The benchmark equity indices ended at the lowest in over a month on Friday and recorded the worst week in months as hawkish outlook from the US Federal Reserve rattled global markets across the globe.

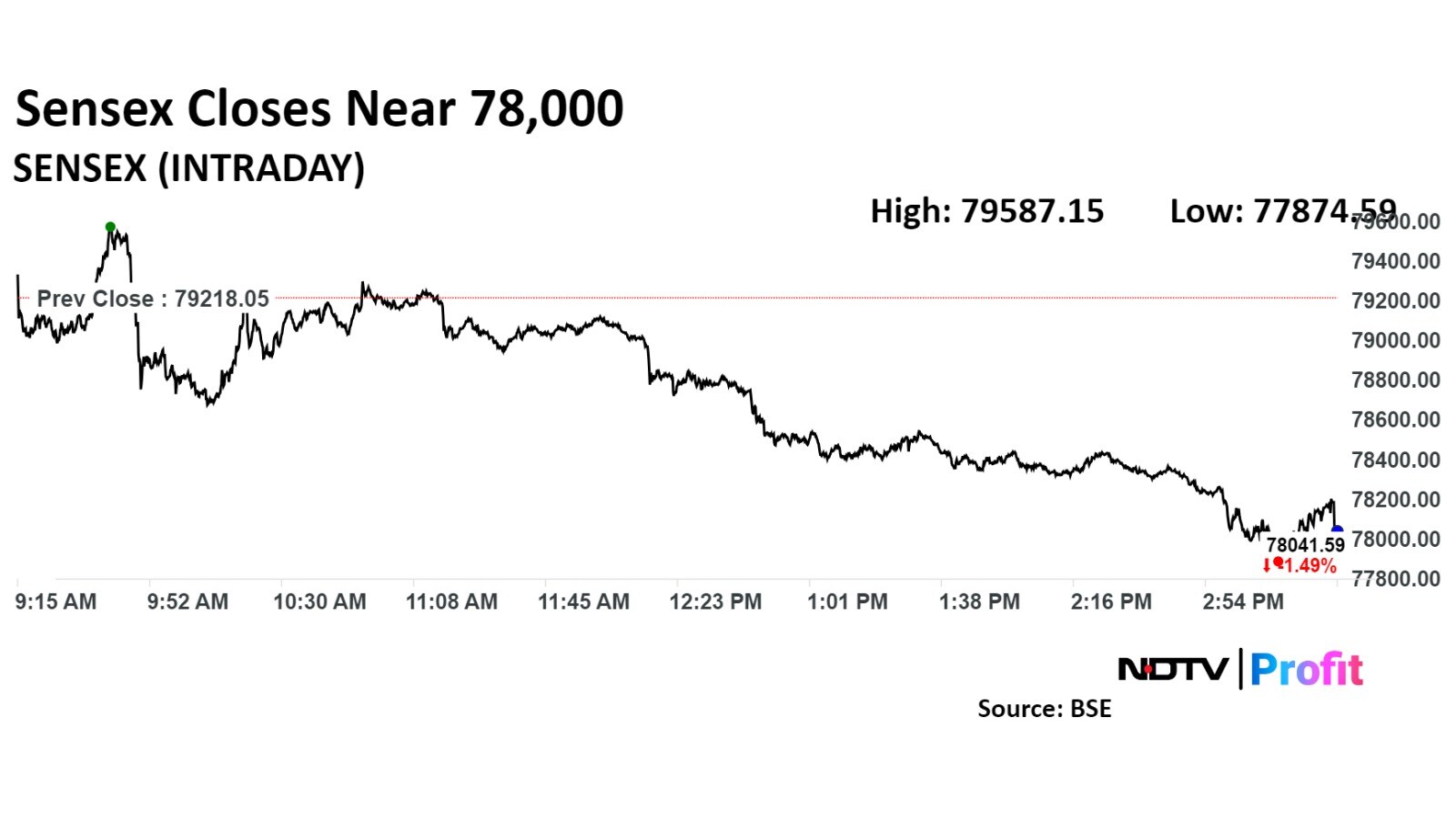

The NSE Nifty 50 closed 364.20 points or 1.52% down at 23,587.50, and the BSE Sensex ended 1,176.46 points or 1.49% lower at 78,041.59.

The market cap of the Nifty 50 companies declined Rs 2.9 lakh crore to Rs 186.97 lakh crore, according to data on the NSE.

The Fed reduced the federal fund target range by 25 basis points to 4.25–4.50% after its two-day policy meeting on Wednesday. It raised the inflation and economic growth outlook, and also reduced the rate-cut projection to 50 bps in 2025 as compared to 100 bps earlier.

Following the hawkish outlook, equity markets in the US, Asia, and Europe slumped, which weighed on the Indian equities.

