Indian equity benchmarks resumed gains after a one-day blip led by the rally in the last hour of trade.

The S&P BSE Sensex ended 0.76 percent higher at 37,384 and the NSE Nifty 50 ended 0.85 percent higher at 11,075.90. The broader markets represented by the NSE Nifty 500 Index ended 0.77 percent higher.

On weekly basis, the 31-share index and the 50-stock gauge ended 1.1 percent higher and 1.2 percent higher respectively. The 500-share gauge ended 1.5 percent higher.

The market breadth was tilted in favour of Buyers. About 1,127 stocks advanced and 655 shares declined on National Stock Exchange.

Ten out of 11 sectoral gauges compiled by NSE ended higher, led by the NSE Nifty Realty Index’s 1.5 percent rally. On the flipside, the NSE Nifty Pharma Index was the only sectoral gainer, down 0.85 percent.

Indian equity benchmarks resumed gains after a one-day blip led by the rally in the last hour of trade.

The S&P BSE Sensex ended 0.76 percent higher at 37,384 and the NSE Nifty 50 ended 0.85 percent higher at 11,075.90. The broader markets represented by the NSE Nifty 500 Index ended 0.77 percent higher.

On weekly basis, the 31-share index and the 50-stock gauge ended 1.1 percent higher and 1.2 percent higher respectively. The 500-share gauge ended 1.5 percent higher.

The market breadth was tilted in favour of Buyers. About 1,127 stocks advanced and 655 shares declined on National Stock Exchange.

Ten out of 11 sectoral gauges compiled by NSE ended higher, led by the NSE Nifty Realty Index’s 1.5 percent rally. On the flipside, the NSE Nifty Pharma Index was the only sectoral gainer, down 0.85 percent.

The yield on the 10-year benchmark fell nearly five basis points to 6.62 percent. It had declined six basis points intraday.

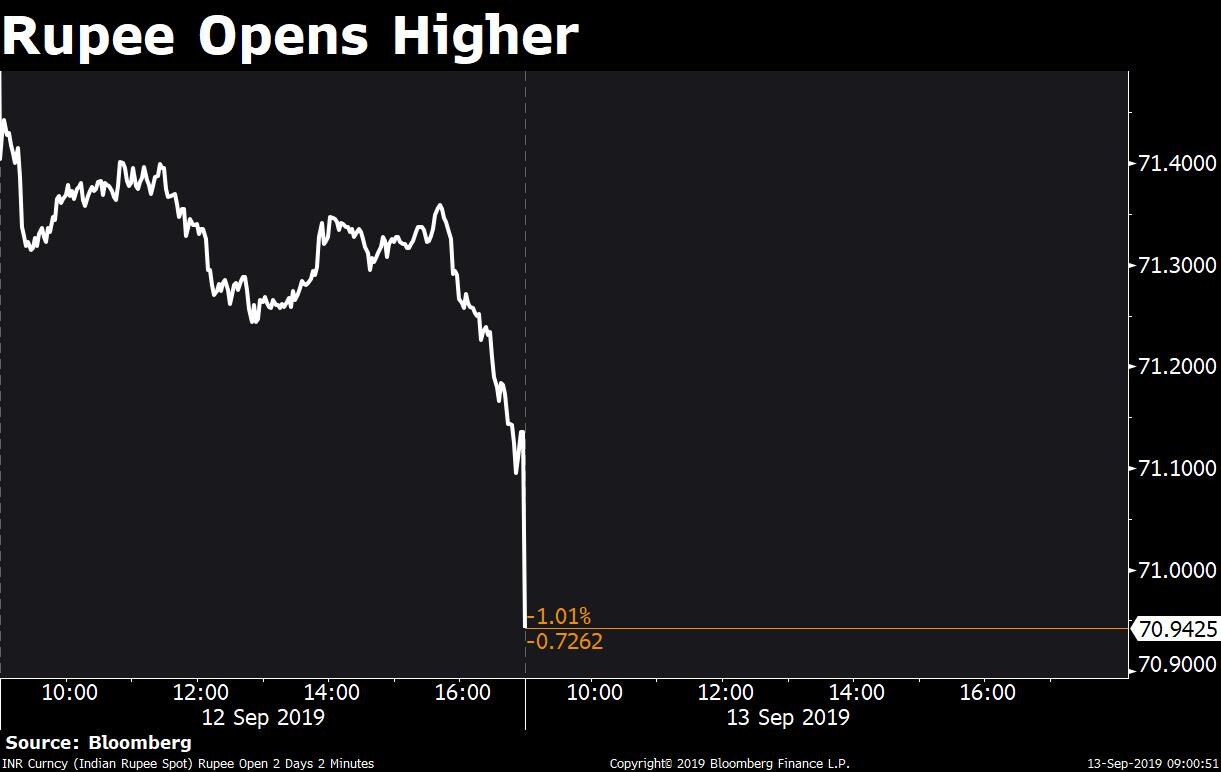

The Indian rupee struggled to hold gains against the U.S. dollar.

