Troubled telecom operator Mahanagar Telephone Nigam Ltd.'s share price surged over 18% during early trade on Thursday, after a senior minister signalled the government is not privatising the state-run firm.

Minister of State for Rural Development and Communications Pemmasani Chandra Sekhar, replying to a question in Parliament on Wednesday, said that last month, the government had approved an additional capital expenditure plan of Rs 6,982 crore for BSNL Ltd.

In 2023, the government approved the allotment of 4G/5G spectrum to BSNL with a total outlay of around Rs 89,000 crore, he said.

"In 2019, first revival package amounting to around Rs 69,000 crore was given that brought down the operating costs of BSNL/MTNL. In 2022, revival package amounting to around Rs 1.64 lakh crore was given. It focused on infusing fresh capital, restructuring debt, viability gap funding for rural telephony etc.," the minister said.

On the specific question by a lawmaker whether BSNL and MTNL are being privatised, there was no pointed answer from the minister.

In a separate response, Sekhar also said that while BSNL received Rs 2,387.82 crore via monetisation of lands and buildings, MTNL made Rs 2,134.61 crore up to January 2025. MTNL also made Rs 258.25 crore from monetisation of close assets comprising tower and fibre up to January 2025.

MTNL Share Price Today

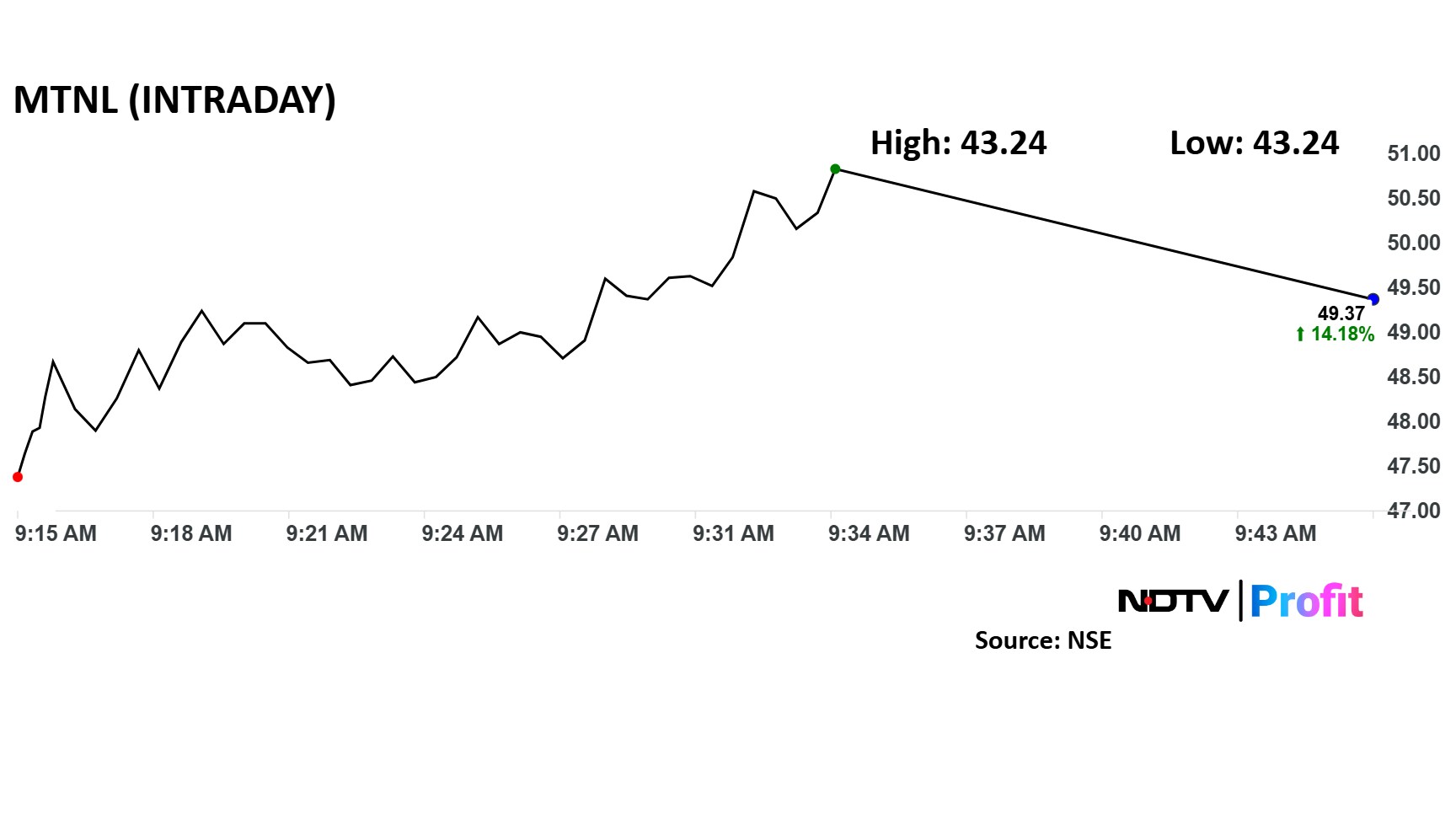

MTNL share price gained as much as 18.36% to Rs 51.18 apiece.

MTNL share price gained as much as 18.36% to Rs 51.18 apiece. The stock was trading 14% higher by 9:45 a.m., compared to a 0.13% rise in the benchmark Nifty 50.

The stock went above the 100-day daily moving average as trading volume surged to 10 times its 30-day average, as per Bloomberg data.

The stock has risen 51% in the last 12 months and fallen 1% so far this year. The relative strength index was 57.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.