Lloyds Metals and Energy Ltd. stock surged over 4% as the company announced its decision to enter the mines development and operations (MDO) business, marking a significant expansion in its operational portfolio. The move, approved by the company's board of directors at a meeting on December 9, 2024, aims to diversify the company's interests within the mining sector and strengthen its integrated steel business.

The company plans to explore, develop, and operate mines to extract various minerals, contributing to its long-term strategy of optimising input costs for its steel operations. By integrating mining into its business model, Lloyds Metals seeks to enhance its supply chain efficiency, reduce operational costs, and improve overall profitability.

The decision to enter the MDO sector falls under the metals and mining industry, specifically within the sub-sector of mineral extraction and resource development. The company will evaluate several opportunities within this field as it progresses with the venture.

While the total investment in this new business line will depend on various factors such as scale, research and development needs, and regulatory compliance, the company has committed to evaluating the financial requirements as the project progresses.

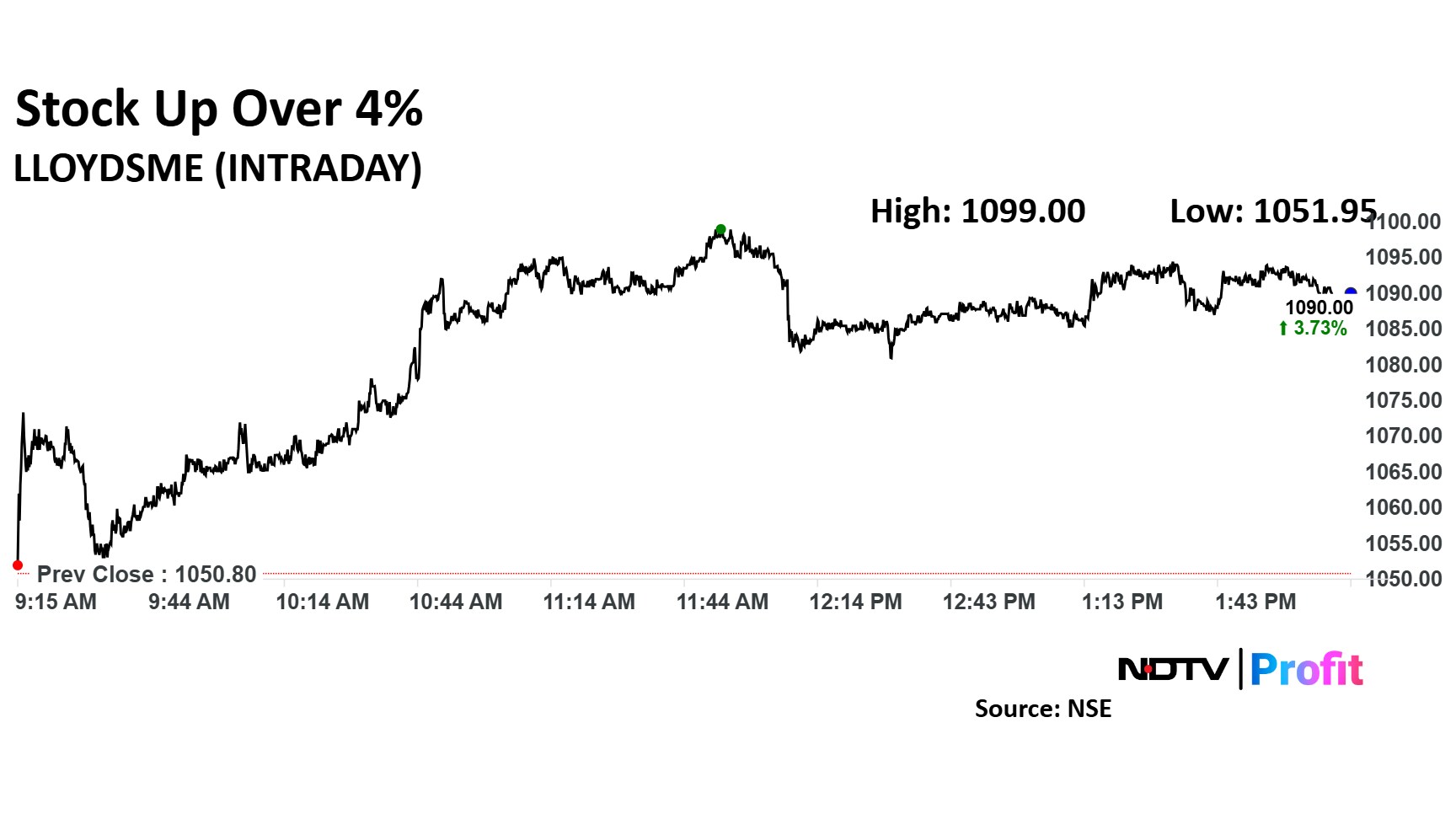

Lloyds Metals and Energy share price rose as much as 4.59% to Rs 1,099 apiece. It pared gains to trade 4% higher at Rs 1,092.80 apiece, as of 2:07 p.m. This compares to a 0.24% decline in the NSE Nifty 50 Index.

It has risen 74.88% in the last 12 months. Total traded volume so far in the day stood at 4.6 times its 30-day average. The relative strength index was at 68.

Four analysts maintain a 'buy' rating on the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 78.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.