(Bloomberg) -- Oil rose after Iran sent a warship to the Red Sea in response to the US Navy's sinking of three Houthi boats over the weekend, adding to regional tensions as ships continue to avoid the key waterway.

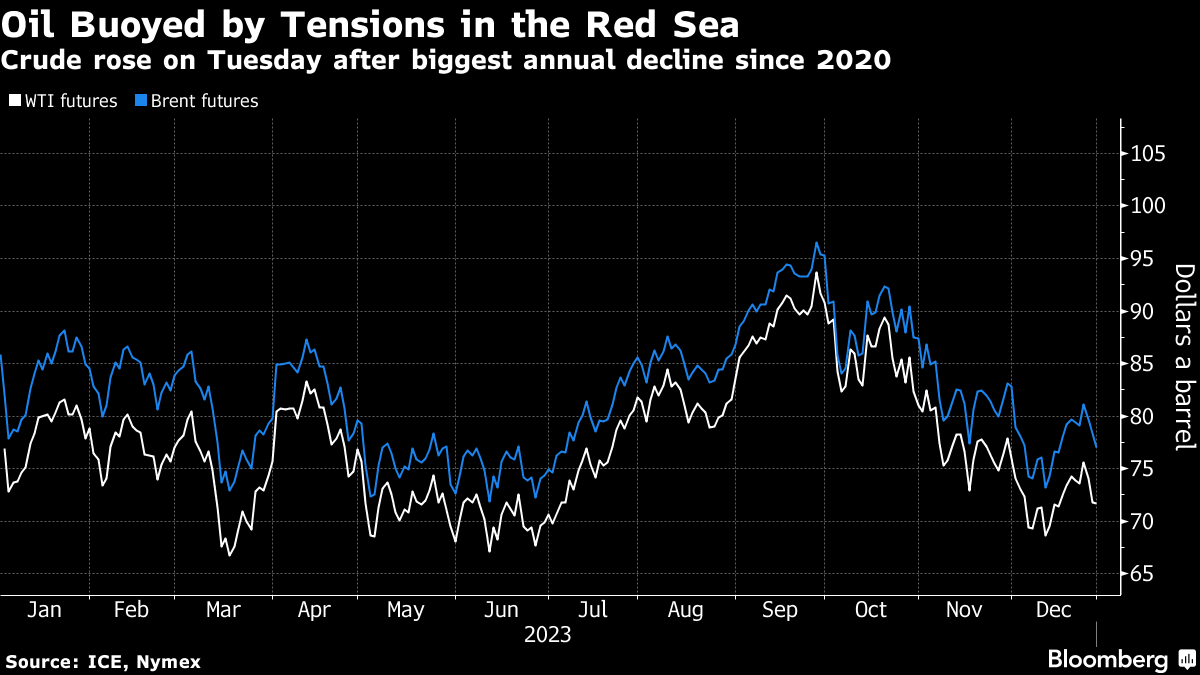

Brent crude climbed above $78 a barrel after declining by 5% over the prior three sessions, with West Texas Intermediate near $73. The US Navy said it was fired upon when responding to a distress call from a vessel in the Red Sea, resulting in the sinking of the three boats. In response, Iran's Alborz destroyer entered the vital waterway on Monday, state media said.

Crude's gains follow the first annual decline since 2020, after a tumultuous year dominated by concerns over increasing production outside OPEC+ and slowing demand growth. That was offset by bullish factors including the wars in Gaza and Ukraine, and signs that the Federal Reserve is done raising interest rates.

A Houthi delegation met with officials in Tehran after the US response to the attack on a Danish-owned container ship. AP Moller-Maersk A/S has again suspended all Red Sea transit to assess the situation in the vital waterway.

“Ongoing geopolitical tensions are anticipated to provide support to prices,” said Priyanka Sachdeva, senior market analyst at brokerage Phillip Nova Pte in Singapore, referring to the Red Sea. A “recovery in China is also a matter of concern for oil traders going into 2024.”

Chinese shares dragged down Asian equities on the first trading day of the year following weaker-than-expected factory data and a speech from President Xi Jinping that flagged the headwinds facing the economy.

The latest cuts from the Organization of Petroleum Exporting Countries and its allies will take effect this quarter, which could then be extended further. Traders have generally been wary of the Nov. 30 pledge from OPEC+ to slash production further, remaining skeptical of its implementation.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.