(Bloomberg) -- Oil rose for a second day, buoyed by shrinking US stockpiles and a wider risk-on mood triggered by signs of ebbing US inflation.

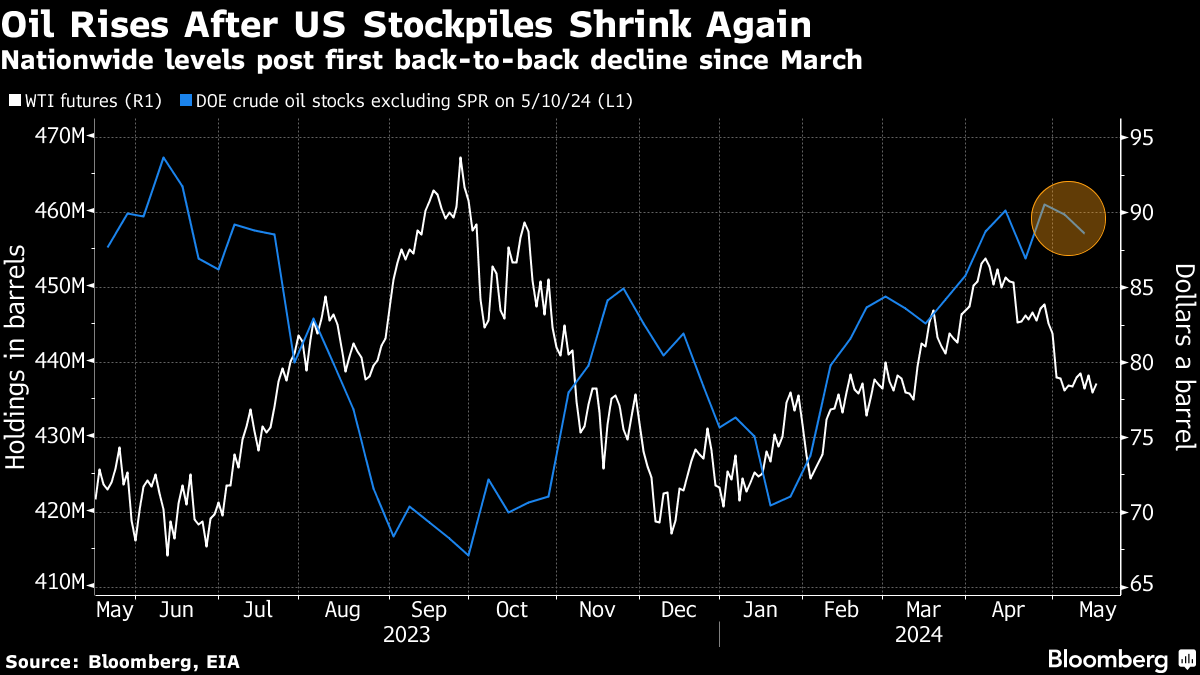

Global benchmark Brent topped $83 a barrel after climbing 0.5% on Wednesday, while US benchmark West Texas Intermediate was over $79. US oil inventories fell by 2.5 million barrels last week for the first back-to-back drop since March, taking nationwide holdings to the lowest in almost a month.

In broader markets, risk assets pushed higher after a measure of US inflation cooled for the first time in six months, offering scope for looser monetary policy from the Federal Reserve. That tugged the US dollar lower — with a Bloomberg gauge of the currency on its third day of losses — making commodities more attractive for overseas buyers.

Crude remains higher in the year to date as OPEC+ nations curbed supply, although prices have pared gains since early April as Middle East tensions faded and signs of some product weakness appeared. The International Energy Agency shaved its yearly demand growth forecast by 140,000 barrels a day, according to a midweek report, although it still sees global demand at an annual record of 103.2 million barrels a day after revising last year's consumption estimates.

“Recent macro data from the US has raised expectations that the Fed could start cutting rates soon, which will be providing some support to oil,” said Warren Patterson, head of commodities strategy for ING Groep NV. Still, the market remains range-bound, and needed either clarity on OPEC+ policy or a fresh catalyst to break out, he said.

Geopolitics was also in focus as Russian President Vladimir Putin arrived in Beijing for his first visit to China in his new term, highlighting the importance of the relationship to Moscow as it continues its war in Ukraine. Asia's largest economy has been taking more flows of Russian crude following the invasion as buyers in Europe and the US turned away.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.