The market hummed and hawed a bit but there really wasn't any halting the advance and new highs continued to be recorded for the indices, keeping the sentiment upbeat. Such highs coming after such a long while (this rise has been in progress from March end) should ideally have produced some sense of euphoria, that sentiment seems to be strangely missing as yet.

Active market players of course are happy but it is not from these players that you take a read of the sentiment. For, they are quick to swap sides and even get on the wrong side even. But the rank retail trade is a better read of sentiment froth. Right now, whoever I meet from outside the market is still mystified as to why the market is moving the way it is and their main question is, when will the reaction come? Or what will happen if the FII suddenly start to sell? And more such doubts. Those that are participating a bit are quick to take money off the table when they see some.

What it reveals is a skeptic mindset as yet. When new or immature traders and investors either choose to stay away, waiting for that elusive ‘correction', the market can never get overbought. Froth sets in when markets get strongly overbought. This is typified by players over-reaching themselves in terms of quantity that they trade, the number of stocks that they juggle at a single go, the inattention to valuations and finally, the justifications of their own actions and how the market “cannot fall!”

None of those are present right now. So, even as the indices head higher and dead portfolios are seen reviving and swift moves are being seen in small and midcap stocks, the level of skepticism of sustenance of the index levels is still keeping the sentiment in check.

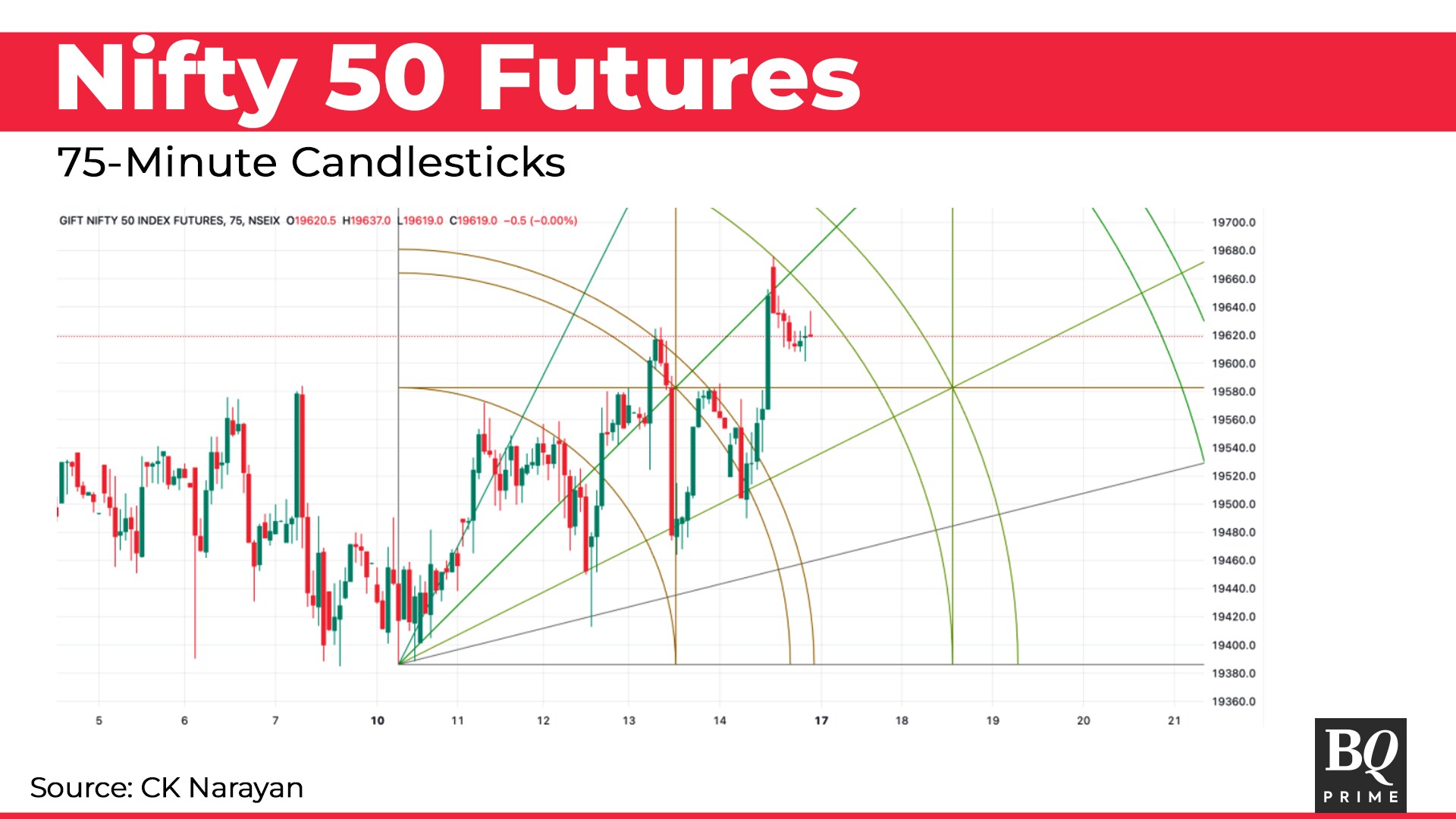

Here is what last week's trading looked like on intraday charts.

