Shares of Keystone Realtors Ltd. rose over 5% on Tuesday, after the company posted 34% rise in pre-sales to Rs 3,028 crore in fiscal 2025. It further added that it has achieved the guidance of pre-sales given for financial year 2025.

However, in the fourth quarter the pre-sales rose 1% to Rs 854 crore in comparison to Rs 843 crore reported in the same period in the previous fiscal, according to an exchange filing.

The collection for the quarter ended March rose 11% year-on-year to Rs 746 crore. The collection for the financial year 2025 rose 6% to Rs 2,326 crore, in comparison to Rs 2,203 crore reported in fiscal 2024.

The company sold total area of 1.69 million sq. ft. in the last financial year, 41% higher than 1.20 million sq. ft.

In the fourth quarter, the company launched two projects with a saleable area of 1.04 sq. ft. and an estimated gross development value of Rs 962 crore. In the previous fiscal, a total of seven projects were launched with a gross development value of Rs 5,019 crore.

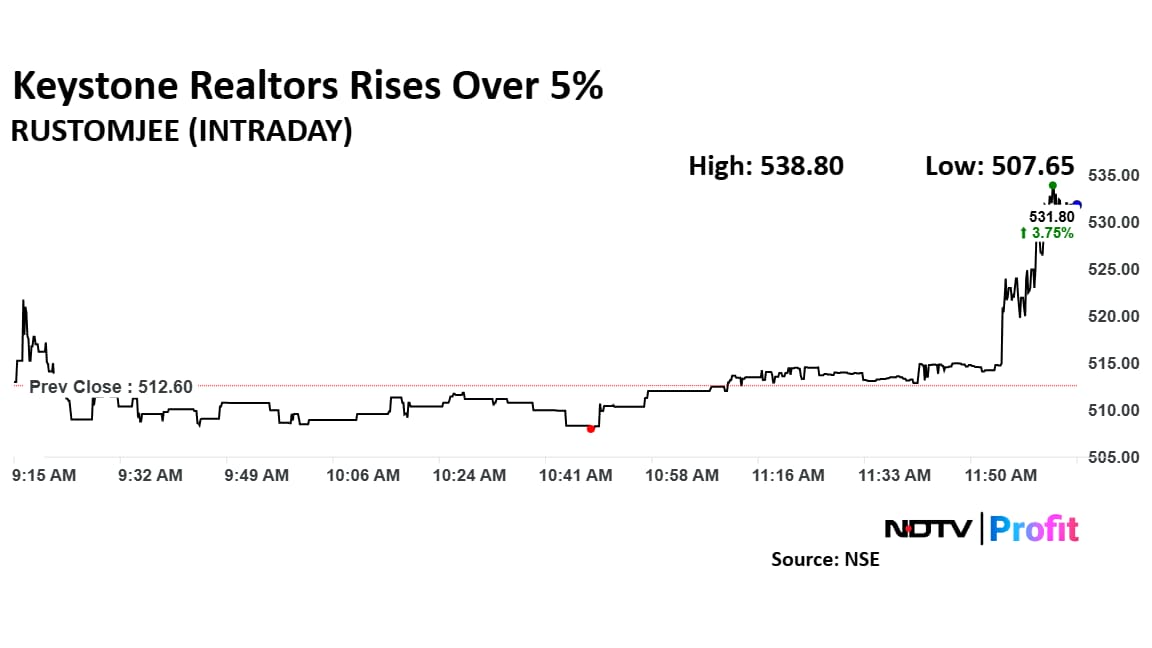

Keystone Realtors Share Price

Shares of Keystone Realtors rose as much as 5.11% to Rs 538.80 apiece, the highest level since April 7. It pared gains to trade 3.17% higher at Rs 528.85 apiece, as of 12:48 p.m. This compares to a 2.14% advance in the NSE Nifty 50.

The stock has fallen 21.40% in the last 12 months and 22.29% year-to-date. Total traded volume so far in the day stood at 3.3 times its 30-day average. The relative strength index was at 48.

All three analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 64.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.