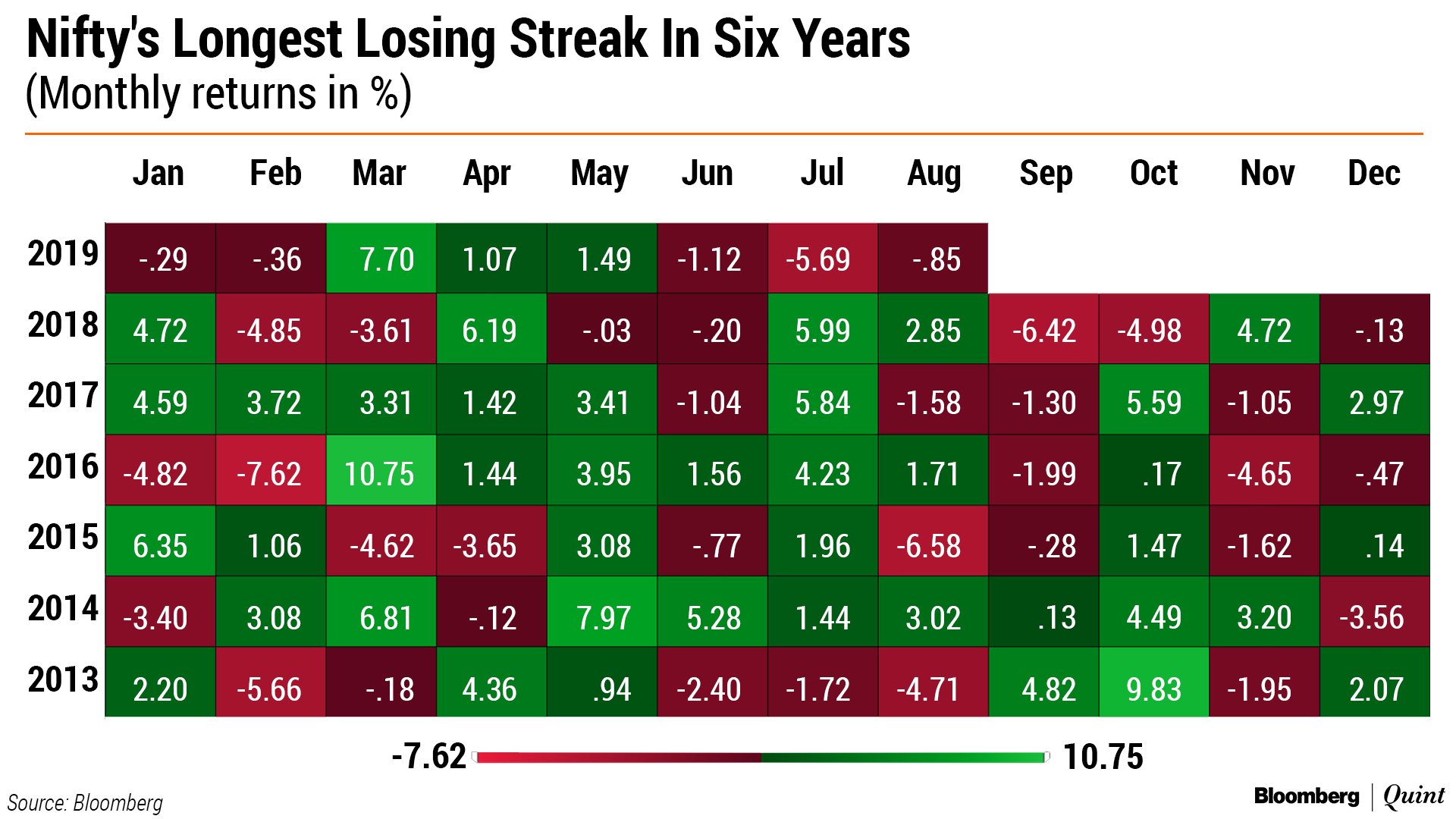

The Nifty 50 fell for the third straight month in August, posting its longest losing streak in the last six calendar years, as slowing domestic demand, weak corporate earnings and geopolitical tensions dampened the sentiment.

The benchmark fell 1 percent in August even after the government announced measures to boost the economy and rolled back a tax surcharge on foreign investors, which pulled out money from equities for the second month in a row.

Oil-to-retail Reliance Industries Ltd. conglomerate contributed the most by points, while State Bank of India was the biggest laggard.

Nifty Auto Index snapped its three-month losing streak as Finance Minister Nirmala Sitharaman announced several incentives to revive the sector facing its worst slowdown in a decade. Sharp gains for index heavyweights like Maruti Suzuki India Ltd. (up 11.5 percent), Bajaj Auto Ltd. (up 9.1 percent) and Hero MotoCorp Ltd. (up 7.9 percent) aided the recovery.

Information and technology gauge also snapped three months of decline, rising as the Indian rupee weakened. Rupee was the worst-performing Asian currency in August as it depreciated nearly 4 percent to 71.5 against the dollar. A depreciating currency helps software services providers that earn revenue in dollars.

Tata Consultancy Services Ltd., Infosys Ltd. and HCL Technologies Ltd., which have a combined weight of 66 percent on the index, rose 1.67 percent, 2.02 percent and 6.1 percent, respectively, in August.

The Nifty Metals Index tumbled more than 10 percent for a second straight month as the global demand outlook weakened because of the U.S.-China trade war.

Foreign Investors Continue To Sell

Foreign institutional investors pulled out the most from stocks since October and remained net sellers for the second month in a row in August. They net sold equities worth Rs 16,000 crore in the secondary market. Overseas investors, according to data on the NSE website, are also net short at the start of the September futures.

Corrects an earlier version which did not mention that the period is based on calendar years.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.