Shares of ITC Hotels Ltd. fell over 2% on Friday, after British American Tobacco Plc, the largest shareholder in ITC Ltd., confirmed that it will soon be reducing stake in the hotels business.

During the earnings con-call of the company, Chief Executive Officer, Tadeu Marroco, said that it will be looking to divest at the right moment. "We will be divesting, and we will be using proceeds to make sure that we get to the leverage corridor of 2.5 and 2 by 2026," Marroco said.

BAT has no interest in being a long-term shareholder of the hotel chain, he said. The firm will decide when the best moment is to maximise shareholder value, he added.

BAT holds 15.27% stake in ITC Hotels, post its recent de-merger. In March 2024, the firm had reduced its stake in ITC from 29.1% to 25.46%.

It had already been looking to unlock ITC's shares, as it provides financial flexibility to the group. "This is the largest asset in our balance sheet," said Marroco.

The global cigarette maker is following a strategy that allows the company to generate cash and pursue buyback programme. A foreign direct investor in ITC, BAT intends to retain its stake in the company.

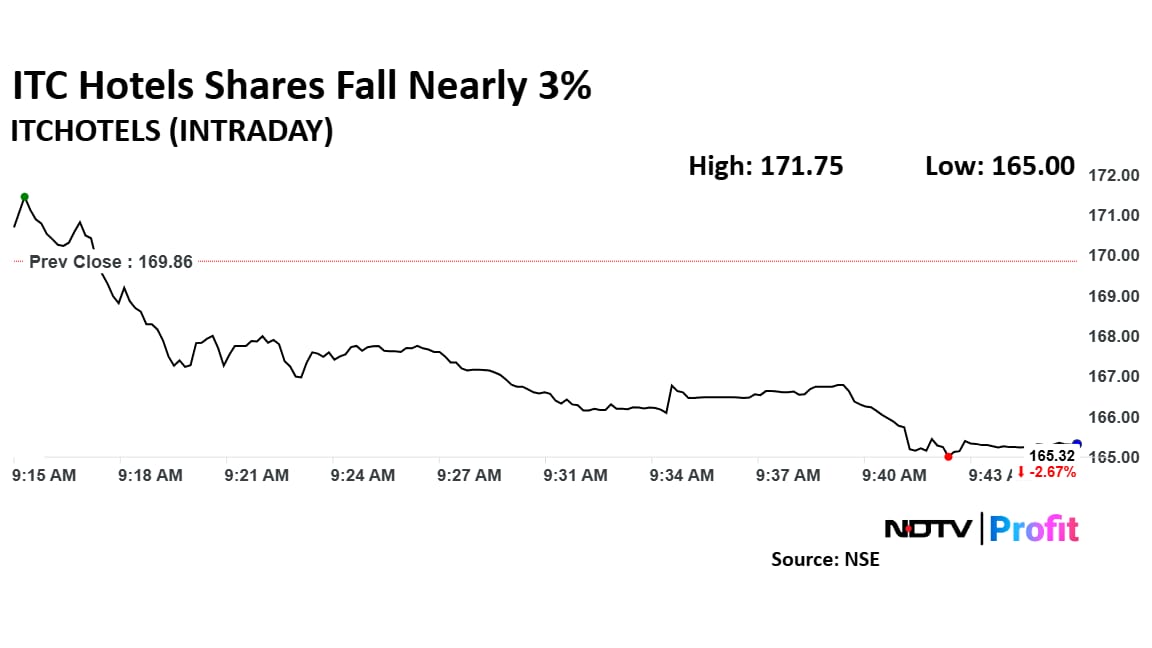

ITC Hotels Share Price

Shares of ITC Hotels fell as much as 2.86% to Rs 165 apiece, the lowest level since Feb. 5. They pared loss to trade 2.71% lower at Rs 165.24 apiece, as of 9:45 a.m. This compares to a 0.01% decline in the NSE Nifty 50.

The stock has risen 3.32% since its listing. The relative strength index was at 45.

The one analyst tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 43.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.