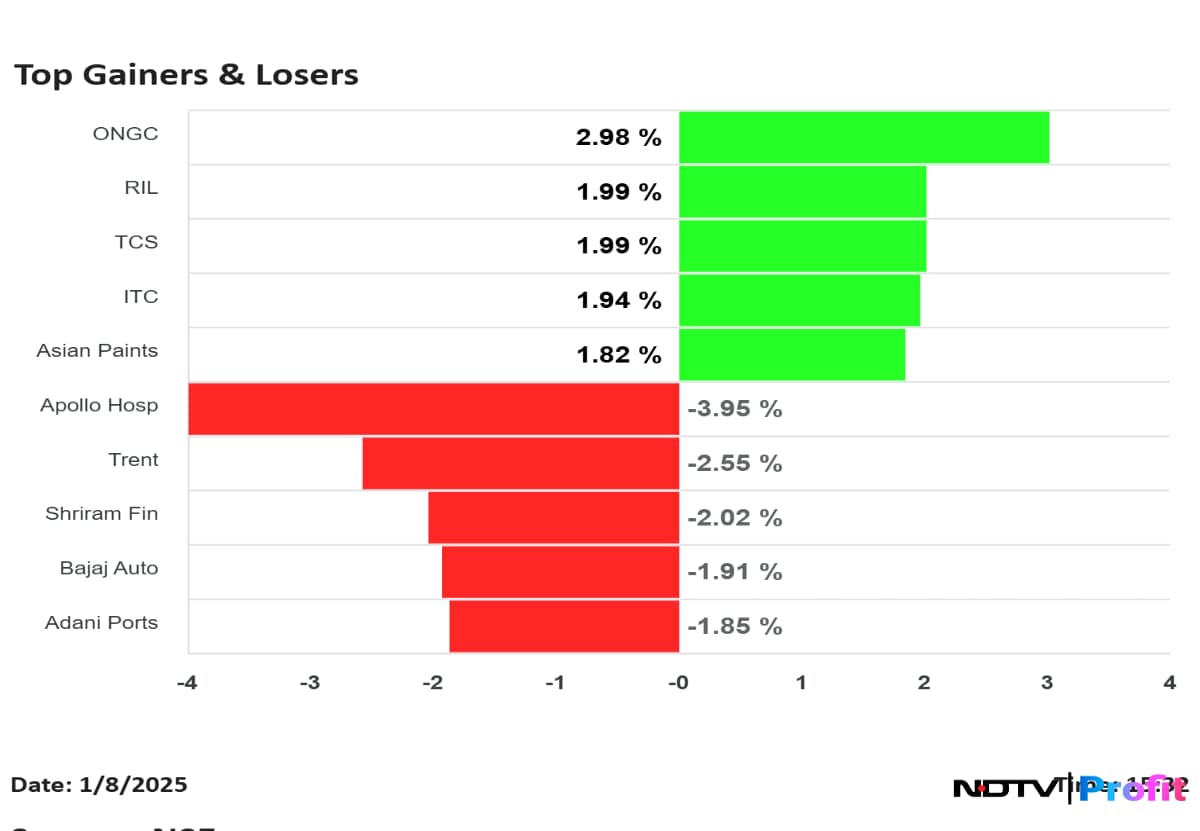

Oil & Natural Gas Corp., Reliance Industries Ltd., Asian Paints Ltd., Tata Consultancy Services Ltd. and ITC Ltd. were among the top NSE Nifty 50 gainers on Wednesday.

On the flip side, Apollo Hospitals Enterprises Ltd., Trent Ltd., Shriram Finance Ltd. and Bajaj Auto Ltd. were among the major losers.

Indian equity benchmarks erased most of the losses during the day and closed on a muted note. Nifty 50 ended at 23688.95, down 0.08% or 18.95 points and BSE Sensex closed at 78148.49, down 0.06% or 50.62 points

Top Gainers

ONGC continued to gain for a second consecutive session and rose as much as 3.80% intraday to Rs 273.50, its highest level since Nov. 4. The stock had risen on Tuesday as well after CLSA identified the company as a top pick, forecasting a 42% upside with a new target price of Rs 360 per share.

Reliance Industries, also among the top gainers, closed nearly 2% higher at Rs 1,265.5 apiece on the NSE, which marked its highest close since Dec. 16.

ITC and TCS snapped their three-day fall and emerged as key gainers of the day. ITC closed 1.92% higher at Rs 449.55, whereas TCS settled 1.99% higher at Rs 4,108.4. The latter will announce its earnings after market hours on Jan. 9.

Asian Paints' was also the major gainers, as its share price gained for a second consecutive session after two-day fall. The scrip settled 1.82% higher at Rs 2,334.35.

Top Losers

Apollo Hospitals was the top loser among Nifty 50 stocks as it fell after two sessions of gains driven by HMPV scare. On Wednesday, it fell as much as 4.1% intraday to hit Rs 7,131, its lowest level since Dec. 4.

Trent's shares declined as much as 4.1% on Wednesday to hit Rs 6,590, its lowest level since Nov. 22. It was the second biggest loser among Nifty stocks.

Meanwhile, Shriram Finance settled 2.02% lower at Rs 2,898.75, and Bajaj Auto closed 1.91% lower at Rs 8,642.25.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.