NBCC (India) Ltd.'s share price rose 1.66% after its wholly owned subsidiary, HSCC (India) Ltd., was awarded work orders worth approximately Rs 599.35 crore.

The orders include the establishment and operation of 'Hinduhridaysamrat Balasaheb Thackery Aapla Dawakhana' in Maharashtra for the National Health Mission, valued at Rs 259.35 crore. Additionally, HSCC has been awarded a contract for setting up Radiation Oncology Units in four districts of Maharashtra—Jalna, Ratnagiri, Baramati, and Dharashiv—for Rs 340 crore.

These projects are part of HSCC's ongoing operations, and the company confirmed that the orders were secured in the normal course of business. The successful acquisition of these contracts has been positively reflected in NBCC's stock performance.

NBCC (India) Ltd. is a public sector enterprise under the Ministry of Housing and Urban Affairs, engaged in project management, construction, and real estate development. It specialises in the development of residential, commercial, and institutional infrastructure.

HSCC (India) Ltd. focuses on healthcare infrastructure projects. It handles the construction of hospitals, medical colleges, and diagnostic centers across India. HSCC has earned a strong reputation for executing high-quality healthcare projects, including turnkey solutions for medical facilities. Both companies play a vital role in the country's infrastructure development, particularly in the public sector.

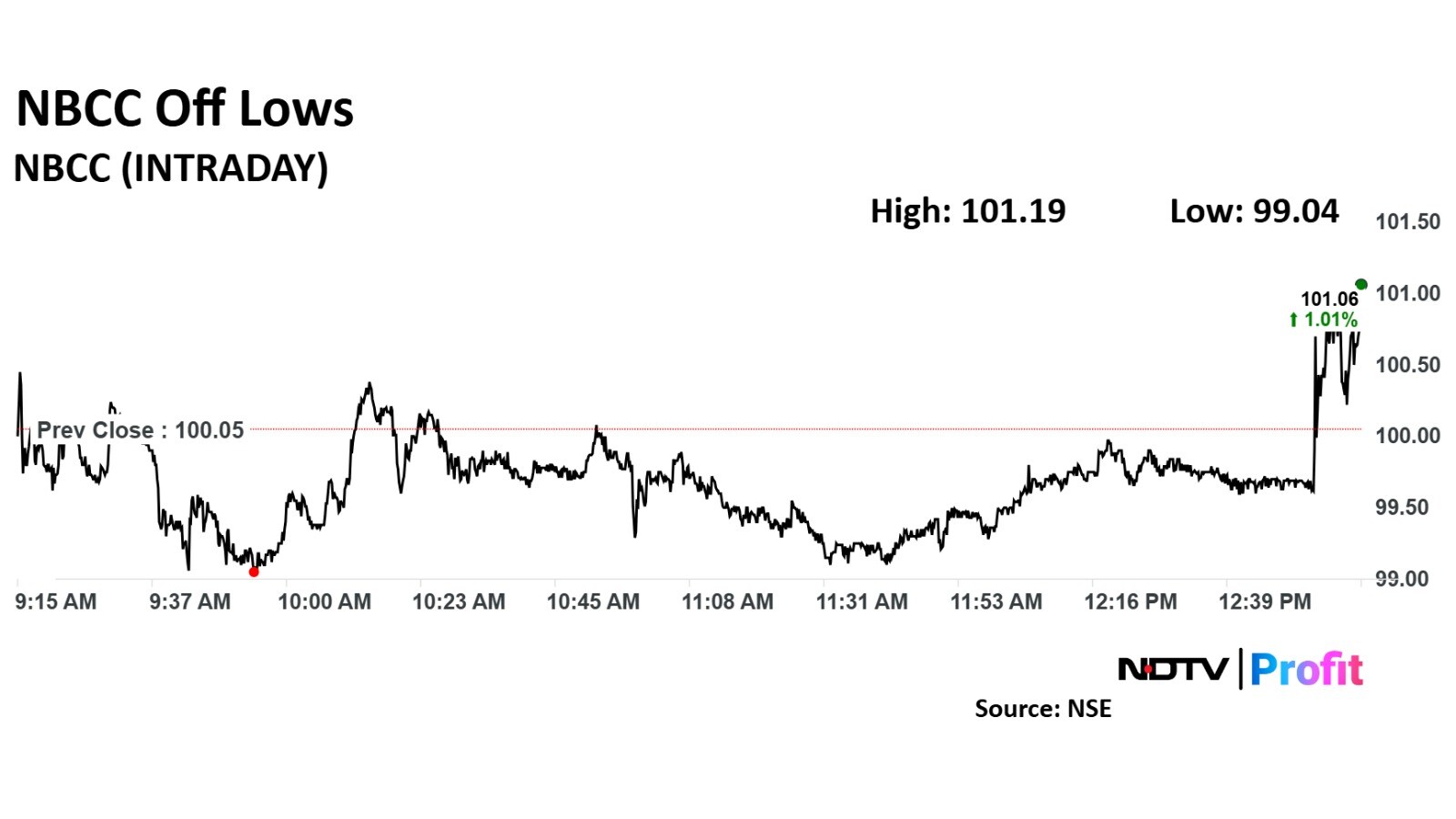

NBCC Share Price Today

Share price of NBCC rose as much as 1.66% before paring gains to trade 1.6% higher at Rs 101.6 apiece, as of 1:09 p.m. This compares to a 0.54% advance in the NSE Nifty 50.

The stock has risen 86.3% year-to-date. Total traded volume so far in the day stood at 1 times its 30-day average. The relative strength index was at 59.6

Out of four analysts tracking the company, two maintain a 'buy' rating and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 31.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.