The home currency appreciated 0.06 percent to 71.09 against the greenback. It had appreciated 0.38 percent intraday.

Gravita India

Motherson Sumi

MMTC

Hindustan Copper

Indian equity benchmarks are set to resume gains after a one-day blip.

The S&P BSE Sensex rose 0.66 percent to 37,348 as of 3:05 p.m. and the NSE Nifty 50 rose 0.76 percent to 11,067. The broader markets represented by the NSE Nifty 500 Index rose 0.7 percent.

Indian Energy Exchange

Sundaram Finance

MMTC

Great Eastern Shipping

Reliance Capital Ltd. today, said that the company would receive Rs 6,000 crore through stake sale of Reliance Nippon Life Asset Management Company Ltd. via offer for sale.

“The proceeds by the OFS and the transaction with Nippon Life Insurance Company of Japan will be utilised to reduce Reliance Capital’s outstanding debt,” Reliance Capital said in a media statement on the exchanges.

“Reliance Capital expects to reduce its debt by at least Rs 12,000 crore (US$ 1.7 billion), or 70 percent, in the current financial year,” the statement added.

U.S. equity futures rose with Asian stocks and European peers edged higher as shares globally headed for a third weekly gain on easing trade fears and a new round of central bank stimulus.

Get your daily fix of global markets here.

Shares of Bharat Petroleum Corporation Ltd. rose as much as 7.1 percent to Rs 411.50.

“India is considering a plan to sell the nation’s second-largest state refiner and fuel retailer to a global oil company as it explores options to give up its controlling stake in BPCL,” Bloomberg reported quoting people familiar with the matter.

Shares of Bharat Petroleum Corporation Ltd. rose as much as 7.1 percent to Rs 411.50.

“India is considering a plan to sell the nation’s second-largest state refiner and fuel retailer to a global oil company as it explores options to give up its controlling stake in BPCL,” Bloomberg reported quoting people familiar with the matter.

Indian equity benchmarks regained momentum after fluctuating between gains and losses.

The S&P BSE Sensex rose 0.2 percent to 37,183 as of 2 p.m. and the NSE Nifty 50 rose 0.21 percent to 11,007. The broader markets represented by the NSE Nifty 500 Index rose 0.17 percent.

The market breadth was tilted in favour of buyers. About 964 stocks advanced and 778 shares declined on National Stock Exchange.

Shares of Wockhardt halted its five-day gaining streak, their longest gaining streak in nearly three months. The stock fell as much as 5.8 percent to Rs 305.60.

The scrip advanced 31 percent in the past five days and rose 7.4 percent in the past 30 days, Bloomberg data showed. Of the shares traded, 38 percent were at the ask price and 44 percent were at the bid.

Shares of Wockhardt halted its five-day gaining streak, their longest gaining streak in nearly three months. The stock fell as much as 5.8 percent to Rs 305.60.

The scrip advanced 31 percent in the past five days and rose 7.4 percent in the past 30 days, Bloomberg data showed. Of the shares traded, 38 percent were at the ask price and 44 percent were at the bid.

Buyers and sellers were not known immediately.

Source: Bloomberg

Indian equity benchmarks were trading marginally lower after fluctuating between gains and losses.

The S&P BSE Sensex fell 0.09 percent to 37,069 as of 1 p.m. and the NSE Nifty 50 fell 0.06 percent to 10,974. The broader markets represented by the NSE Nifty 500 Index fell 0.04 percent.

Shares of Gravita India rose as much as 5.3 percent to Rs 47.75.

The company’s Ghana arm has increased its capacity of its existing Lead Recycling Plant from 60,000 MTPA to 12,000 MTPA.

The stock returned 24 percent in the past five days and 27 percent in the past 30 days, according to Bloomberg data.

About 10.4 lakh shares of Indian Oil Corporation changed hands in a large trade, Bloomberg data showed. Buyers and sellers were not known immediately.

