The share price of Muthoot Finance Ltd. rose over 6% to hit a fresh life high on Thursday after the company reported strong third-quarter earnings. In addition, the shares were also trading at a higher volume.

The firm's standalone net profit during the quarter ended December rose 32.7% to Rs 1,363 crore, compared to Rs 1,027 crore in the year-ago period.

The net interest income—the difference of interest earned, and interest paid— for the quarter rose 42.8% to Rs 2,722 crore. This compares to Rs 1,906 crore reported in the corresponding quarter of the previous fiscal.

The bank has reported its highest consolidated loan AUM at Rs 1.11 lakh crore as of Dec. 2024, according to its investor presentation. This is 34% higher than Rs 82,773 crore reported in the same period last year. Its gold loan AUM in the quarter ended December stood at Rs 92,964 crore, 34% higher than Rs 69,221 crore reported in the same period last year.

Muthoot Finance has raised $400 million through Global issuance of bonds, it said in its press statement on Wednesday.

Nuvama Upgrades To Buy

Additionally, Nuvama has upgraded its rating on Muthoot Finance from 'Reduce' to 'Buy' and raised its target price to Rs 2,550 from Rs 1,870. The firm reported another solid quarter with strong growth in assets under management and stable net interest margins, the brokerage said in its note on Thursday. Nuvama remains bullish on the company's consistent performance, supported by rising gold prices and a mixed performance across its other lending segments.

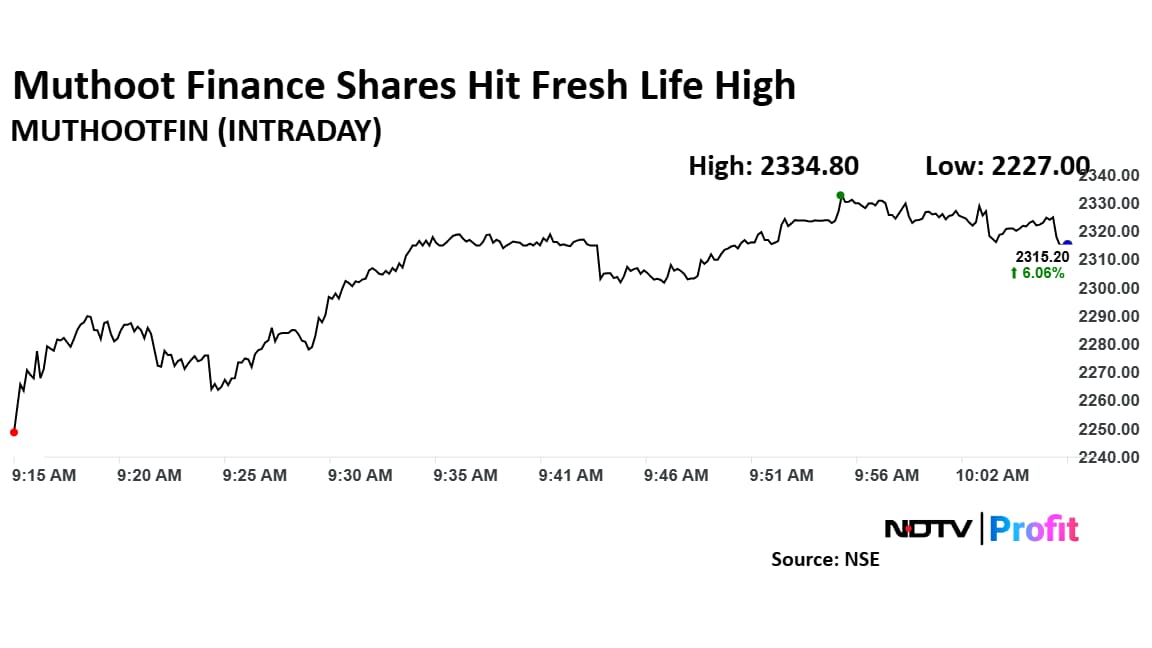

Muthoot Finance Shares Hit Fresh Life High

The shares of Muthoot Finance rose as much as 6.37% to Rs 2,322 apiece, the highest level since its listing in 2011. It pared gains to trade 6.06% higher at Rs 2,315 apiece, as of 10:03 a.m. This compares to a 0.60% advance in the NSE Nifty 50 index.

It has risen 69.65% in the last 12 months. Total traded volume so far in the day stood at 24 times its 30-day average. The relative strength index was at 64.

Out of 25 analysts tracking the company, 19 maintain a 'buy' rating, five recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.