The US Dollar Index is trading at over two–year high, and the US treasury yield above 4%. A rise in safe–haven assets prompts investors to take out their money from risky assets like emerging markets equities and currencies.

"Global equity markets witnessed various degrees of selloff (Brazil down 10%, Japan down 5%, S&P-500 down 4%) in the past week in the aftermath of the US Fed policy meeting," Shrikant Chouhan, head of equity research at Kotak Securities, said.

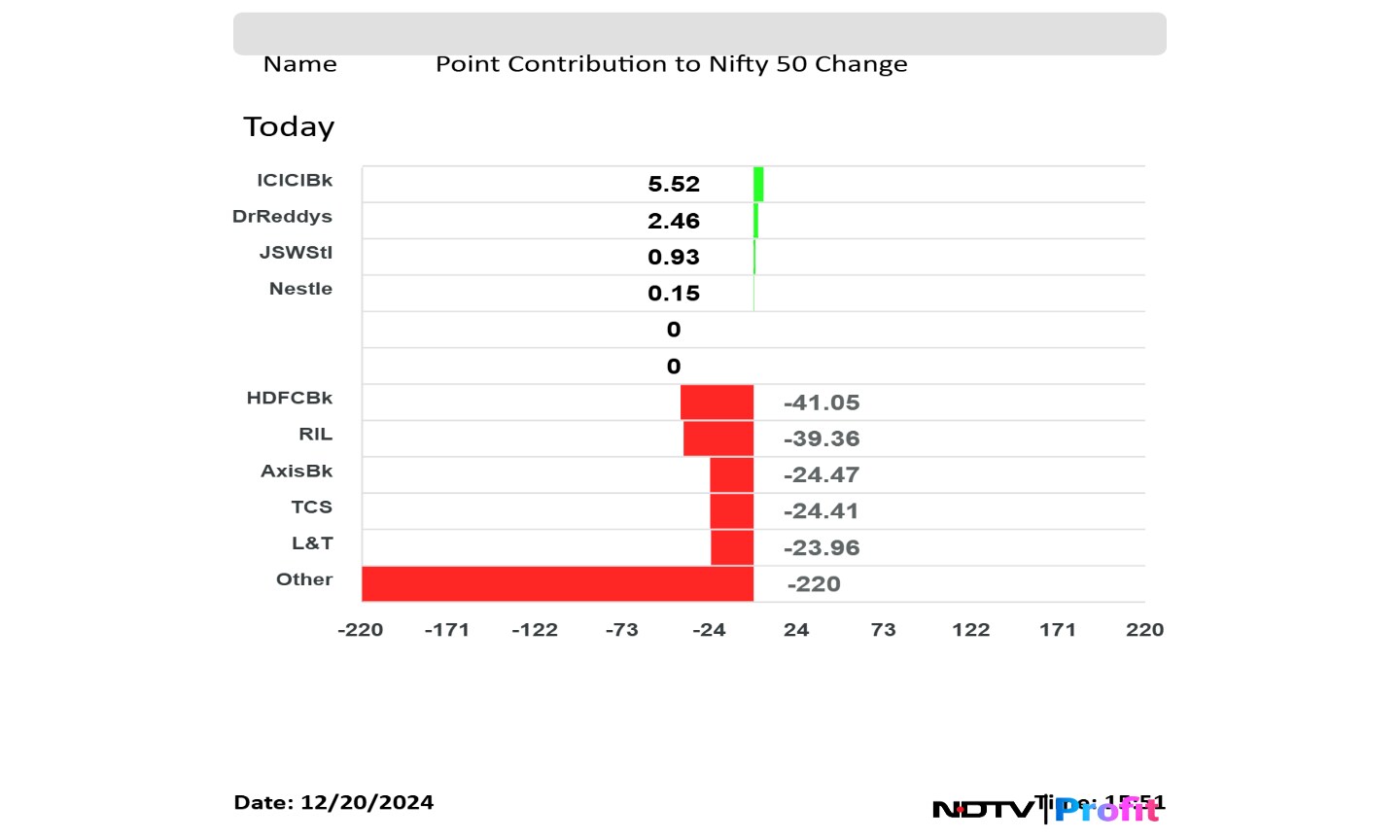

HDFC Bank Ltd., Reliance Industries Ltd., Axis Bank Ltd., Tata Consultancy Services Ltd. and Larsen & Toubro Ltd. dragged the Nifty the most.

ICICI Bank Ltd., Dr. Reddy's Laboratories Ltd., JSW Steel Ltd. and Nestle India Ltd. cushioned the fall.

