Multi Commodity Exchange Ltd.'s share price fell nearly 8% in early trade on Tuesday after it reported third quarter financial results that clouded outlook on valuations.

Consolidated net profit rose 4.17% sequentially to Rs 160 crore, meeting the estimate of Rs 163 crore as per analysts' consensus compiled by Bloomberg. Revenue increased 5.5% to Rs 301.4 crore, compared to the projection of Rs 294 crore.

On the operating side, Ebitda rose 7.6% to Rs 193 crore, while margin improved to 64.07%, compared to 62.83% in the previous quarter.

Morgan Stanley said the commodity trading bourse's current valuation is stretched given low conviction on sustainability of revenues. The stock trades at 42.5 times its earnings projection, compared to 23 times for comparable companies, according to Bloomberg data.

The management's commentary on the outlook on product launches and costs will be closely followed, the brokerage said.

It maintained 'underweight' rating on the stock with a target price of Rs 3,715 per share.

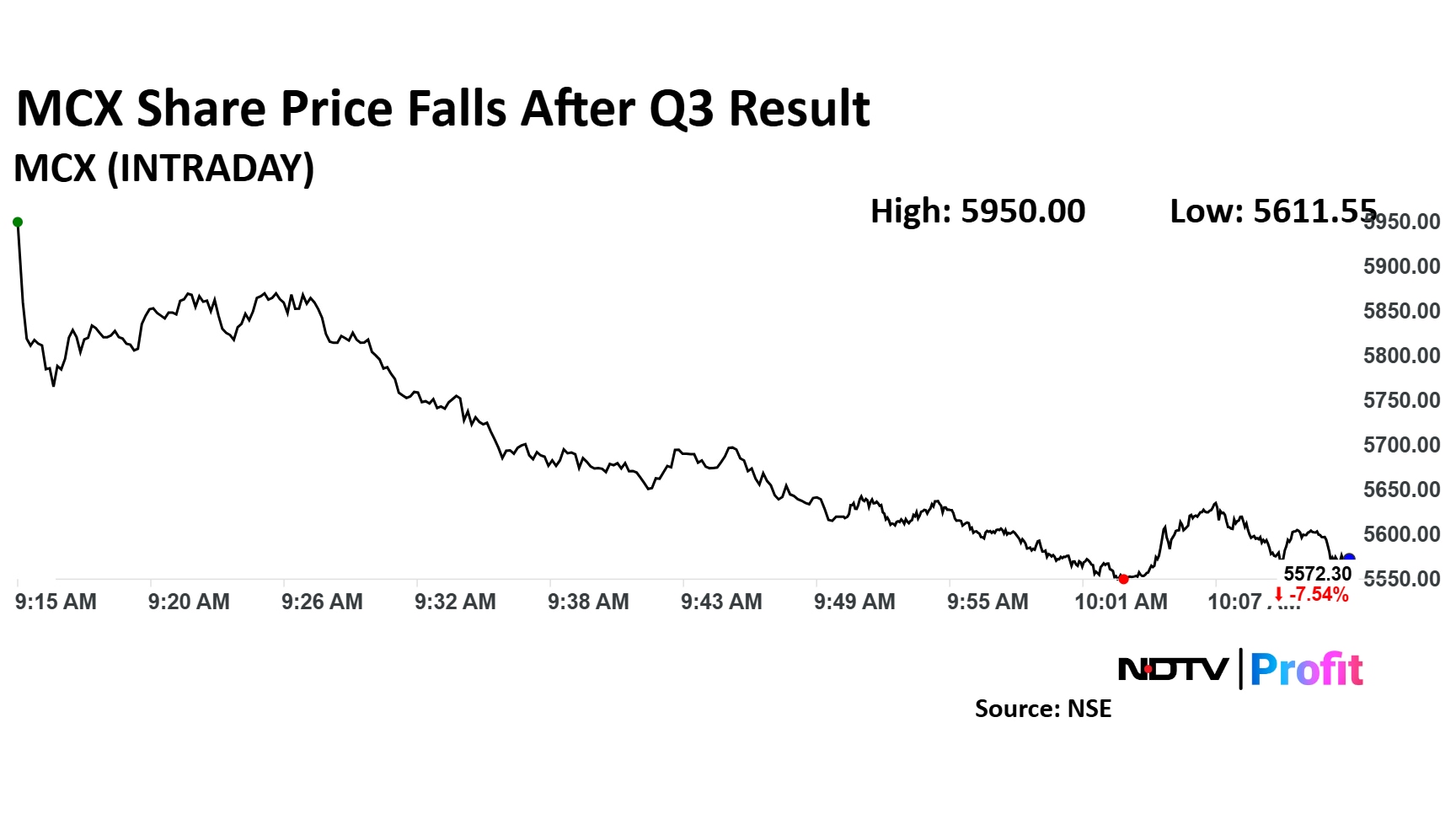

MCX Share Price Movement

MCX' share price tanked 7.9% intraday to Rs 5,550 apiece. The scrip was trading 7.5% lower at Rs 5,572.3 per share by 10:12 a.m. The benchmark NSE Nifty 50 was down 0.36%.

The stock has risen 85% in the last 12 months. The total traded volume so far in the day stood at 6.2 times its 30-day average. The relative strength index was at 36.

Four of the 12 analysts tracking the company have a 'buy' rating on the stock, six recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 6,563 implies a potential upside of 19%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.