The equity markets have recovered well from the lower levels, and the charts indicate that the NSE Nifty 50 can snap the resistance level, according to Nagaraj Shetti of HDFC Securities Ltd.

The benchmark had seen a sharp downtrend in the previous week, but it has bounced back well from the 21,700 level, the senior technical research analyst told NDTV Profit on Friday.

Shetti highlighted that Nifty was showing the potential to break the resistance level of 22,200/300 in the near term. Given the current momentum, he is long on the market.

Shetti recommends a 'buy' call for shares of L&T Finance Holdings Ltd. at Rs 155 apiece and a stop loss at Rs 150 at a target price of Rs 165 per share. He has a 'buy' call for Borosil Renewables Ltd. at Rs 522 apiece, stop loss at Rs 510 at a target price of Rs 545 per share.

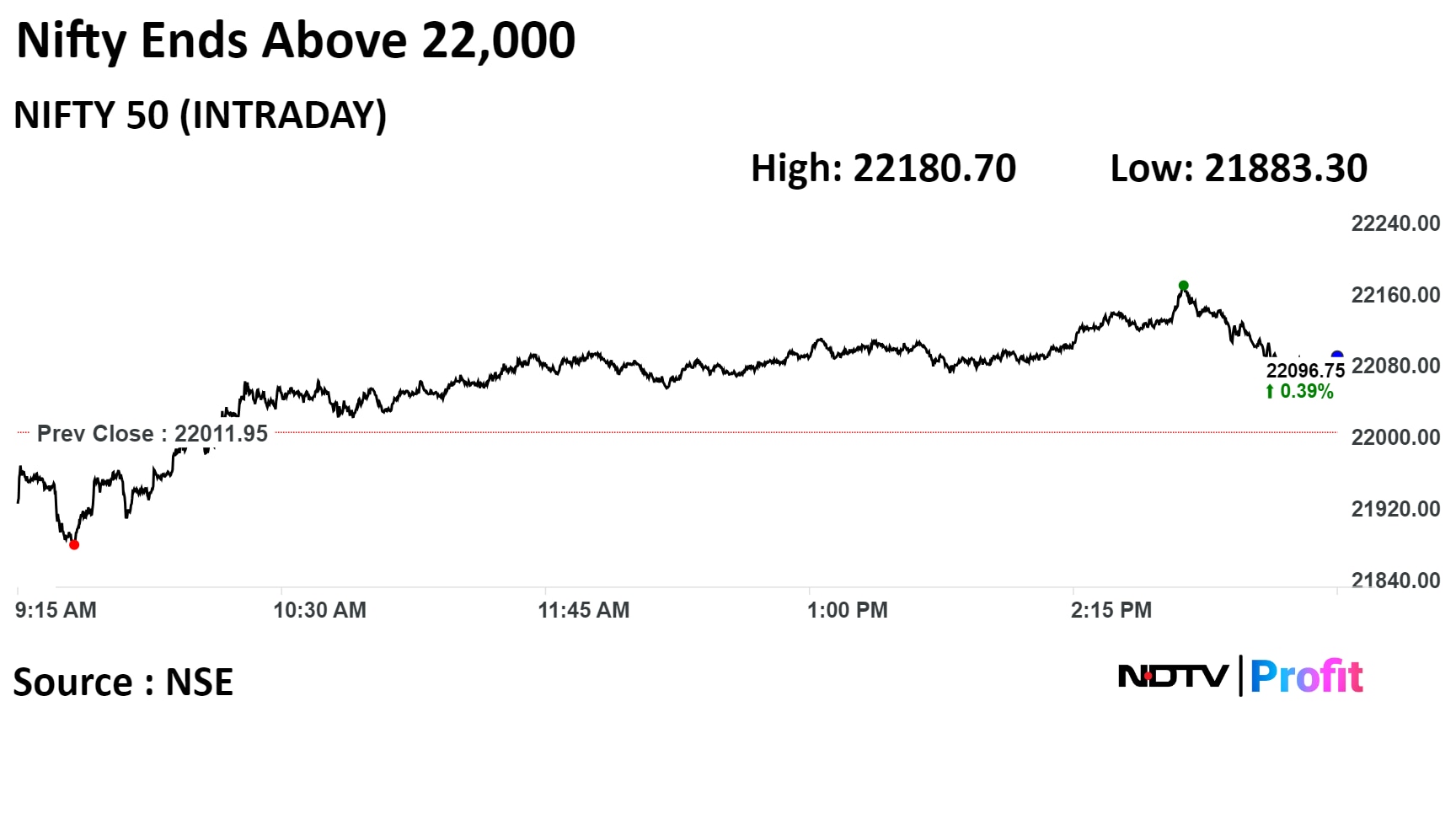

The NSE Nifty 50 closed 84.80 points or 0.39% higher at 22,096.75, while the S&P BSE Sensex ended 190.75 points or 0.26% up at 72,831.94.

During the week, the market slipped below its 50-day simple moving average, but it bounced back sharply in the last two days on the backdrop of strong global cues, according to Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

Technically, the index has formed a promising reversal formation and currently, it is comfortably trading above the 50-day SMA, which is largely positive, Chouhan said.

Real Estate

"Signalling a possible interest (rate) cut in the coming two months can boost the real-estate sector," Avinash Gorakshakar, director of research at Profitmart Securities Pvt., said.

Gorakshakar said the real-estate prices had been very firm in pockets like Mumbai, Gurugram and western India. This makes him positive about companies like Oberoi Realty Ltd., DLF Ltd. and Anant Raj Ltd.

"The earnings trajectory for these companies in the next six to 12 months is going to be robust. The government is also looking quite positive. Post budget, we could see some announcements for the sector," he said.

Watch The Conversation Here

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.