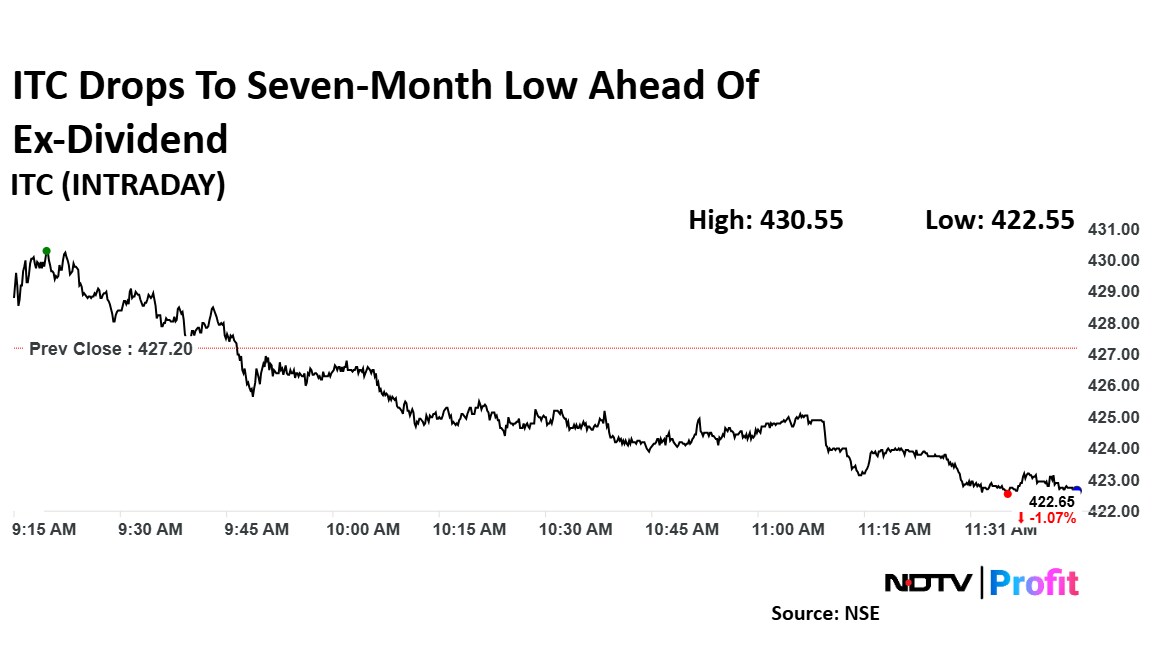

Shares of ITC Ltd. were trading at a seven-month low ahead of ex-date and record date for the interim dividend payout. This also made today the last day for investors to purchase shares to qualify for corporate action.

ITC had declared a dividend of Rs 6.50 per equity share, with a face value of Rs 10, and the record date for eligibility is set for Wednesday, Feb. 12.

Under the T+1 settlement mechanism, investors must ensure their purchase is completed a day before the record date. This means shares bought on Tuesday will be settled in time for shareholders' names to appear on the company's records on Wednesday, securing their entitlement to the dividend.

ITC had announced the interim dividend on Feb. 6. This comes after a final dividend of Rs 7.50 per share in June 2024, disbursing Rs 9,383.78 crore to shareholders.

Investors aiming to benefit from the dividend must ensure their purchases are completed on Tuesday to be included in the company's shareholder records on the record date.

ITC Q3 FY25 Highlights (Consolidated, YoY)

The company posted a 1.18% year-on-year increase in its consolidated net profit to Rs 5,638.25 crore, compared to Rs 5,572.07 crore in the year-ago period.

The standalone revenue rose 8.45% year-on-year to Rs 18,290.24 crore, as compared to Rs 16,864.34 crore in the year-ago quarter. Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 1.55% year-on-year to Rs 5,828.4 crore. The Ebitda margin narrowed 216 points to 31.86%.

The firm also saw an exceptional item of Rs 12.18 crore and tax expense of Rs 72.43 crore from discontinued operations.

ITC Share

Shares of ITC fell as much as 1.08% to Rs 422.60 apiece, the lowest level since July 10. It pared losses to trade 1.02% lower at Rs 422.85 apiece, as of 11:34 a.m. This compares to a 0.56% decline in the NSE Nifty 50.

The stock has risen 10.16% in the last 12 months. The relative strength index was at 36.

Out of 40 analysts tracking the company, 35 maintain a 'buy' rating, three recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 20.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.