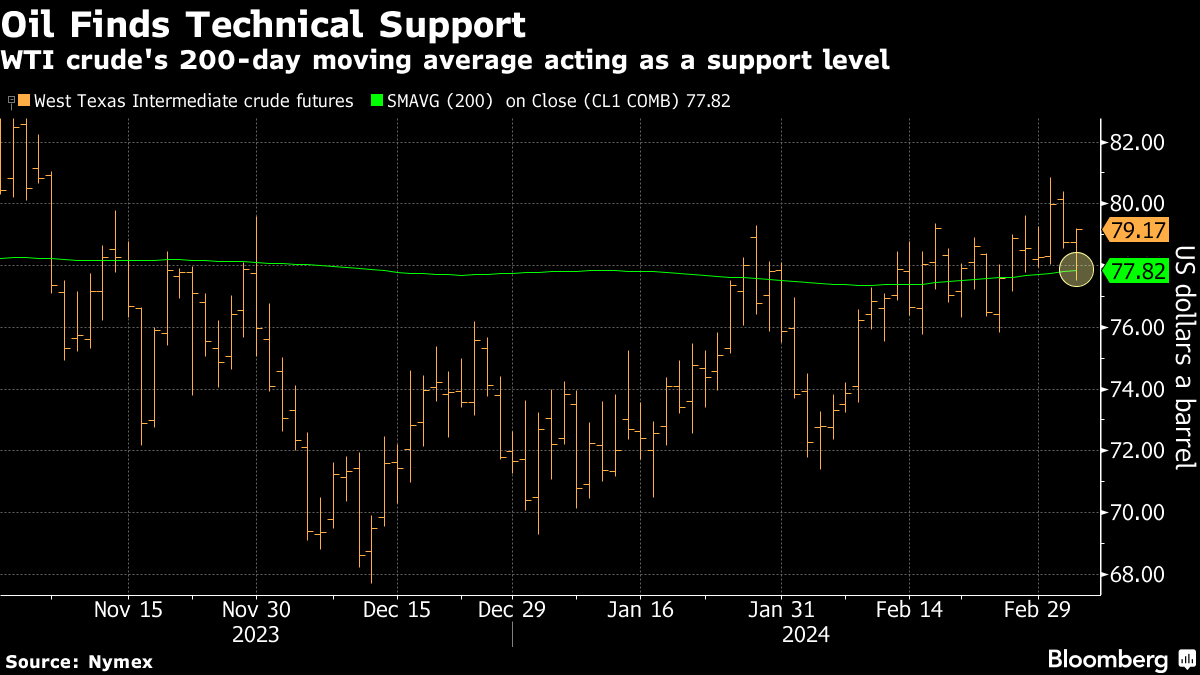

(Bloomberg) -- Oil edged lower, with technical support levels limiting its losses amid risk-off sentiment in broader markets.

West Texas Intermediate slipped 0.7% to just over $78 a barrel after fluctuating in a $2 range for the day. Equity markets dropped as traders weighed mixed economic data ahead of Federal Reserve Chair Jerome Powell's testimony in Congress. Crude's 200-day moving average of about $77.84 has provided resistance for its declines.

“The anticipation of the Fed chairman holding interest rates steady into mid-year is a pressure point to crude prices,” said Dennis Kissler, senior vice president at BOK Financial. “Higher interest rates will keep the US dollar elevated, which is a headwind for crude exports.”

WTI has gained 9.2% this year in a slow-motion ascent aided by strength in physical markets as global shippers avoid the Red Sea and OPEC+ works to limit supply. That optimism has been tempered by strong production from outside of the cartel, a shaky demand outlook in China and expectations central banks will start monetary easing later than previously expected.

Meanwhile, China set its annual growth target at about 5%, raising expectations for officials to unleash more stimulus as they try to lift confidence in a slowing economy. The nation also set a more ambitious target for reducing the energy needed for economic expansion, or energy intensity, this year.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.