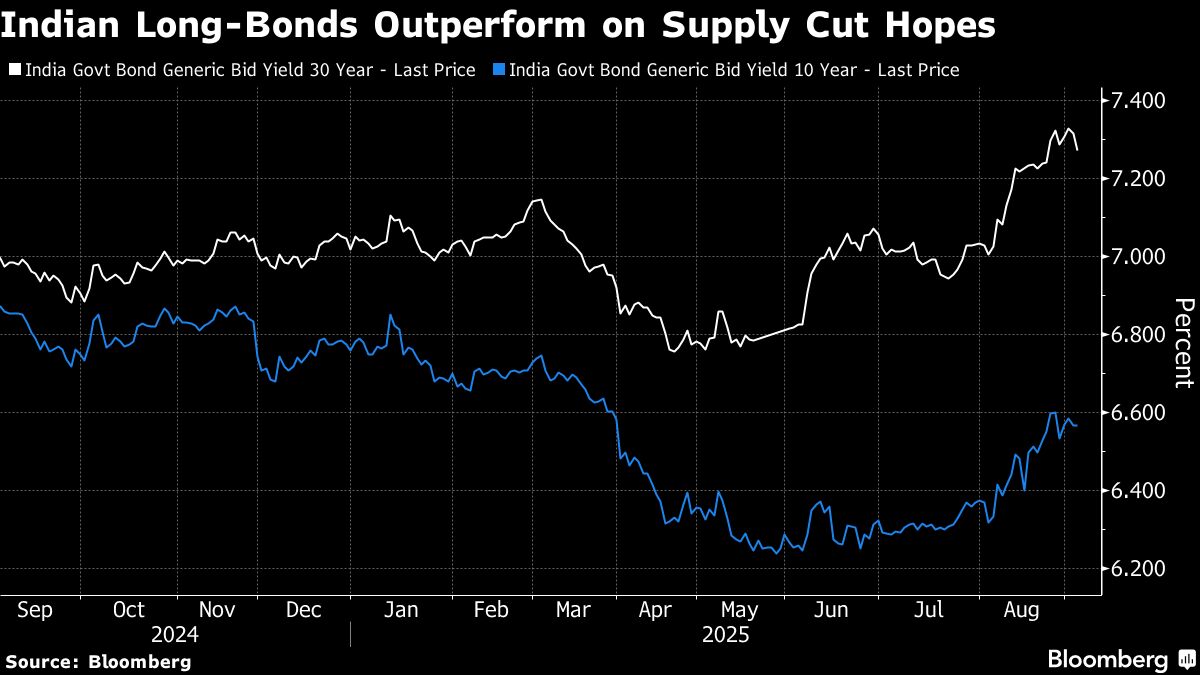

Longer-dated Indian bonds rose on Wednesday amid hopes that the government may trim supply of such securities in its borrowing plan for the second half of the fiscal year.

The yields on the 30-year and 40-year bonds fell by six basis points each, following a Bloomberg report on Tuesday that some Indian lenders had urged the Reserve Bank of India to scale back issuance of longer-tenor debt for the October–March period. Those on on benchmark 10-year notes fell three basis points.

The central bank manages the government's borrowing program.

“There is expectation that some of the supply at the long-end could be reduced, which may ease some of the steepness in the bond yield curve,” said Gopal Tripathi, head of treasury at Jana Small Finance Bank, referring to the gap between short- and long-term bond yields.

The rally in long-term bonds follows a prolonged selloff, driven by diminishing expectations of interest rate cuts and fiscal concerns after the government proposed cuts in some consumption taxes.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.