Shares of Kalpataru Projects International Ltd. rose over 7% on Monday after it won a construction order.

The EPC player in the power transmission and distribution and civil infrastructure sector secured two new projects worth Rs 3,789 crore, according to an exchange filing on Monday.

The first order is in the building and factories business in India. This includes the largest B&F order secured by the company to date for the development of over 12 million square feet of residential buildings along with associated facilities on a design-build basis.

The second order is in the power transmission and distribution segment in the overseas market.

“We feel privileged to announce the receipt of the above-mentioned orders, especially the largest ever B&F order received by us on a design and build basis, which is a testament to our strong EPC capabilities in the B&F business," said Manish Mohnot, managing director and chief executive officer at Kalpataru Projects.

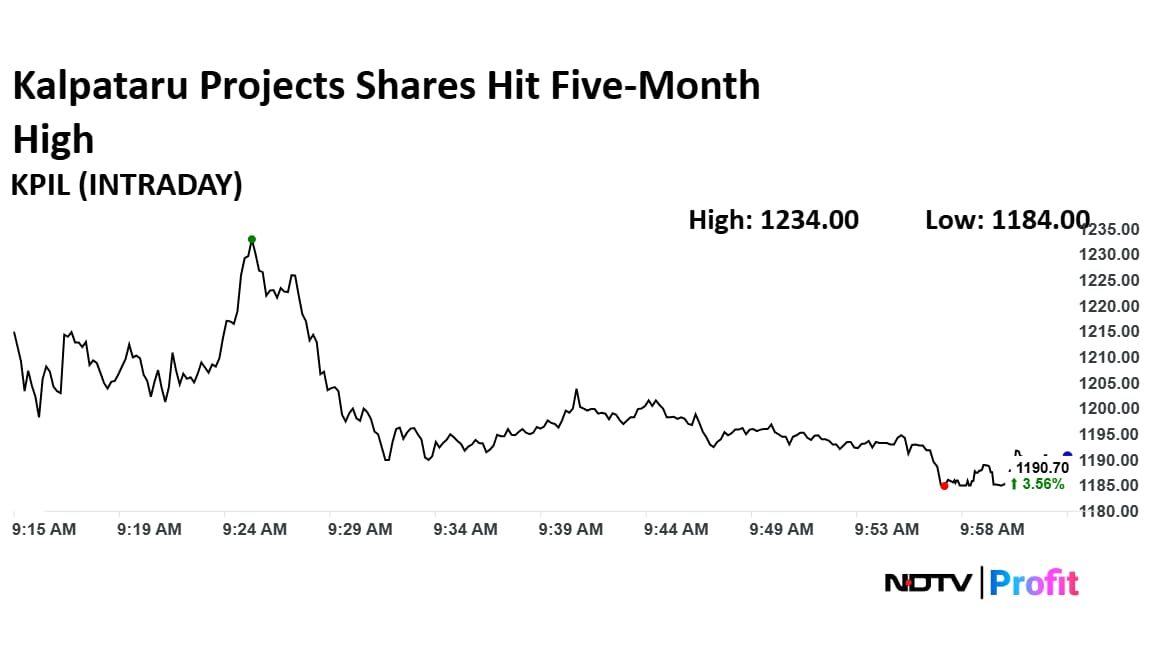

Kalpataru Projects Share Price Advances

The shares of Kalpataru Projects rose as much as 7.32% to Rs 1,234 apiece, the highest level since Jan. 10. It pared gains to trade 3.05% higher at Rs 1,185.10 apiece, as of 9:58 a.m. This compares to a 0.36% advance in the NSE Nifty 50 Index.

It has fallen 6.21% in the last 12 months and 8.61% year-to-date. Total traded volume so far in the day stood at 1.2 times its 30-day average. The relative strength index was at 55.92.

Out of 17 analysts tracking the company, 15 maintain a 'buy' rating and two recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 7.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.