Shares of Jana Small Finance Bank Ltd. rose over 6% in early trading on Tuesday following the company's submission of an application to the Reserve Bank of India seeking approval for its voluntary transition from a small finance bank to a universal bank.

This move aligns with RBI's 'on tap' licensing guidelines for small finance banks in the private sector, issued on Dec. 5, 2019, and complies with the RBI circular concerning the voluntary transition of small finance banks to universal banks, as stated in an exchange filing on Monday.

To obtain a universal banking licence, the bank must meet several criteria, including being listed on a stock exchange, maintaining a minimum net worth of Rs 1,000 crore, and fulfilling minimum capital requirements.

Additionally, the lender is required to have posted a net profit in the last two fiscal years and ensure that its non-performing asset ratios remain within the prescribed limits.

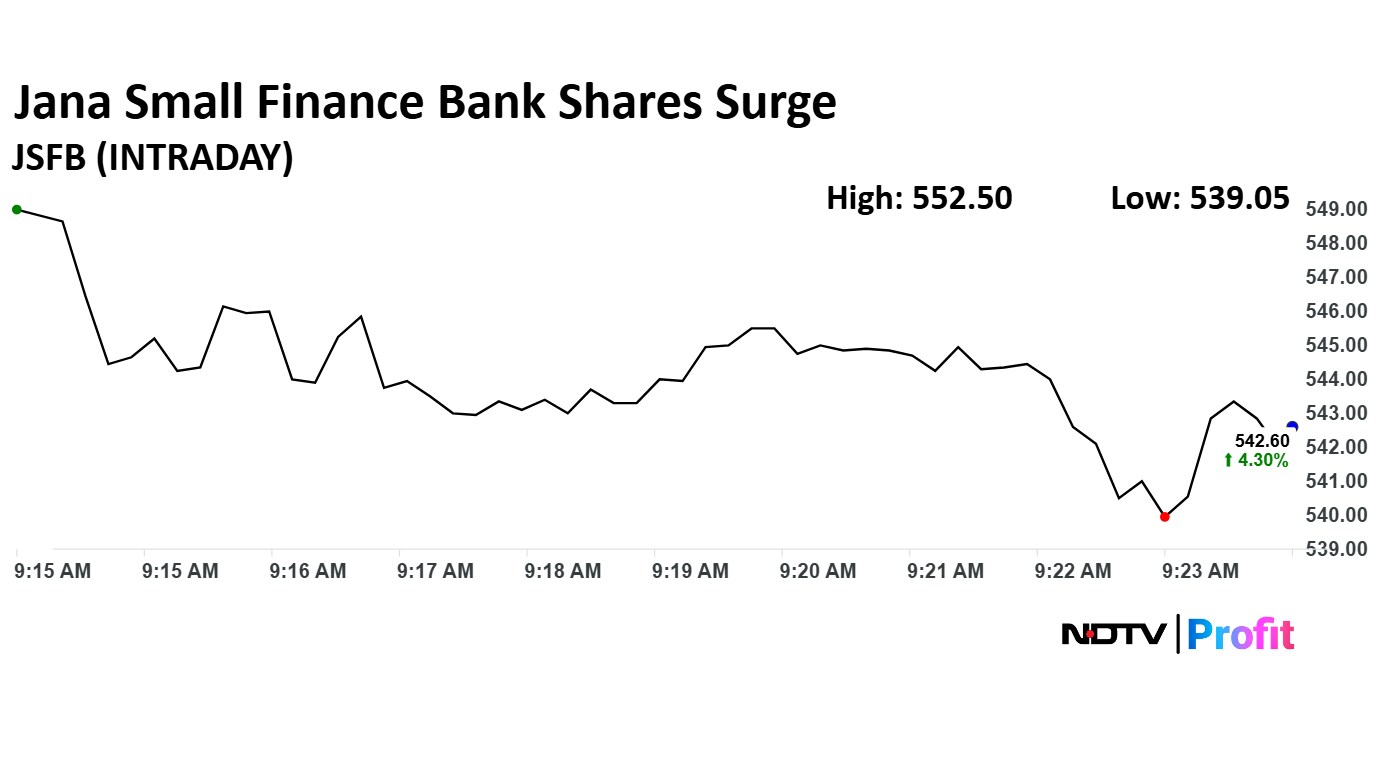

Jana Small Finance Bank Share Price Today

The scrip rose as much as 6.20% to Rs 552.50 apiece, the highest level since Oct. 17, 2024. It pared gains to trade 4.34% higher at Rs 542.85 apiece, as of 09:24 a.m. This compares to a 0.14% advance in the NSE Nifty 50 Index.

Share price has risen 28.84% on a year-to-date basis but has dipped 35.08% in the last 12 months. The relative strength index was at 72.13.

Out of four analysts tracking the company, three maintain a 'buy' rating, and one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.