest maiden public issue this year.

The company raised Rs 3,960 crore from 107 anchor investors a day before its initial public offering opened for bidding. The company allotted 36.66 crore shares at an issue price of Rs 108 apiece.

Life Insurance Corporation of India emerged as the top investor, securing 12.63% of the total issue for Rs 500 crore. Other marquee investors included Goldman Sachs India, the Government of Singapore and Capital Group affiliate New World Fund Inc.

The first lock-in period for these investment institutions ended on Dec. 25 with 50% of these shares being available for trade from Thursday. The lock-in for the remaining shares held by anchor investors will end on Feb. 23.

NTPC Green issued 4.35% of its equity to anchor investors, with half of the anchor shares, or 2.18%, of the equity coming out of the lock-in period.

The Rs 10,000-crore initial public offering of NTPC Green Energy Ltd. was subscribed 2.42 times on its final day of bidding, with retail investors leading the demand with 3.44 times subscription. Shares the renewable energy arm of NTPC Ltd., closed at a premium of 12.31% over the issue price on the listing day.

NGEL plans to utilise 75%, or Rs 7,500 crore, of the IPO proceeds towards debt repayment. The balance 25% will be used for general corporate purposes.

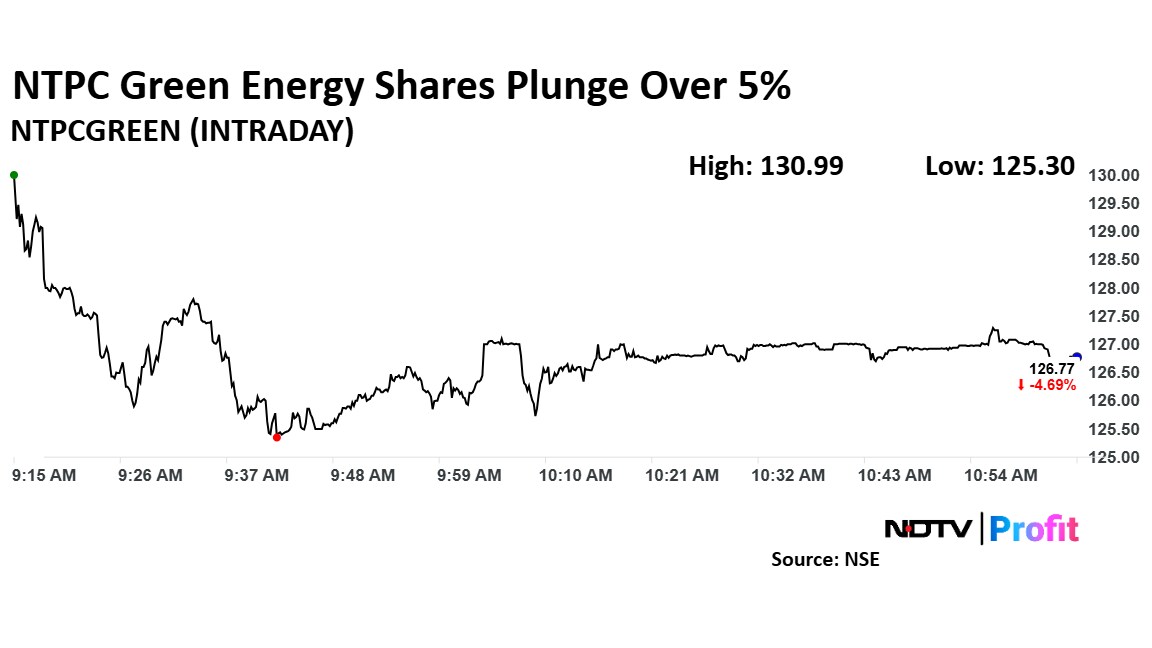

NTPC Green Energy's stock fell as much as 5.87% during the day to Rs 125.2 apiece on the NSE. It was trading 4.4% higher at Rs 127.05 apiece, compared to a 0.07% advance in the benchmark Nifty 50 as of 11:01 a.m.

It has risen 17% since its listing on Nov. 26. The total traded volume so far in the day stood at 0.6 times its 30-day average. The relative strength index was at 56.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.