Shares of 'Navratna' defence company Mazagon Dock Shipbuilders Ltd. gained 5% on Tuesday ahead of the company's upcoming stock-split at the end of the month.

The stock split, which shall be the company's first ever recorded, implies the sub-division of the existing 1 equity share of the face value of Rs 10 each fully paid up into 2 equity shares of the face value of Rs 5 each fully paid up.

The ex/record date to determine the eligibility of shareholders for the stock split has been fixed on Dec. 27, 2024.

Mazagon Dock Q2 Earnings Highlights (Consolidated, YoY)

Revenue up 51% to Rs 2,757 crore versus 1,828 crore (Bloomberg estimate: Rs 2,148 crore)

Ebitda up 189% to Rs 511 crore versus 177 crore (Estimate: Rs 364 crore).

Margin expands to 18.5% versus 9.7% (Estimate: 16.9%).

Net profit up 76% to Rs 585 crore versus Rs 333 crore (Estimate: Rs 489 crore).

Order book stood at Rs 39,872 crore as of September 2024.

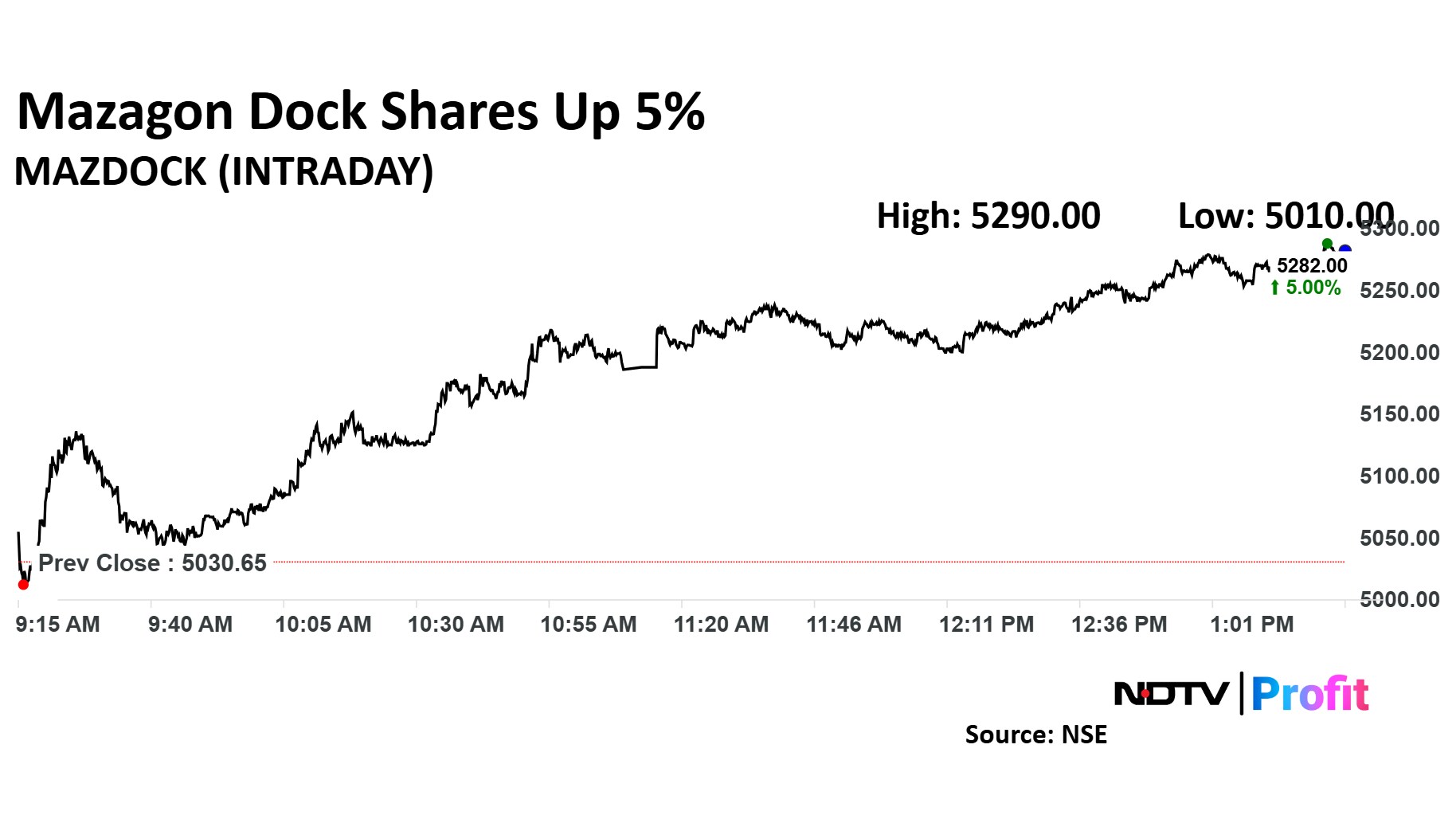

Mazagon Dock Share Price Today

Mazagon Dock Shipbuilders share price rose as much as 5.16% to Rs 5,290 apiece, the highest level since Aug. 1, 2024. It pared gains to trade 4.96% higher at Rs 5,279.95 apiece, as of 01:27 p.m. This compares to a 1.25% decline in the NSE Nifty 50 Index.

It has risen 134.70% on a year-to-date basis. Total traded volume so far in the day stood at 2.7 times its 30-day average. The relative strength index was at 76.26.

Out of five analysts tracking the company, two maintain a 'buy' rating, two recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 23.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.