Shares of Max Estates Ltd. rose over 6% on Thursday, after it announced its takeover of Boulevard Projects Pvt. in a bid to revive the Delhi One project in Noida.

The real estate developer acquired Boulevard Projects for Rs 3.4 lakh, as per an exchange filing that came out on Thursday. The total capital commitment, including settlement of outstanding liabilities, is estimated to be Rs 1,400 crore, as per the filing.

The acquisition was completed after approval from the National Company Law Tribunal and National Company Law Appellate Tribunal in February 2023 and October 2024, respectively.

Situated at the edge of South Delhi and directly connected via the Delhi-Noida-Direct flyway, the Delhi One project is close to the key metro stations. The project spans approximately 2.5 million square feet of development, part of an approximately 10-acre land parcel constituting 34,696 square metres of area, a press release said.

"We are delighted to announce that Max Estates has taken over Delhi One. We believe that we will provide a world class real estate experience to the residents and office goers of the NCR. We look forward to bringing to life our first integrated campus, weaving Max Estates' philosophy of LiveWell, WorkWell, PlayWell, and EatWell into a holistic downtown experience," said Sahil Vachani, vice chairman and managing director at Max Estates.

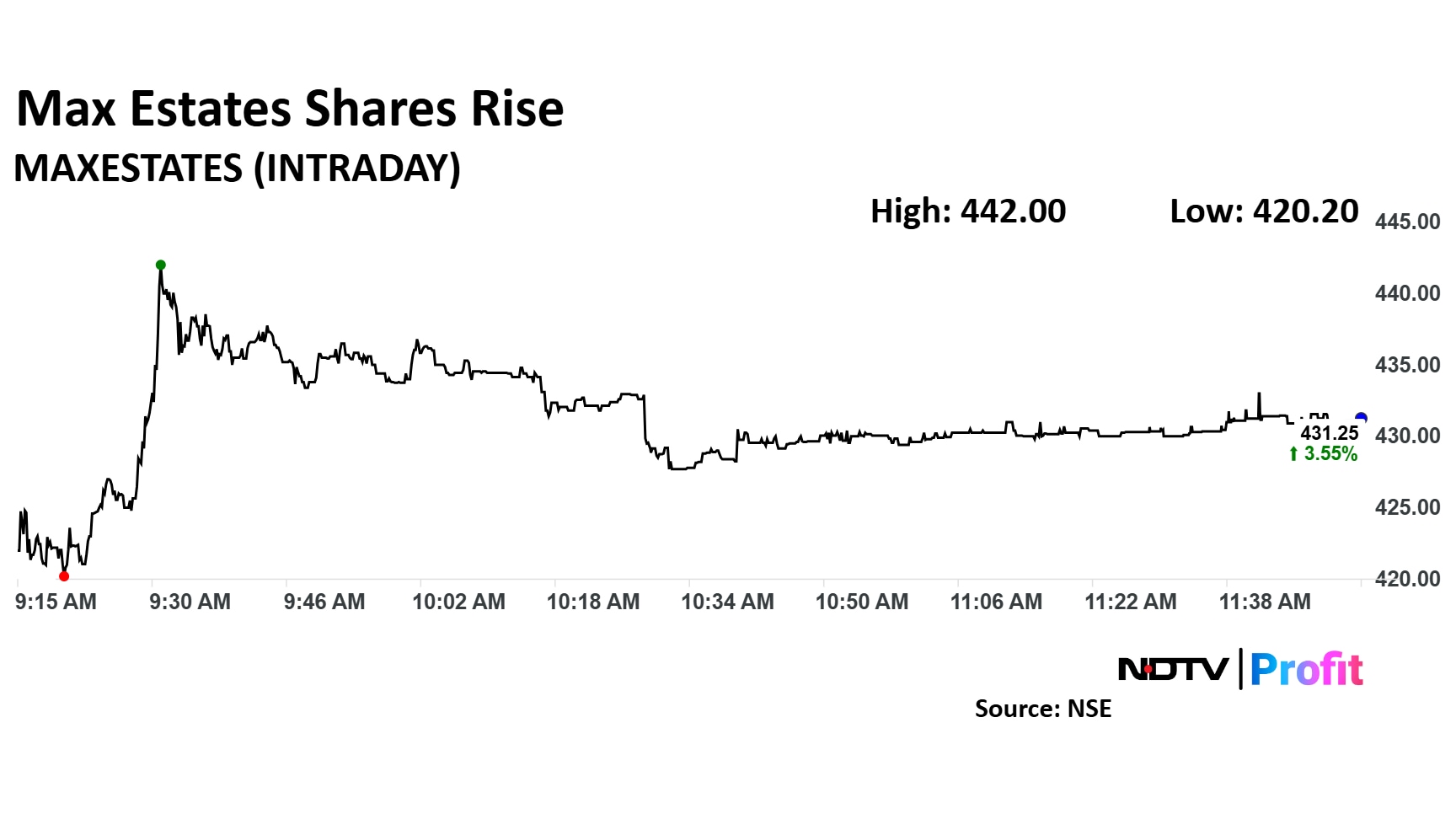

Max Estates Share Price Today

Shares of Max Estates rose as much as 6.14% to Rs 442 apiece, the highest level since March 7, 2025. They pared gains to trade 3.33% higher at Rs 430.30 apiece, as of 11:30 a.m. This compares to a 0.3% decline in the NSE Nifty 50.

The stock has fallen 24.20% on a year-to-date basis, and has risen 47.87% in the last 12 months. Total traded volume so far in the day stood at 0.52 times its 30-day average. The relative strength index was at 55.81.

All three analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 68.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.