As can be seen in Chart 1, the week was quite choppy and probably increased the sense of disquiet that many harboured about the trend. But the strong finish on Friday, notching up another new high, reading should have satisfied some but many would probably ascribe it ‘short covering' action.

Be that as it may, the weekly chart shows an interesting set up.

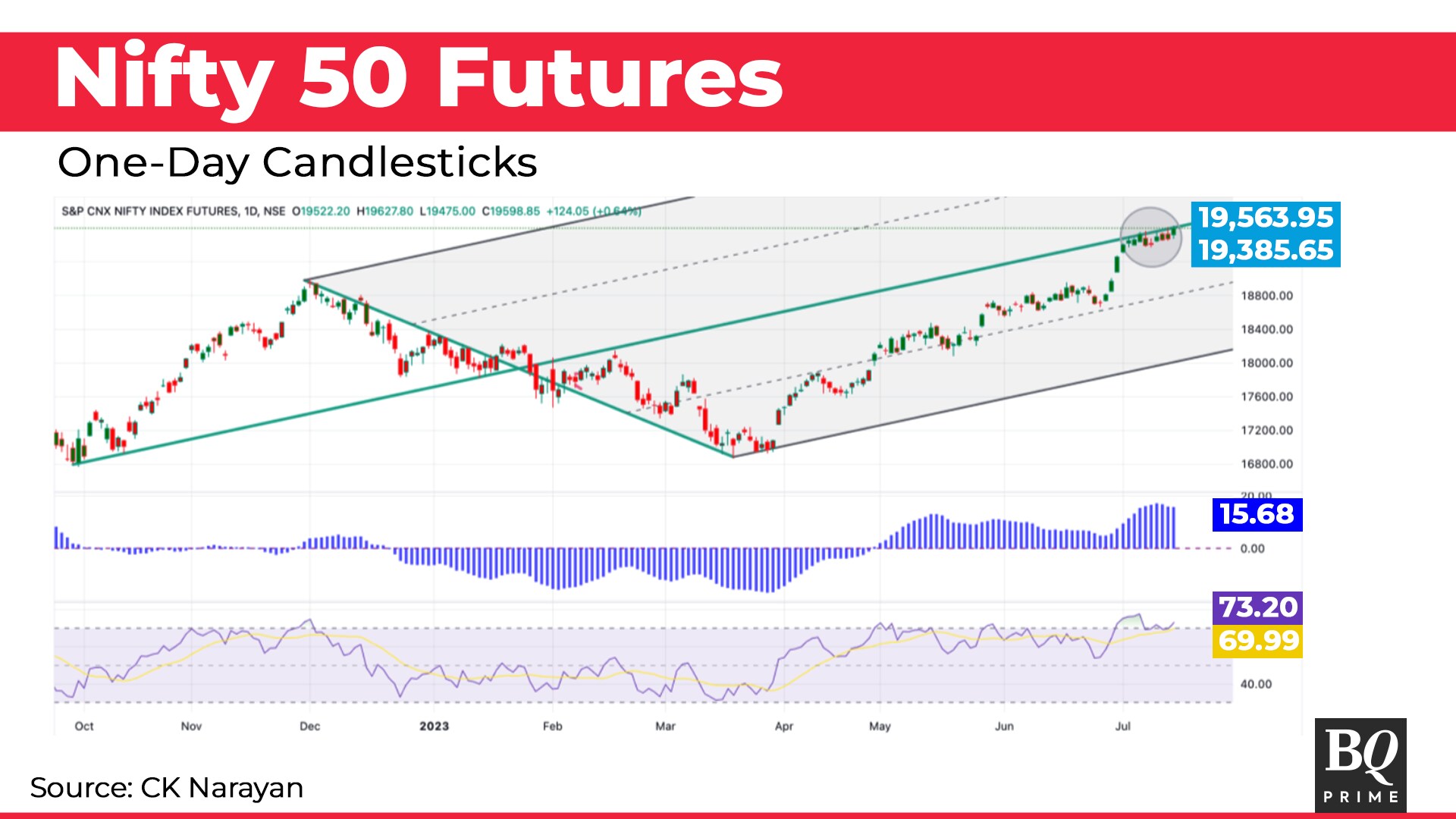

The daily chart of the Nifty futures is shown with the Pitchfork laid on it. It can be seen that the prices are currently trading at the median line (doing so for the past several days). The resistance posed by this median line has been good enough to contain the advances at even new high levels. Hence, the index is at a level where it needs to work up additional momentum in order to cross the resistance. So, that is one of the things to look for in the week ahead.

