ITC Ltd.'s share price rose nearly 2% following the release of its fourth-quarter financial results. The company's performance showcased mixed outcomes, with revenue growth, but pressured margins due to rising input costs.

For the quarter ended March, ITC reported a 9.6% increase in standalone revenue, reaching Rs 17,248 crore, surpassing the estimated Rs 16,979.7 crore.

However, ITC's earnings before interest, taxes, depreciation, and amortisation rose by only 2.5% to Rs 5,987 crore, slightly below the estimated Rs 6,017.7 crore. The Ebitda margin contracted to 34.7% from 37%, falling short of the anticipated 35.4%.

The margin compression was primarily due to higher prices of key inputs such as edible oil, wheat, maida, potato, cocoa, leaf tobacco, and pulpwood, especially in the latter half of the fiscal.

The standalone profit from continued operations for India's largest cigarette manufacturer stood at Rs 4,874 crore for the quarter, marking a modest 0.8% increase from Rs 4,837 crore in the same period last year. This figure was slightly below the consensus estimate of Rs 4,942.6 crore tracked by Bloomberg.

A significant highlight of the quarter was ITC's exceptional gain of Rs 15,179 crore from the sale of its hotels' business. This one-time gain propelled the company's overall net profit to Rs 19,561 crore, representing a 290% year-on-year surge.

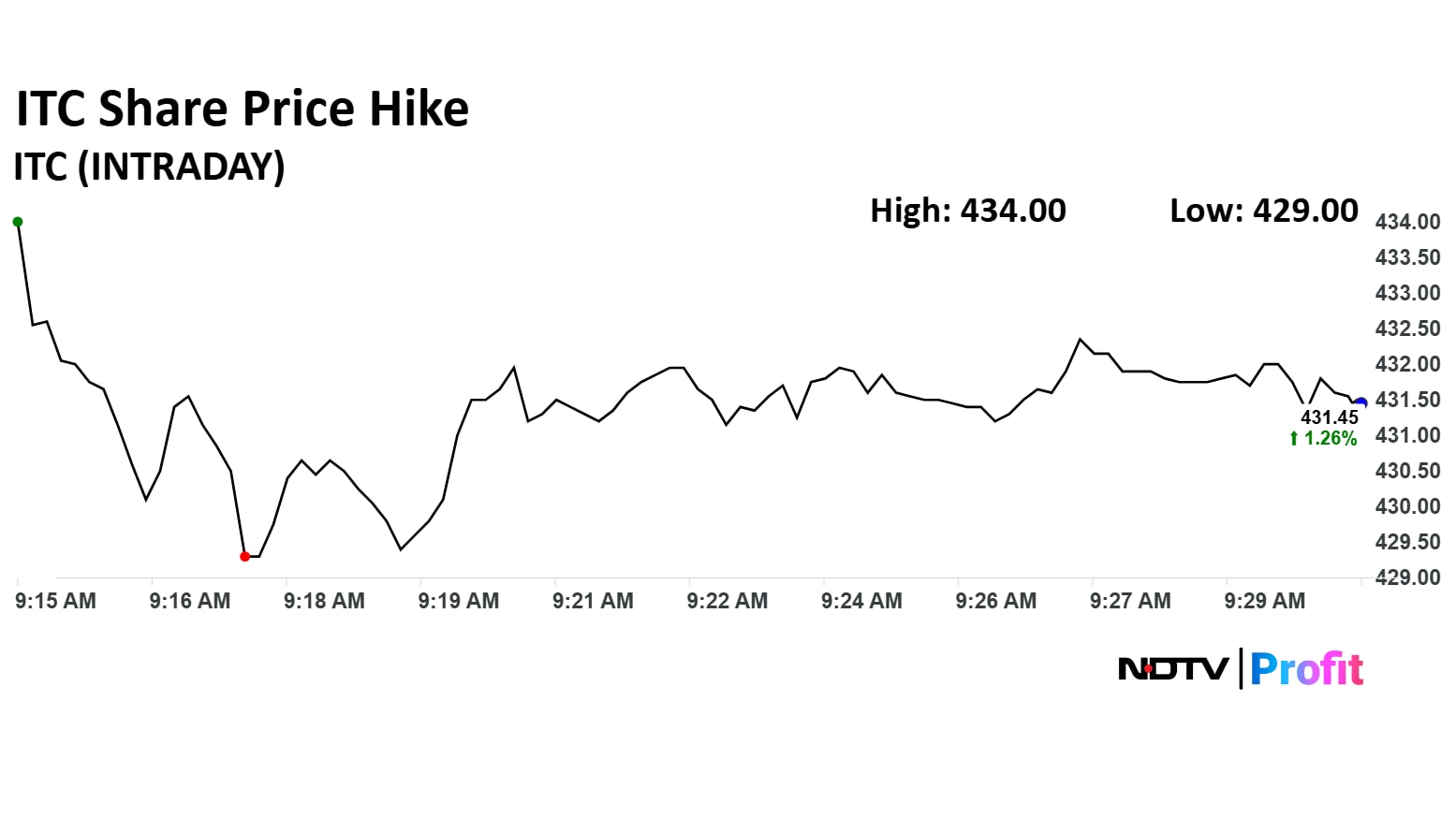

ITC Share Price Today

The scrip rose as much as 1.85% to Rs 434 apiece. It pared gains to trade 1.27% higher at Rs 431 apiece, as of 09:26 a.m. This compares to a 0.40% advance in the NSE Nifty 50.

It has risen 3.38% in the last 12 months. Total traded volume so far in the day stood at 0.24 times its 30-day average. The relative strength index was at 53.

Out of 40 analysts tracking the company, 38 maintain a 'buy' rating, one recommends a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 15.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.