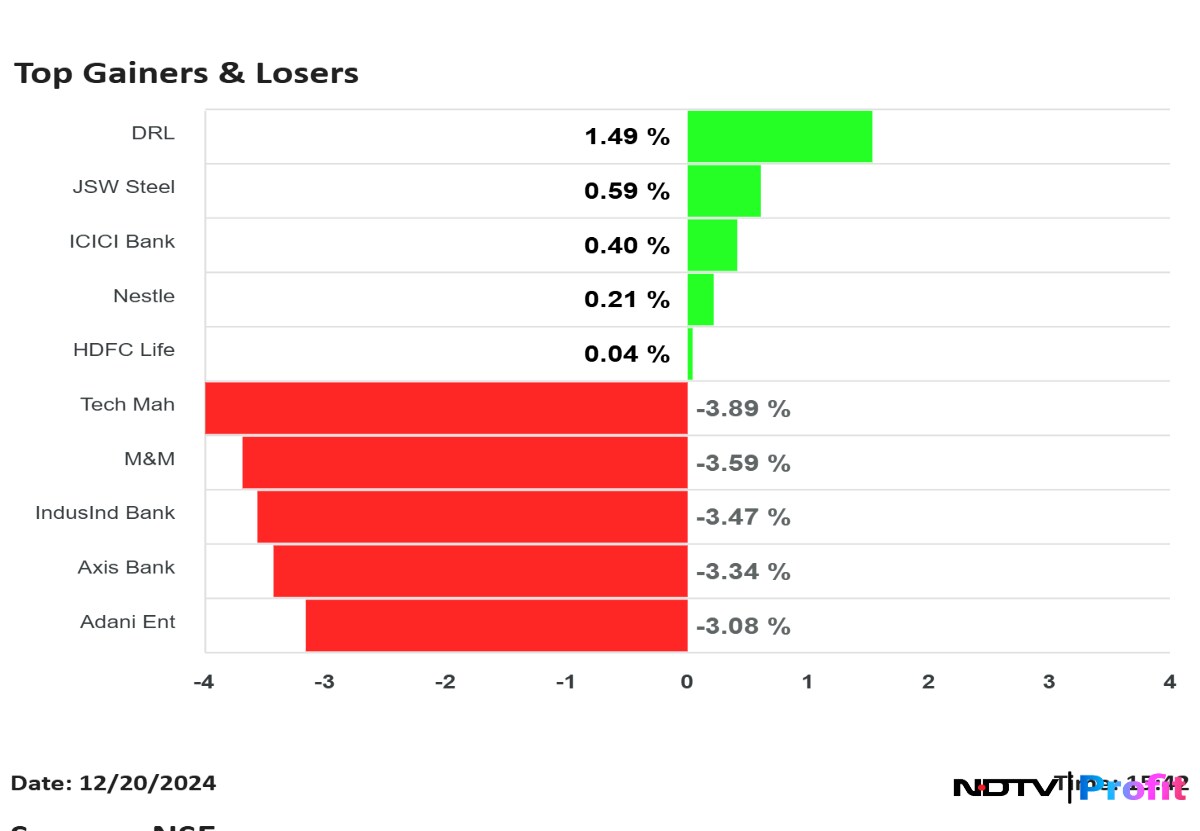

Shares of Tech Mahindra Ltd., Mahindra & Mahindra Ltd., IndusInd Bank Ltd., Axis Bank Ltd. and Adani Enterprises Ltd. were the top losers.

Dr. Reddy's Laboratories, JSW Steel, ICICI Bank, Nestle, and HDFC Life Insurance Co. were the top gainers.

