Share price of Kaynes Technology Ltd. rose 4.05% after the company announced the launch of its qualified institutional placement on Thursday, to raise funds of up to Rs 1,600 crore.

The floor price for the company's QIP has been fixed at Rs 5,625.75 per share, which is around 4.8% lower than the stock's closing price of Rs 5,612.

Promoters of the company are offloading up to 28.5 lakh shares, marking 4.67% stake of pre-issue outstanding equity capital at the upper end of the offer, as per the term sheet.

Net proceeds from the fundraiser are expected to be used for prepayment of debt and capital expenditure, funding of working capital requirements, funding of inorganic growth opportunities, and general corporate purposes.

Axis Capital Ltd., Motilal Oswal Investment Advisors Ltd., and Nomura Financial Advisory and Securities (India) Pvt. are the book-running lead managers of the QIP.

The company may offer a discount of not more than 5% on the floor price calculated for the QIP, according to the filing.

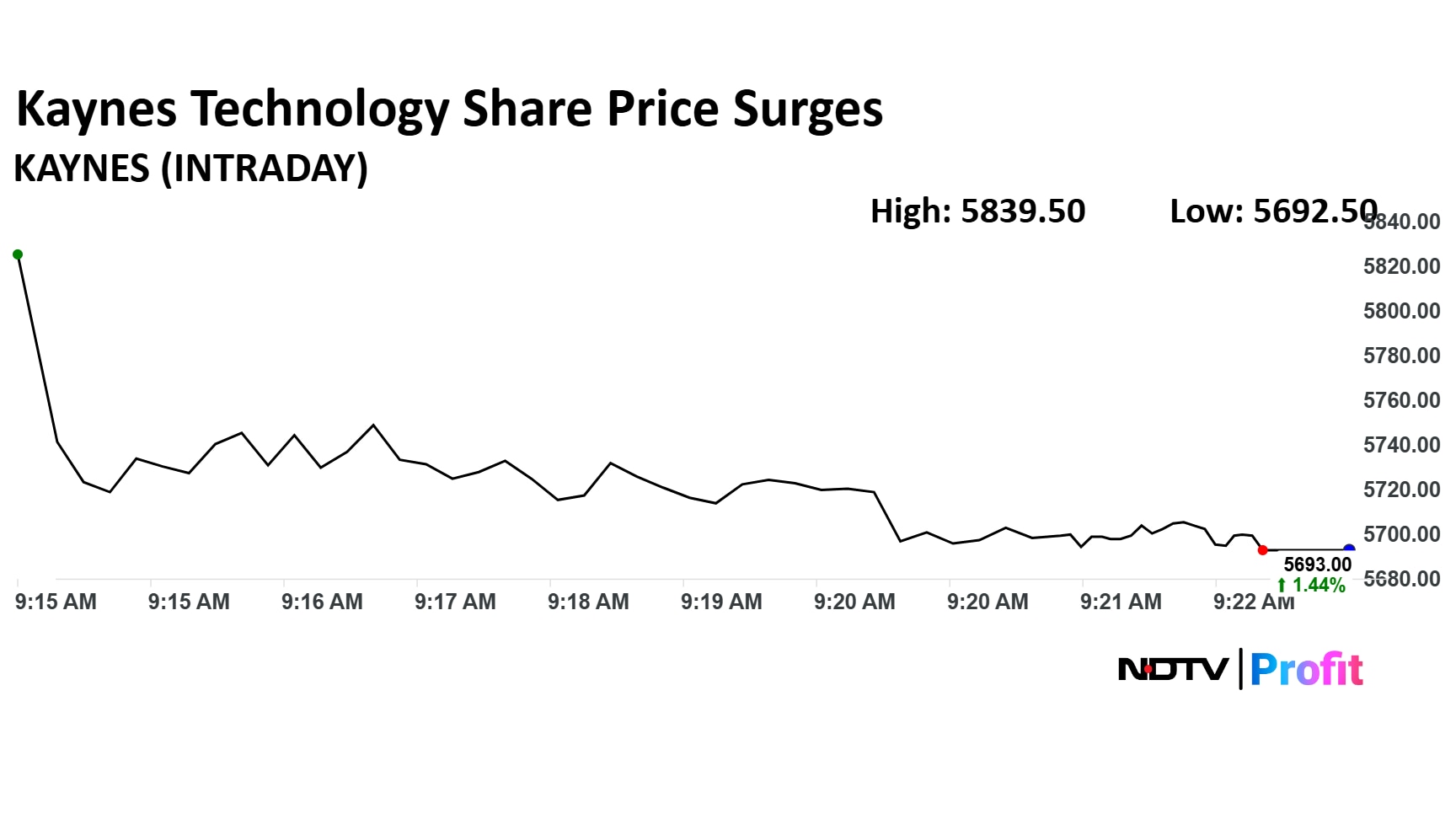

Kaynes Technology Share Price Today

The scrip rose as much as 4.05% to Rs 5,839.50 apiece, the highest level since June 5. It pared gains to trade 1.92% higher at Rs 5,700 apiece, as of 9:21 a.m. This compares to a 0.26% advance in the NSE Nifty 50.

It has fallen 23.21% on a year-to-date basis, and is up 50.32% in the last 12 months. Total traded volume so far in the day stood at 0.9 times its 30-day average. The relative strength index was at 53.66.

Out of 24 analysts tracking the company, nine maintain a 'buy' rating, 10 recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.