The NSE Nifty 50 is still trading below its historical valuations, even as the benchmark index briefly crossed the 23,000 milestone to hit an all-time high on Friday.

The gauge is trading at 22.7 times its current earnings, a discount of 8.1% to its five-year average, according to research done by NDTV Profit.

This makes the country's benchmark index among the least-valued major global indices, with Nasdaq 100 taking the cake on the back of Nvidia's record-breaking rally.

Among global peers, only the Euro Stoxx 50, which provides a blue-chip representation of supersector leaders in the Eurozone, trails the Nifty, with a discount of 10.5% to its five-year average P/E.

US' Nasdaq 100, S&P 500 and Korea's Composite Stock Price Index all are currently trading at over 5% premium to their historic valuations.

The Market Cap Picture

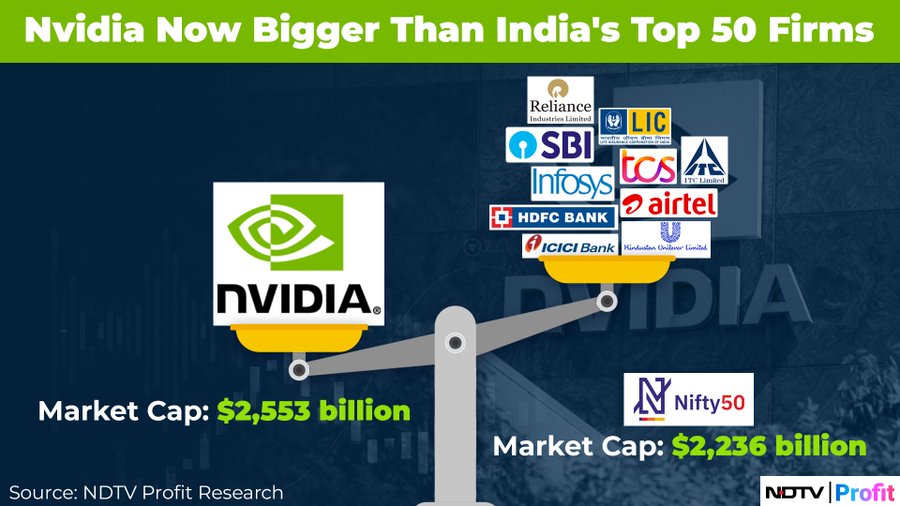

As Nifty hit its peak on Friday, its market capitalisation was at Rs 185 lakh crore, or about $2.24 trillion. It added as much as Rs 2.97 lakh crore in investor wealth during the day, before paring some gains. However, this did not change things much in a global perspective, as India's benchmark continues to be around $550 billion behind the closest major peer, the London Stock Exchange's FTSE 100.

Also interesting to note is that despite Nifty hitting record high of 23,026.4 intraday—before paring some gains—its cumulative market cap was lower than that of Nvidia Corp., which soared over 15% last week to close with a market cap of around $2.6 trillion.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.