Shares of Mahindra & Mahindra Ltd. fell over 6% on Friday following the company's announcement that it would invest in the proposed rights issues of its subsidiaries, Mahindra & Mahindra Financial Services (MMFSL) and Mahindra Lifespace Developers (MLDL).

The board of M&M Financial Services has approved raising up to Rs 3,000 crore through a rights issue, while Mahindra Lifespace Developers plans to raise up to Rs 1,500 crore via a similar route.

According to an exchange filing, M&M Financial Services will offer and issue fully paid-up equity shares of face value Rs 2 apiece, not exceeding Rs 3,000 crore.

With a sharp fall in provisions and healthy growth in its loan book, M&M Financial Services reported a 63% year-on-year rise in its net profit for the quarter ended December, amounting to Rs 899 crore. However, the asset quality worsened, with stage 3 assets rising to 3.9% in December from 3.83% a quarter ago, and net stage 3 assets increasing to 2.0% from 1.59% a quarter ago.

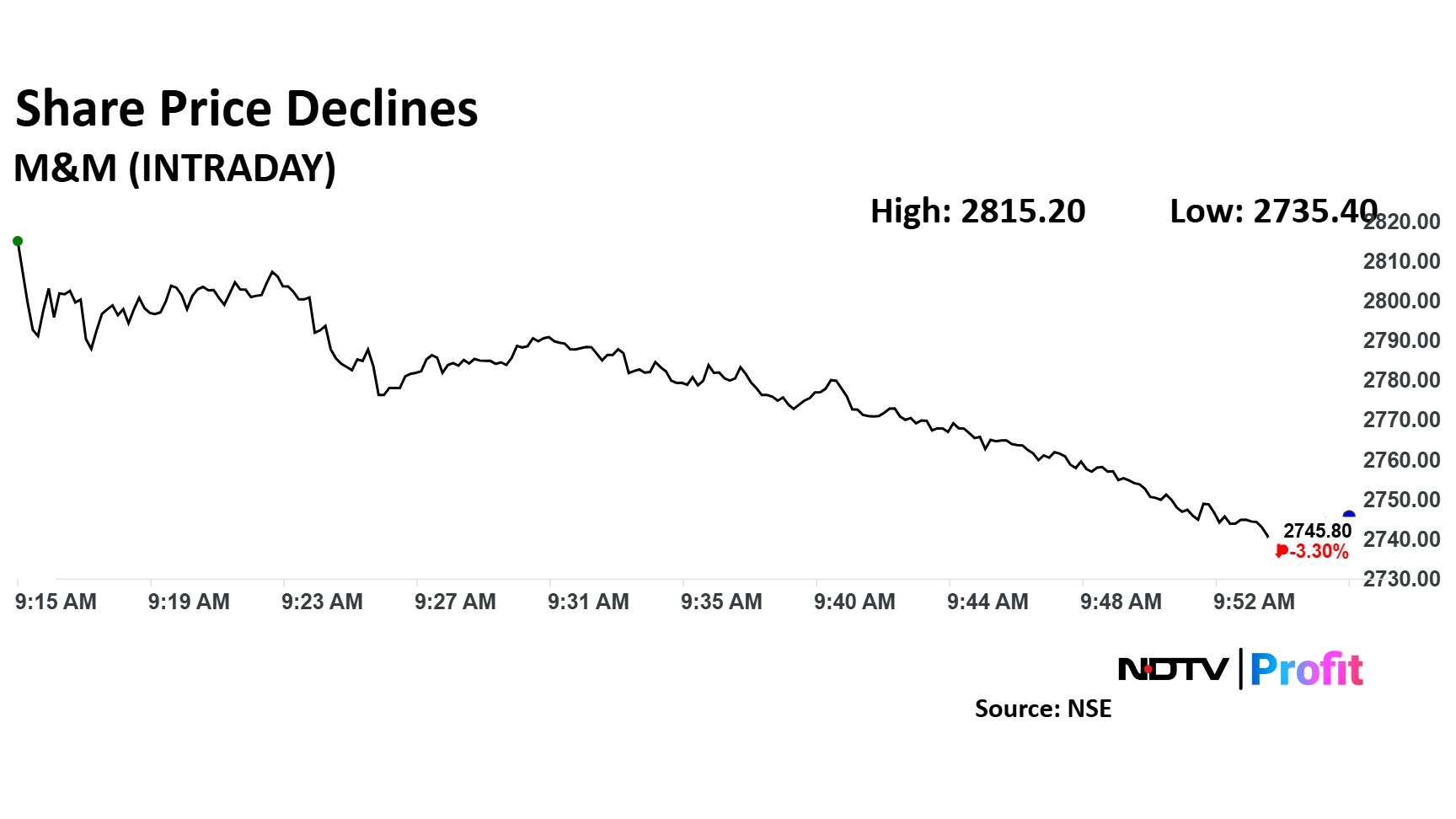

The scrip fell as much as 6.14% to Rs 2,665.00 apiece to the day's low at 11:00 p.m. This compares to a 0.62% decline in the NSE Nifty 50 Index.

It has risen around 43% in the last 12 months. Total traded volume so far in the day stood at 2.0 times its 30-day average. The relative strength index was at 35.

Out of 40 analysts tracking the company, 37 maintain a 'buy' rating, two recommend a 'hold,' and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 29.6%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.