Kotak Institutional Equities has initiated coverage on Mamaearth's parent, Honasa Consumer Ltd., with an 'add', citing the company's ability to scale its several brands amid a continuous improvement in their product's research and development.

Since launching its first product in 2016, Honasa has demonstrated an enviable track record of speed and success in seeding and scaling several brands, the brokerage said in an April 29 note. This expansion happened while maintaining sound financial discipline, Kotak said.

The brokerage has set a target price of Rs 450 apiece, implying an upside of 5% from its previous closing. Kotak has an "attractive" outlook on the beauty and personal care segment.

According to Kotak, the successful scale-up of multiple brands, omnichannel operations, and financial discipline sets India's largest digital-first BPC company apart.

"We attribute Honasa's success to its strong marketing acumen, a flair for spotting emerging trends and capitalising on them, and nimble execution."

The research firm estimates about 19% average revenue growth over FY2024–27, led by about 10% and 35% average growth for Mamaearth and other brands, respectively. It expects a 585 basis point expansion in Ebitda margin over FY2024–27E, driven by operating leverage, an increase in offline salience, and a reduction in advertising spending, it said.

The key risks the brokerage estimates are the further deceleration in Mamaearth growth and the rise in competition from traditional BPC players, the note said.

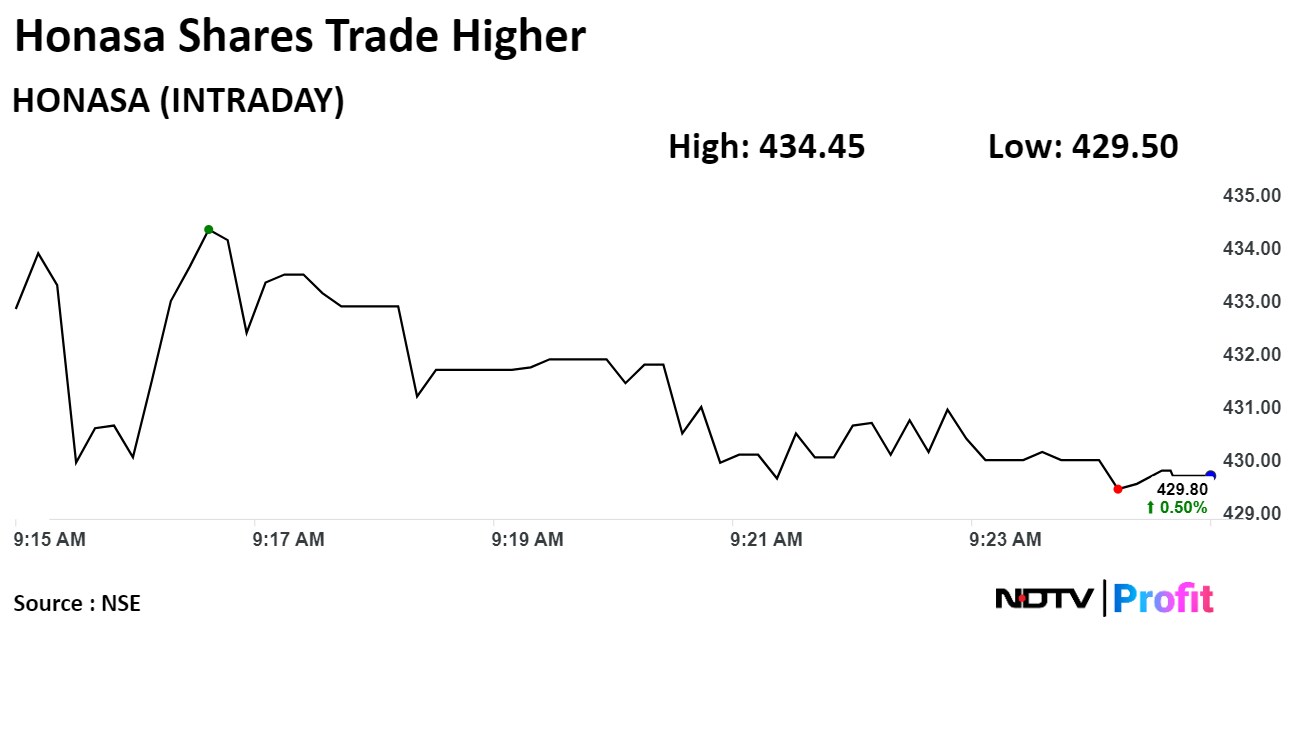

Shares of Mamaearht rose as much as 1.59% during the day to Rs 434.45 apiece on the NSE. It was trading 0.97% higher at Rs 431.8 apiece, compared to a 0.15% advance in the benchmark Nifty 50 as of 9:21 a.m.

The stock has risen 28.09% since its listing on Nov. 7 but has declined 0.49% on a year-to-date basis. The relative strength index was at 62.

Six out of the eight analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold', and another one suggests a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.