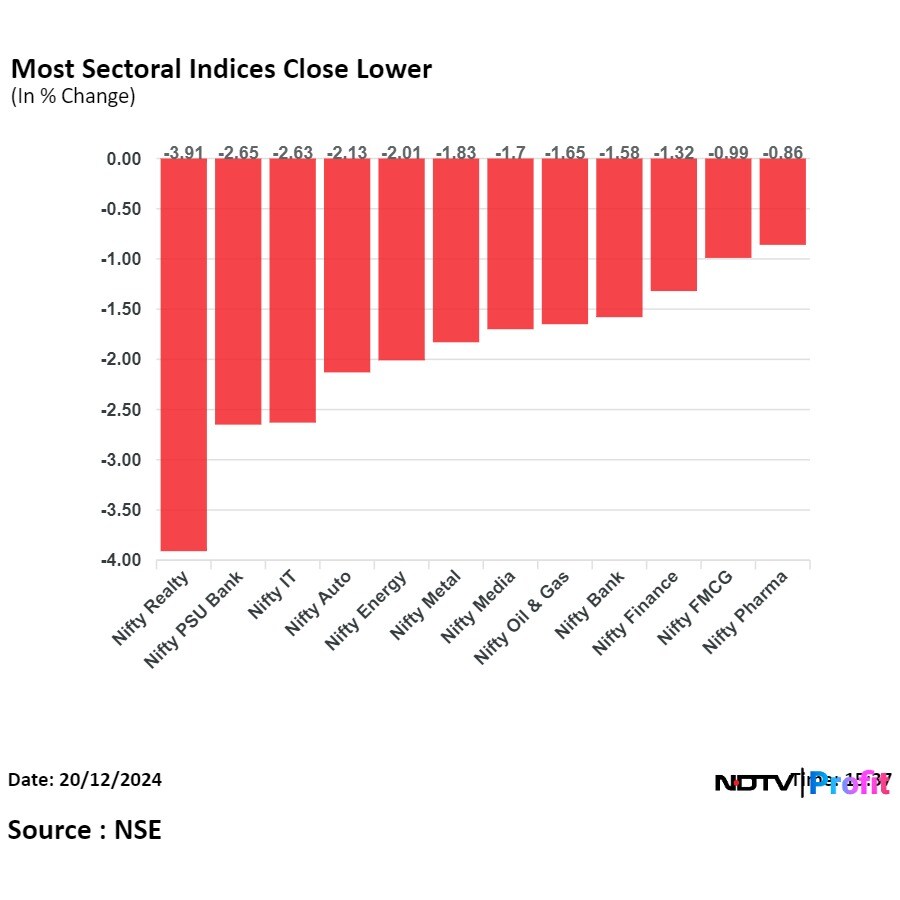

On the NSE, all the 12 sectors closed lower, with the Nifty Realty declining the most.

The broader indices underperformed as the BSE MidCap closed 2.4% down and the SmallCap closed 2.1% lower.

All sectoral indices on the BSE fell, with Power falling the most.

The market breadth was skewed in favour of the sellers as 2,929 stocks fell, 1,061 rose and 95 remained unchanged on the BSE.

On a weekly basis, the Nifty fell 4.77%, the most since Sept 30. The BSE Sensex fell 4.98%, the worst decline since June 13.

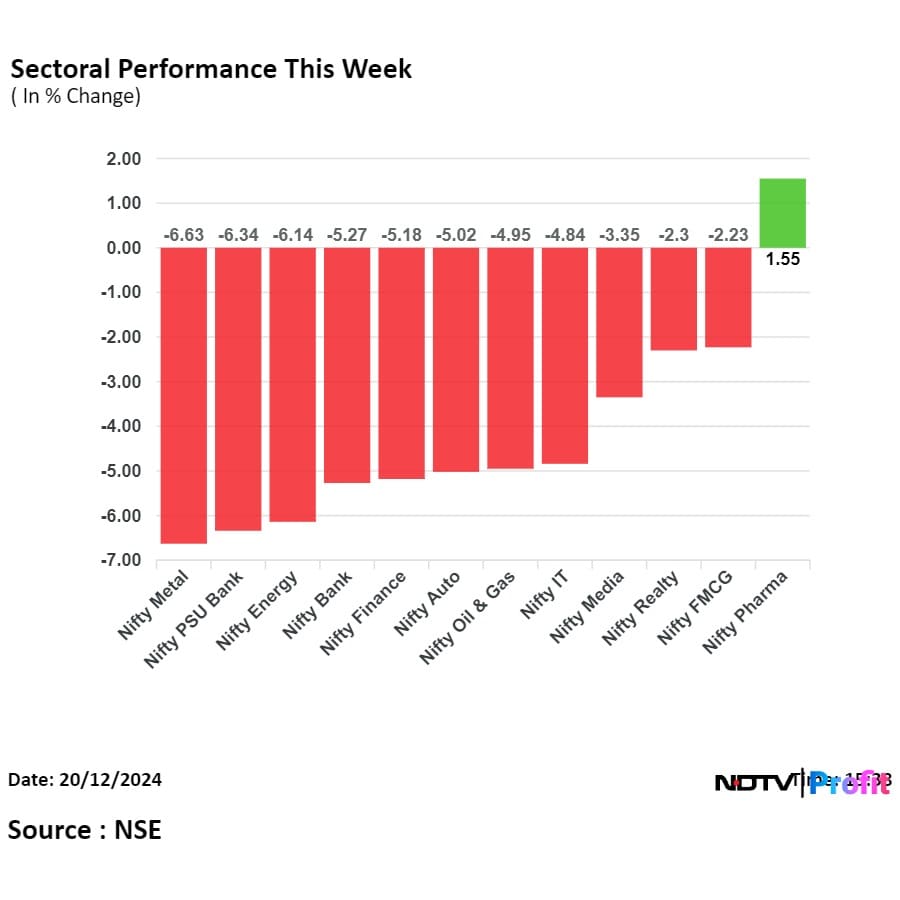

This week, 11 sectors declined and one advanced out of 12. The Nifty Metal rose the most and Pharma outperformed the other sectoral indices.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.