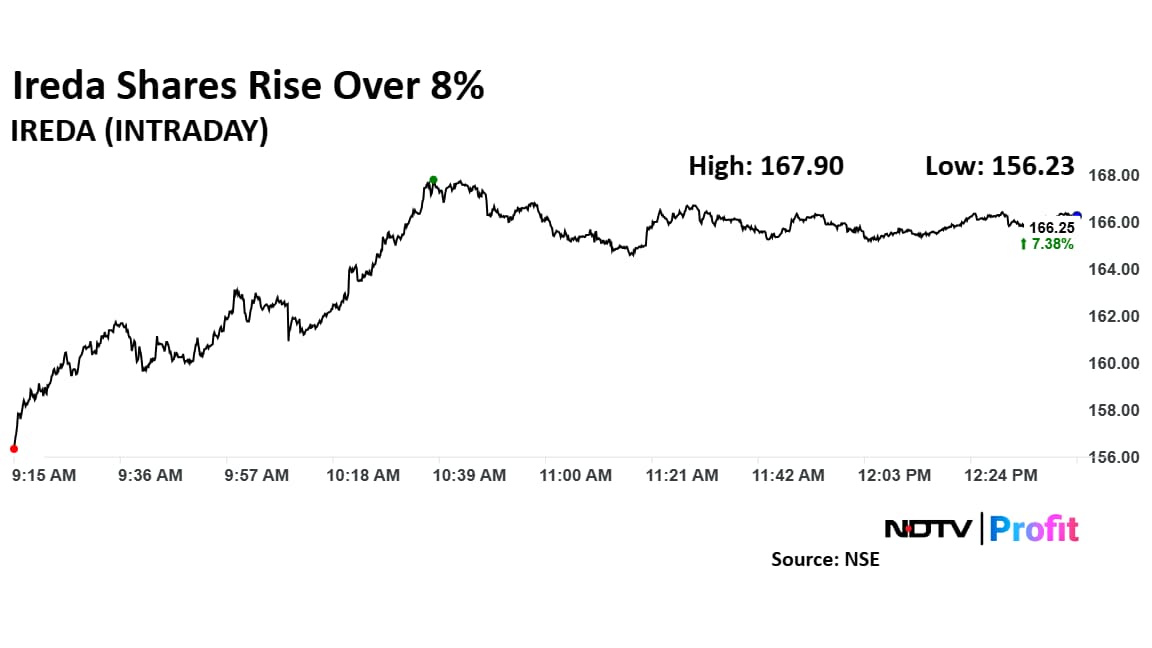

Shares of Indian Renewable Energy Development Agency Ltd. rose over 8% on Monday to hit near one-month-high due to a strong spike in trading volumes.

This marked the second consecutive day of major gains for Ireda's stock, after it rose over 3% on Friday. The scrip has risen by 12.55% over the past week and by 20% over the last six sessions.

The non-banking financial company last week launched its first-ever issue of perpetual bonds for an amount of Rs 1,247 crore at an annual coupon rate of 8.40%.

The company, in addition, announced that it has received a partial refund of Rs 24.48 crore on March 19, from the Income Tax Department for the partial relief granted for Assessment year 2011-12 relating to certain disallowances.

It also added that a refund of Rs 195 crore in under process by Commissioner of Income Tax (Appeals), which is yet to be received.

Earlier this month, the company announced that it will raise an additional Rs 5,000 crore through debt instruments as it hiked the borrowing limit for the current financial year. This was after the borrowing limit for the fiscal increased from Rs 24,200 crore to Rs 29,200 crore.

Ireda Share Price Rises

The shares of Ireda rose as much as 8.45% to Rs 167.90 apiece on the NSE, the highest level since Feb 27. It pared some of the gains to trade 7.29% higher at Rs 166.11 apiece, as of 12:31 a.m. This compares to a 1.26% advance in the benchmark Nifty 50 Index.

The stock has risen by 18.02% in the last 12 months and fallen 25.05% year-to-date. Total traded volume so far in the day stood at 3.4 times its 30-day average. The relative strength index was at 56.

Out of two analysts tracking the company, one maintains a 'buy' rating and one suggest 'sell,' according to Bloomberg data. The average of 12-month consensus price target implies a potential upside of 21%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.