Shares of NBCC India Ltd. surged over 2% following the company's announcement of receiving multiple work orders worth approximately Rs 489.6 crore. The orders, which include significant infrastructure and construction projects, are expected to bolster the company's revenue and growth prospects in the coming months.

The largest of the new orders is for the construction of Eklavya Model Residential Schools across various locations in Chhattisgarh. The project, valued at Rs 459.6 crore, is commissioned by the Department of Tribal and Scheduled Caste Welfare, Chhattisgarh. The schools will be built in several districts, including Bastar, Sukma, Dantewada, and Narayanpur, addressing the educational needs of tribal students in the region.

In addition to the Chhattisgarh project, NBCC has been awarded a Rs 30 crore order for the construction of a permanent building for the Composite Regional Centre (CRC) in Jaipur. This project is being commissioned by the Pt. Deen Dayal Upadhyaya National Institute for Persons with Physical Disabilities (PDUNIPPD), New Delhi.

NBCC (India) is a leading public sector enterprise in India, specialising in construction, real estate development, and infrastructure projects. The company is known for its role in executing large-scale government projects, including residential, commercial, and institutional buildings. Established in 1960, NBCC has successfully completed several high-profile projects across the country, including the construction of government offices, housing complexes, and educational institutions.

The company operates under the Ministry of Housing and Urban Affairs, and its expertise in project management, engineering, and design has positioned it as a key player in the infrastructure development sector.

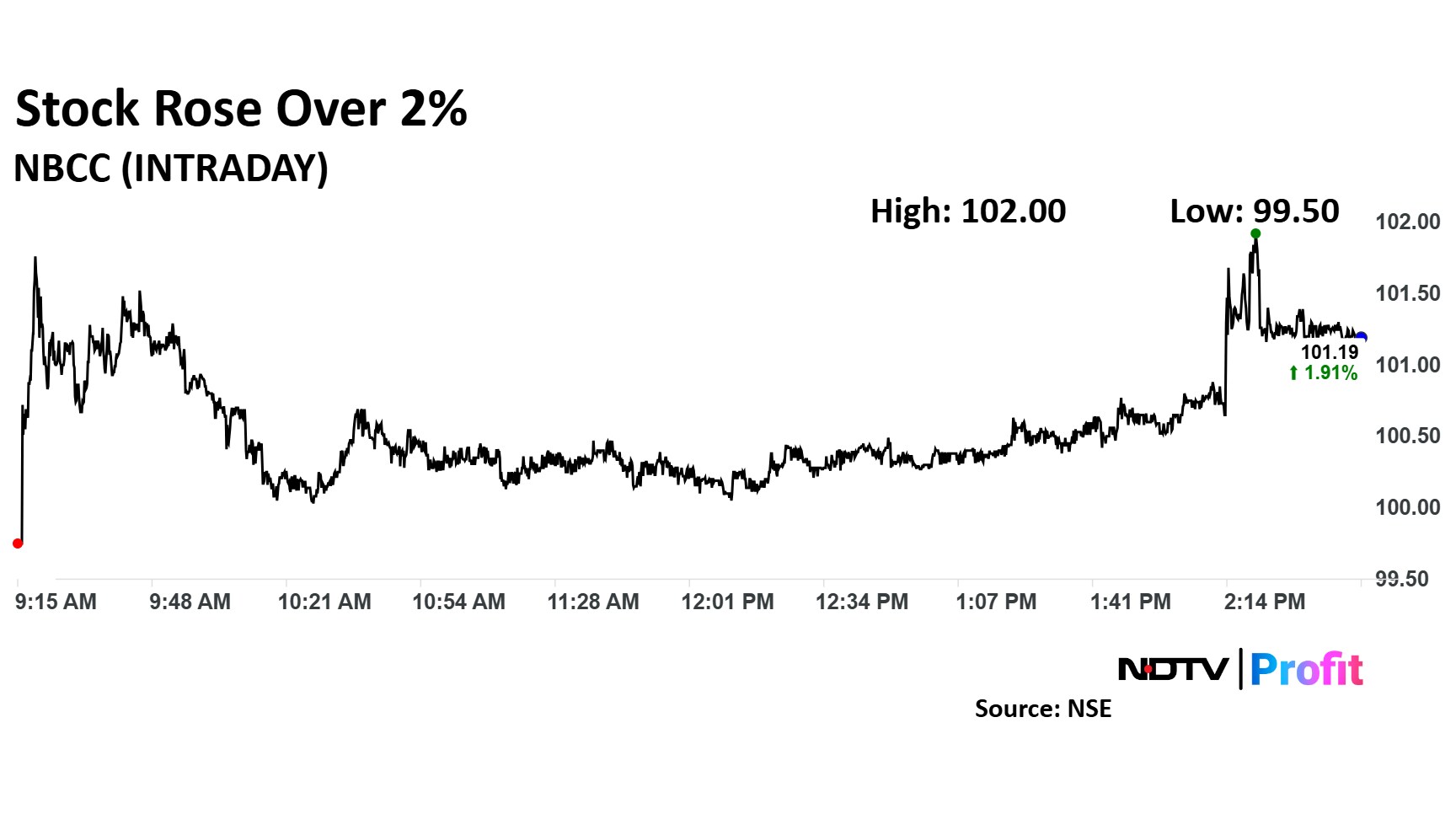

NBCC share price rose as much as 2.73% to Rs 102 apiece. It pared gains to trade 1.98% higher at Rs 101.26 apiece, as of 02:42 p.m. This compares to a 0.39% decline in the NSE Nifty 50 Index.

It has risen 83.44% in the last 12 months. Total traded volume so far in the day stood at 0.70 times its 30-day average. The relative strength index was at 54.

Out of four analysts tracking the company, two maintain a 'buy' rating and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 31.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.