Brokerage house IDFC Securities has initiated coverage on textile maker KPR Mill Ltd. with an ‘Outperform' rating citing favourable industry dynamics. It has pegged a price target of Rs 1,052 – implying a potential upside of nearly 30 percent from Tuesday's close.

The brokerage said the company is likely to benefit from a slowdown in China's garment exports on rising labour costs. It expects KPR Mills to report strong earnings growth along with good return ratios and healthy free cash flow over FY17-19E.

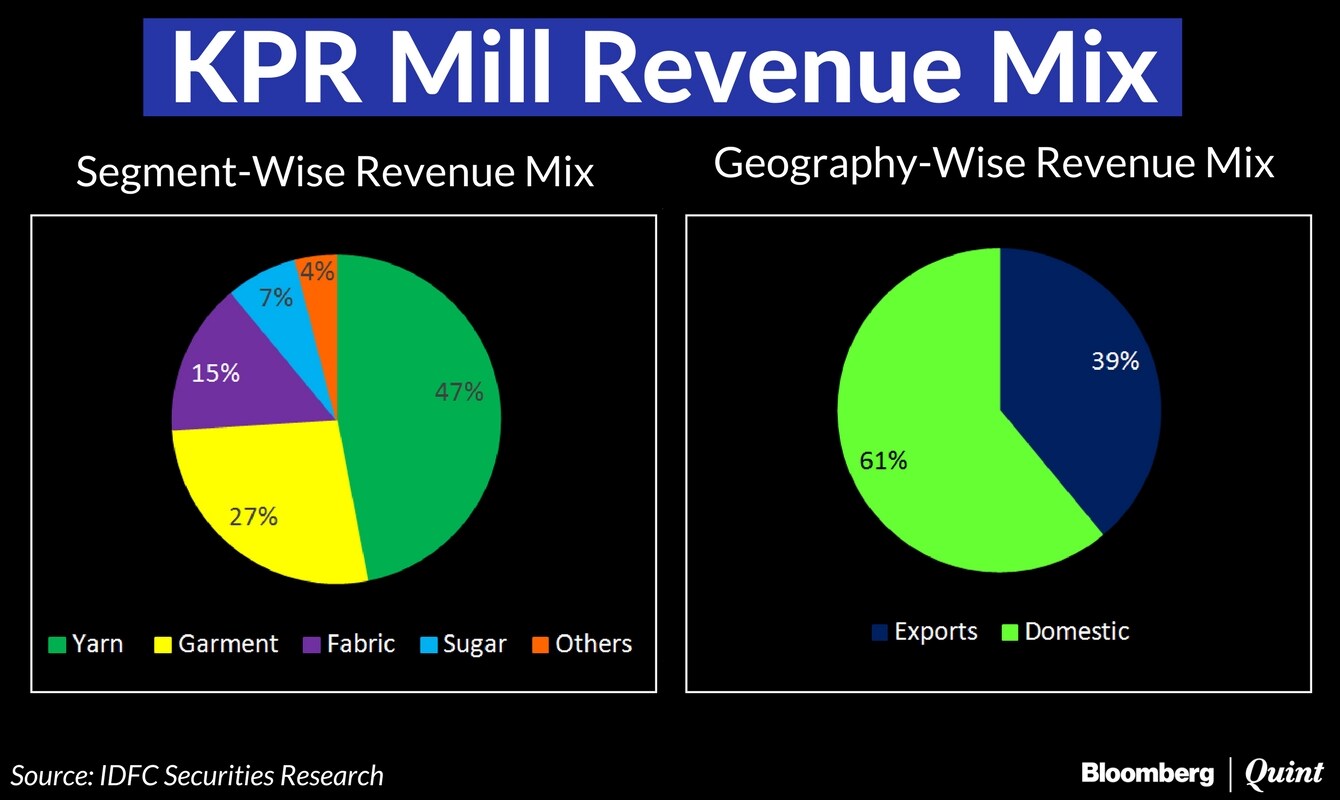

Higher orders from existing clients and addition of new clients could raise garment capacity utilisation to 70 percent in FY18E and 75 percent by FY19E.IDFC Securities Research

The brokerage said the textile maker may look at demerging its non-core businesses to unlock value. Meanwhile, it identified possible fluctuations in cotton prices, slowdown in global economy and high dependence on labour as key risks for the company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.