But also notice the layup of the momentum indicators. The histogram for the ECO indicator is nicely in bullish territory while the RSI is showing a bullish set-up with supports developing at the 60 levels—which portends the probability of an acceleration from here. Therefore, the two momentum indicators are suggesting that the rise should continue into the next week as well. Typically, such RSI signals don't get played out swiftly and, hence, the move could probably last right into the month end. The ECO also doesn't get reversed so quickly either. Now, that is useful information for those holding longs as well as those who play options. It is also useful for those who may be holding longs and are a bit on the backfoot as their stocks may not have performed. Such holders should continue with their positions (assuming ,of course, that the trade is in the right direction overall) as they can get a chance to exit at better levels, even with profits.

One of the questions that can be raised is how do markets that are seemingly part of a frenzied upmove come to naught?

The answer lies in the correlation to fundamentals that are in play at the moment. At points of reversals, the price action is at a big variance with the underlying fundamentals. In the current situation, the underlying fundamentals are actually turning better. The valuations are reasonable and nowhere stretched. A point-to-point comparison with 5 or even 10 years of PE levels does not throw up any alarming data. The RBI seems to be in control of the situation. GST collections are consistently getting higher, IIP numbers are seen improving, the Dollar index is falling (although USD-INR remains a bit aloft yet), U.S. inflation talk is seen easing a bit and multi week upmoves are seen in their markets now, hinting at recovery of sentiments, India growth story is quite intact even as many across the globe are seen slipping into recession of some kind.

Given all these, the ‘frenzy' that is being observed by many is actually a state of fear of heights. In the present case, the technical picture is actually quite in sync with the underlying fundamentals. Hence, there is no real danger of a reversal—only a reaction every now and then.

But the consistency of the inflow from FPIs is overwhelming even the small attempts to show reactions. Plus, the flow of domestic funds, too, continues. So, positive fund flow will ensure continuity rather than any reversals.

So, what lies ahead now? Let's address time aspect first. In earlier letters, I have alluded to the time aspect of the current rally extending till July 27. That continues to be open and may extend all the way till July 31. It is not a linear rise but the tempo will continue to be upward biased. Hence, we need to still be buyers on dips in the indices and in trended stocks. I have also mentioned that mid-August will offer us a buying opportunity for the balance of the year. I continue to hold this view. Hence, I would want to next lighten up longs towards the end of July and wait for a pullback, which could be sharp and swift.

In the earlier letter, I had indicated the levels around 19,650 as a possible target zone and we have so far hit 19,627 in the futures as of last week. Since it is our finding that the index could go higher (but the time available is not very much), there shall be slow move (like what we had last week) where the Nifty gets to near or just over 20,000. The sentiment tripping level this time, I reckon, will be 20,000 on the Nifty. See, 60,000 was hit on the Sensex but hardly anyone took notice because Nifty and Bank Nifty are the traded items and the Sensex is not. It is traders who set the pace for sentiment drives. The max I am setting out for the moment is 20,200 but I am not seriously betting that high.

In the near term, I would want to use dips to near 19400 area to be a buyer and would want to set short-term stoploss levels below that zone. Chart 3 shows the short term set-up.

Currently, momentum investing dominates and is expected to continue further. Results season has been set off and this will make the market stock specific. The market is in mood to reward good performances, so be on the watchout for the same. Momentum investing needs some capital so those who like doing this can be active across the coming two weeks by arranging some additional capital for swift in and out investing.

