Shares of Indian Renewable Energy Development Agency Ltd. rose over 2% on Tuesday after the company's outstanding loan book surged 27% at Rs 79,960 crore, the company said in its business updates for first quarter of the financial year ending March 2025-26.

Ireda sanctioned Rs 11,740 crore loans in the first quarter of fiscal 2026, 29% rise from Rs 9,136 crore in the same period last year, the compant said.

The company reported a 31% year-on-year increase in loan disbursements, reaching Rs 6,981 crore in the June quarter, up from Rs 5,326 crore during the same period in fiscal 2025.

Ireda's outstanding loan book stood at Rs 79,960 crore, reflecting a 27% rise for April-June period from Rs 63,207 crore in the year ago period.

In June, Ireda set the floor price for the share sale to institutional investors to raise funds worth Rs 5,000 crore that was conducted through qualified institutional placement. The board set the floor price of Rs 173.83 per share, offering a discount of not more than 5% on the floor price.

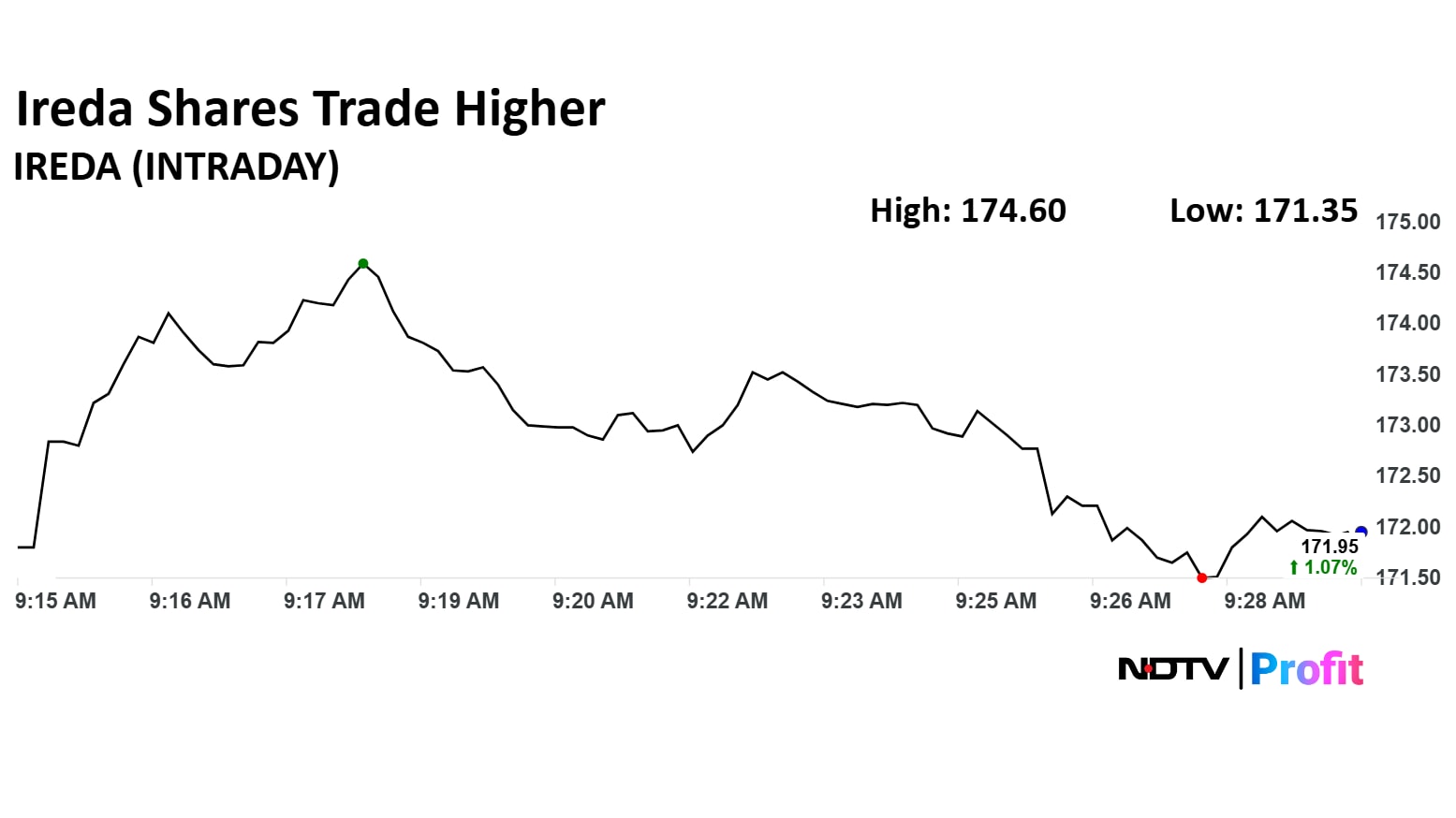

Ireda Share Price

Shares of Ireda rose as much as 2.63% to Rs 174.60 apiece. They pared gains to trade 1.07% higher at Rs 171.95 apiece, as of 9:30 a.m. This compares to a 0.23% advance in the NSE Nifty 50.

The stock has fallen 12.36% in the last 12 months and 20.21% year-to-date. Total traded volume so far in the day stood at 4.19 times its 30-day average. The relative strength index was at 35.

Out of two analysts tracking the company, one maintain a 'buy' rating and one recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an downside of 13.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.