Shares of MMTC extended gains for the fourth consecutive trading session. The stock rose as much as 7.7 percent to Rs 23.80, the highest in two months.

The company has invited bids for import of 2,000 tonnes of onion from countries such as Pakistan, Egypt, China and Afghanistan, to improve domestic supply and check prices, according to a PTI report on Sept. 11.

This is the fist tender MMTC has floated this year. The government has decided to import onions as retail prices have shot up to Rs 50 per kg in most parts of the country due to shortage of the key kitchen staple, the news agency said.

Trading volume was almost five times its 20-day average, Bloomberg data showed. Of the shares traded, 47 percent were at the ask price and 39 percent were at the bid.

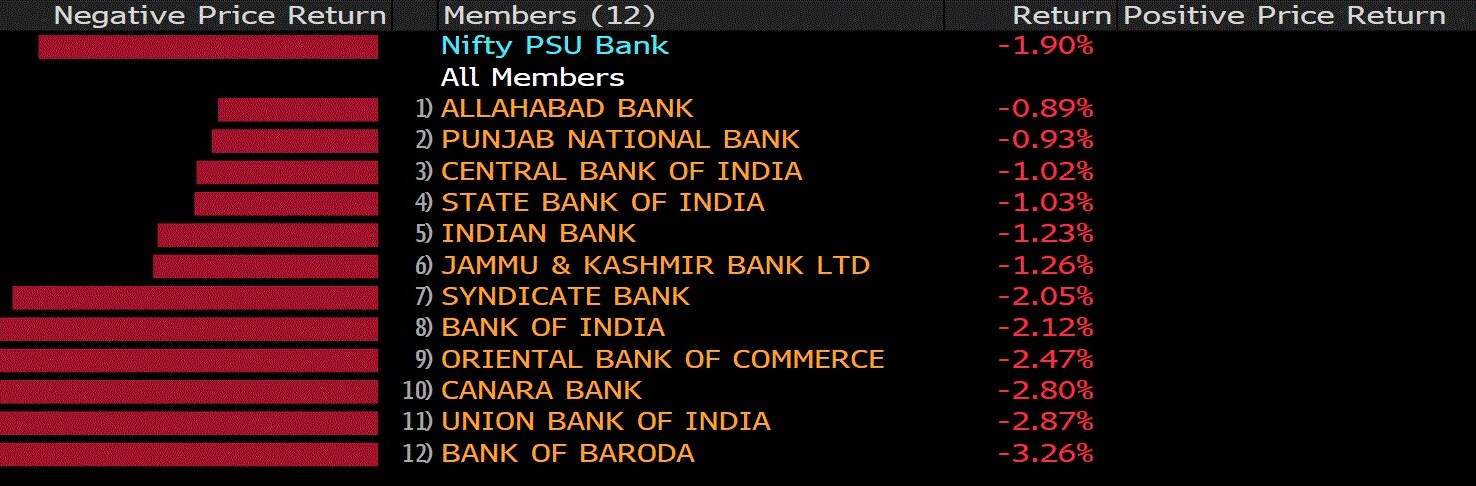

The NSE Nifty PSU Bank Index fell 1.9 percent and was the worst performing sectoral index on National Stock Exchange.

The declines were led by Bank of Baroda, Union Bank of India and Canara Bank.

The NSE Nifty PSU Bank Index fell 1.9 percent and was the worst performing sectoral index on National Stock Exchange.

The declines were led by Bank of Baroda, Union Bank of India and Canara Bank.

The mid- and small-cap indices are under a correction mode and after having a bearish momentum for almost seven quarters valuations are at very attractive levels, according to Epic Research’s Chief Executive Officer Mustafa Nadeem

“One needs to have that kind of patience and longevity in terms of investment. Therefore, the investors should think of the broader picture here and make sure they are invested in this space,” he told in a mailed statement.

Picking out single stock for that kind of return is not an easy task and there is no point in it. So one can look at funds that have exposure in this space. If not, you are already late, Nadeem said.

The NSE Nifty MidCap 100 and the NSE Nifty SmallCap 100 have declined 26.9 percent and 41.6 percent respectively since Jan 15, 2018—when they clocked their record highs.

Indian equity benchmarks traded marginally lower in the forenoon session as investors awaited clarity on U.S.-China trade tensions. Yes Bank emerged as the worst performer after falling 5.7 percent intraday.