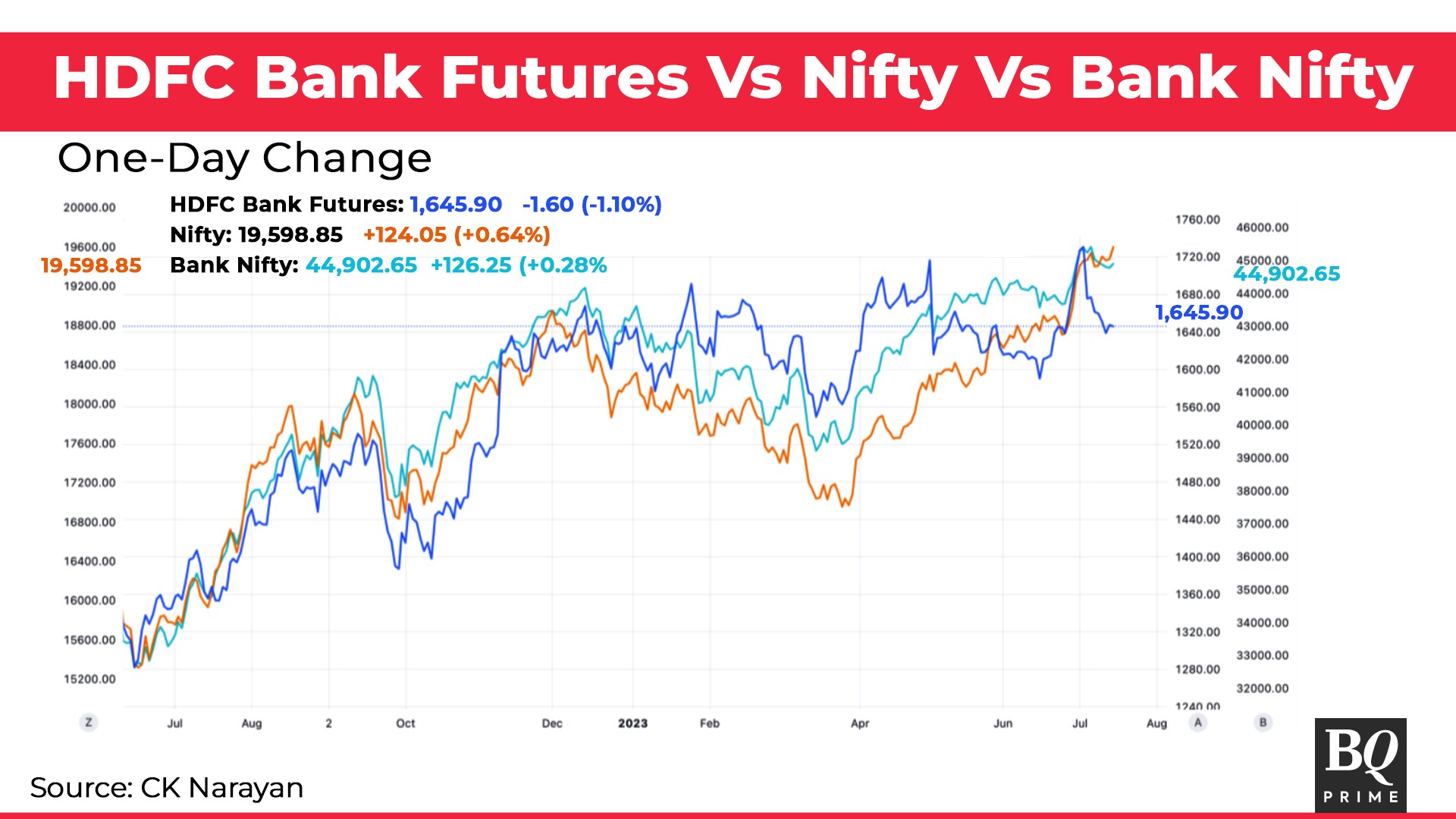

One of the major developments of last week was the merger of the HDFC twins, creating a massive weightage for HDFC Bank—becoming the highest weighted item in the Nifty (14%) and Bank Nifty (42%). Chart 4 shows the relative moves of HDFC Bank with Nifty and Bank Nifty.

It can be easily noted that HDFC Bank has been extremely correlated with the index moves. Now, this is probably set to become even more prominent, particularly in Bank Nifty where it hogs the weightage. So, going forward, HDFC Bank moves should be analysed every day to get a view on how indices can move.

In the last week, HDFC Bank dropped (owing to position readjustments for the merger) but that should cease in the coming week. The indices have kept up despite the fall, possibly because the market knew that these moves would be temporary. Now, if and when Hdfc Bank kicks back into a rising action, the impact on the indices could be quite positive. So, if you see HDFC Bank rising next week, the chances are that the Nifty will clear the overhead resistance of the median line (see chart 2) and head higher.

Summing up, the market is still in good form and there is continued expectation of advances in the week ahead. Time counts have enough room for this to happen and price action also shows room higher. Patterns, too, are in support of advances. Participation is wide in small- and mid-cap space and results season should drive different sets of stocks in coming weeks. Success at momentum investing coupled with a rising portfolio value ought to keep the sentiment ticking higher. No signs of any froth yet. Let the good times continue.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.