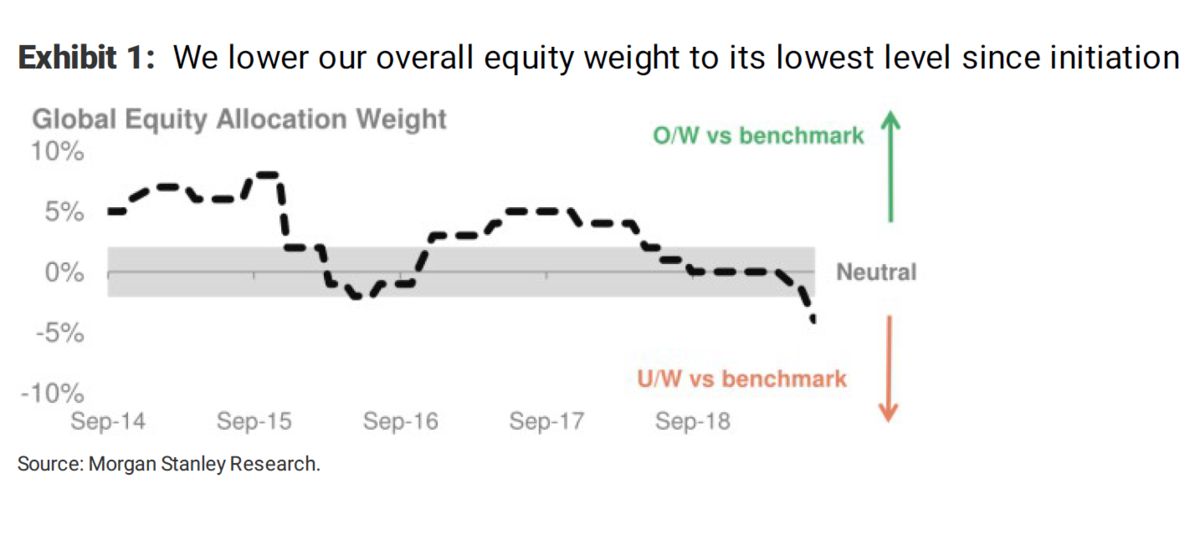

Morgan Stanley reduced the global equity allocation to lowest in five years and downgraded its stance to ‘Underweight', citing poor outlook on stocks over the next three months.

The investment banking firm lowered the overall global equity weight to -4 percent, the lowest since it initiated coverage of stocks in 2014, its strategists said in a note on Sunday. Its average expected return for global stocks fell to the lowest in six years, global PMIs and commodity prices continued to deteriorate and earnings estimates remained higher.

“We see a market too sanguine about what lower bond yields may be suggesting—a worsening growth outlook,” the note said.

Where To Put Money?

Regionally, Morgan Stanley now prefers Japan and Europe over emerging markets and the U.S., the note said. It increased allocations to emerging market sovereign credit and Japanese government bonds.

“Emerging market fixed income won't be immune in a larger equity selloff, but we do think it will do better, supported by better valuations and our expectations for a weak U.S. dollar and further central bank easing,” it said. “JGBs have lagged the decline in core European yields and look attractive on a currency-hedged basis.”

“Europe also looks less bad than elsewhere,” it said.

The Risks To Morgan Stanley's Call

There are plenty of risks to this downgrade, Morgan Stanley said.

“Light investor positioning could make it harder for stocks to decline and easier for them to squeeze higher,” it said. “The second-quarter earnings season could be better than we expect.”

But the biggest risk, according to the research firm, is a scenario where growth recovers while central banks continue to pile on the stimulus. “If the U.S. Federal Reserve and the European Central Bank ease the policy and the data improves, it could be equity positive.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.