The S&P BSE Sensex declined 0.11 percent to 37,063.80 and the NSE Nifty 50 fell 0.10 percent to 10,965.40, as of 11:15 am. The broader markets represented by the NSE Nifty 500 Index fell 0.17 percent.

The market breadth was tilted in favour of sellers. About 855 stocks declined and 792 shares advanced on National Stock Exchange.

Seven out of the 11 sectoral gauges compiled by NSE traded lower, led by the NSE Nifty PSU Bank Index’s 2.23 percent fall. Nifty Media Index was the top gainer, up 0.70 percent.

Shares of the Mumbai-based firm rose nearly 3.5 percent to Rs 134.90 apiece.

The company bagged a Rs 1,998-crore order from Mumbai Metropolitan Regional Development Authority, according to an exchange filing.

The stock has declined 44 percent in the past 12 months compared to a 1.5 percent fall in the Nifty Index.

Shares of the state-owned tourism infrastructure developer advanced over 35 percent in the last two trading sessions.

The shares rose 17.3 percent intraday to Rs 261 apiece, emerging as the top gainer on NSE Nifty 500 Index.

The relative strength index on the stock was over 35 percent, indicating it may be overbought. The trading volume was over 50 times its 20-day average for this time of the day, Bloomberg data showed.

Shares of the state-owned tourism infrastructure developer advanced over 35 percent in the last two trading sessions.

The shares rose 17.3 percent intraday to Rs 261 apiece, emerging as the top gainer on NSE Nifty 500 Index.

The relative strength index on the stock was over 35 percent, indicating it may be overbought. The trading volume was over 50 times its 20-day average for this time of the day, Bloomberg data showed.

Shares of the private lender slumped 5.3 percent intraday to Rs 64.35 apiece, emerging as the top loser on Nifty Index.

This comes as Altico Capital, a non-banking finance company backed by a set of marquee global investors, has defaulted on interest payment to Dubai-based Mashreqbank PSC. Yes Bank is likely to have an exposure to Altico Capital.

The stock traded 39 percent below the Bloomberg consensus one-year target price.

Shares of the autoparts maker rose 4.1 percent intraday to a one-month high of Rs 107.25 each.

Brokerage firm Goldman Sachs upgraded its recommendation on the stock to ‘Buy’ from ‘Neutral’. It also fixed the target price at Rs 121, indicating a potential return of 17.3 percent from last close.

Here’s what the brokerage firm had to say on the stock:

The stock traded 19 times its estimated earnings per share, Bloomberg data showed.

Shares of the autoparts maker rose 4.1 percent intraday to a one-month high of Rs 107.25 each.

Brokerage firm Goldman Sachs upgraded its recommendation on the stock to ‘Buy’ from ‘Neutral’. It also fixed the target price at Rs 121, indicating a potential return of 17.3 percent from last close.

Here’s what the brokerage firm had to say on the stock:

The stock traded 19 times its estimated earnings per share, Bloomberg data showed.

Indian equity benchmarks fluctuated in opening trade as gains in automakers were offset by losses in private lenders such as Yes Bank and HDFC Bank.

The S&P BSE Sensex rose 0.07 percent to 37138.90 and the NSE Nifty 50 rose 0.13 percent to 11,000.45, as of 9:20 am. The broader markets represented by the NSE Nifty 500 Index rose 0.24 percent.

The market breadth was tilted in favour of buyers. About 838 stocks advanced and 604 shares declined on National Stock Exchange.

Ten out of the 11 sectoral gauges compiled by NSE traded higher, led by the NSE Nifty IT Index’s 0.90 percent gain. Nifty Media Index was the only loser, down 0.02 percent.

The Indian rupee opened higher against the U.S. dollar. The home currency rose as much as 0.18 percent to 71.01 against the greenback. Rupee has gained for the seventh-straight session—its longest streak in over two months.

The Indian rupee opened higher against the U.S. dollar. The home currency rose as much as 0.18 percent to 71.01 against the greenback. Rupee has gained for the seventh-straight session—its longest streak in over two months.

Good Morning!

The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index’s performance in India, traded unchanged 10,994 points as of 8:10 a.m.

Asia stocks saw modest gains Friday at the end of a week in which trade optimism continued to grow and the European Central Bank introduced a fresh round of stimulus. Japanese and Australian shares pushed higher, with markets in China and South Korea closed for a holiday.

Short on time? Well, then listen to this podcast for a quick summary of All You Need To Know before the opening bell.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.