Auto component maker Minda Industries Ltd. will merge automobile seating manufacturer Harita Seating Systems Ltd. with itself.

According to an exchange filing, shareholders of Harita Seating will have two options:

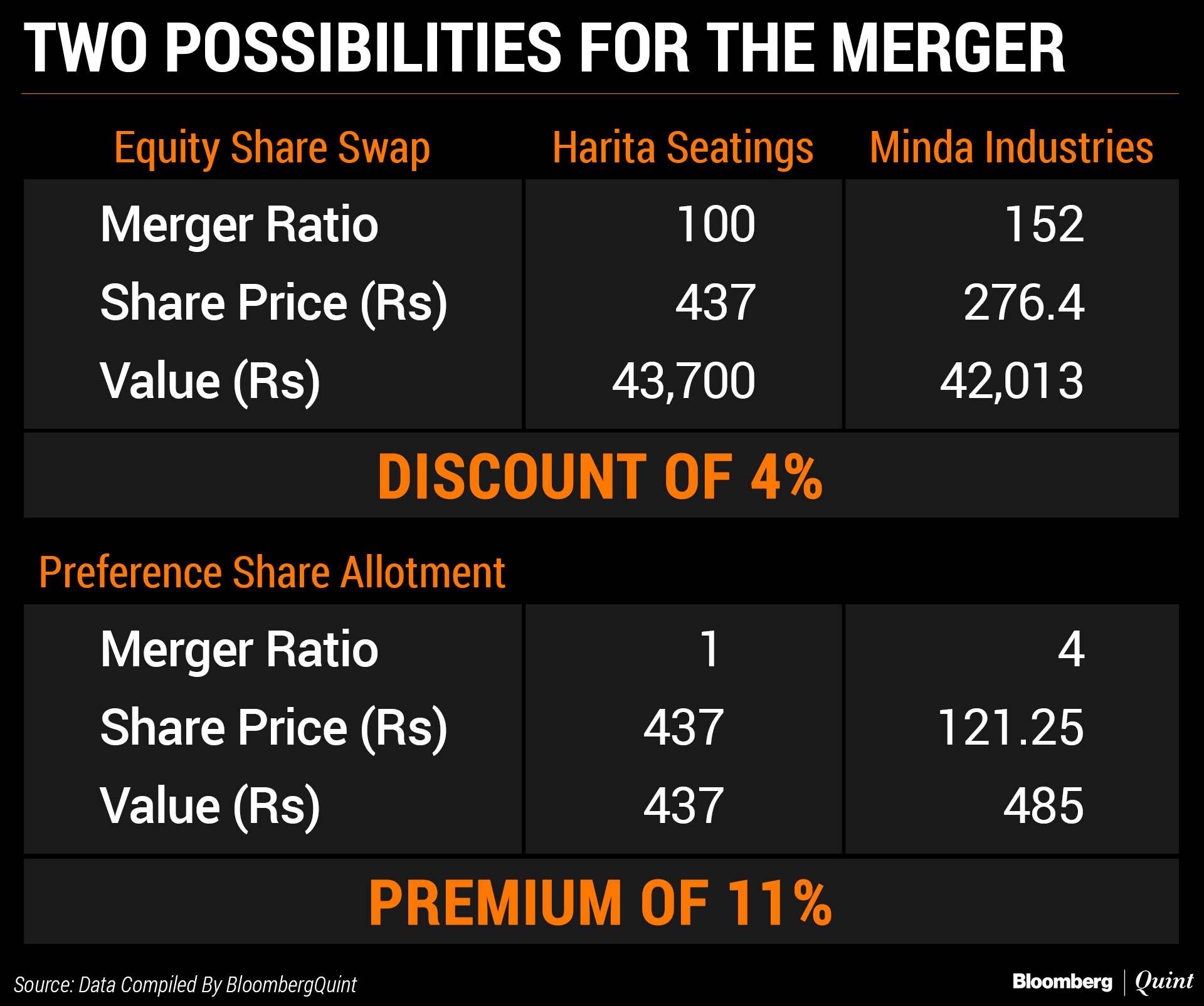

- Opting for shares of Minda Industries through a share swap.

- Seeking allotment of non-convertible preference shares.

The shareholders may stand to lose if they opt for the swap as the shares, according to prevailing market prices, will be at a discount of 4 percent. However, an allotment of preference shares can help them gain up to 11 percent, but they won't own stake in the company.

Assuming full equity option for Harita Seating merger, we anticipate an equity dilution of 4.8 percent, said Sunil Bohra, chief financial officer of Minda Industries, in an interaction with BloombergQuint. “If Harita Seating shareholders opt for Minda Industries share swap, then promoter holding in the company will drop to around 67 percent.”

The companies didn't indicate a timeline for merger completion in their filings.

The acquisition will aid our topline growth and product line, said Bohra. “We expect to leverage Harita Seating products and expand the customer base.”

Harita Seating's largest customer in the two-wheeler segment is TVS Motors Ltd.

Watch the full interaction here:

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.