Indian Railway Catering and Tourism Corp.'s share price rose nearly 5% as it received an 'outperform' rating from Macquarie, as the brokerage initiated coverage with a target price of Rs 900 per share. This target represents a potential upside of 16.9% from the stock's closing price on Thursday. The stock could see returns twice as large, as India progresses with modernising its railway infrastructure, according to Macquarie.

The brokerage's optimistic outlook hinges on the potential for growth exceeding its base case of a 12% three-year revenue compound annual growth rate, should the Government of India accelerate its railways upgrade plans.

IRCTC's dominant position in the Indian railways e-ticketing and catering sectors has contributed to its robust cash position, according to the brokerage. The company controls an 80% share in the railway e-ticketing market and benefits from a free cash flow margin of 30%, along with a 30% return on capital employed and return on invested capital. These advantages are achieved with minimal capital expenditure.

Macquarie highlighted that IRCTC generates a fixed commission fee for each ticket sold, based on factors like seat class and payment method, and also earns additional revenue from its 20% share of indirect sales through third-party online travel agents.

In terms of profitability, Macquarie estimates that IRCTC's EBIT margin will be in the range of 80-85% for its e-ticketing segment, while the catering business will see margins between 12-15%. The brokerage also expects IRCTC to provide a higher dividend payout due to its strong cash position.

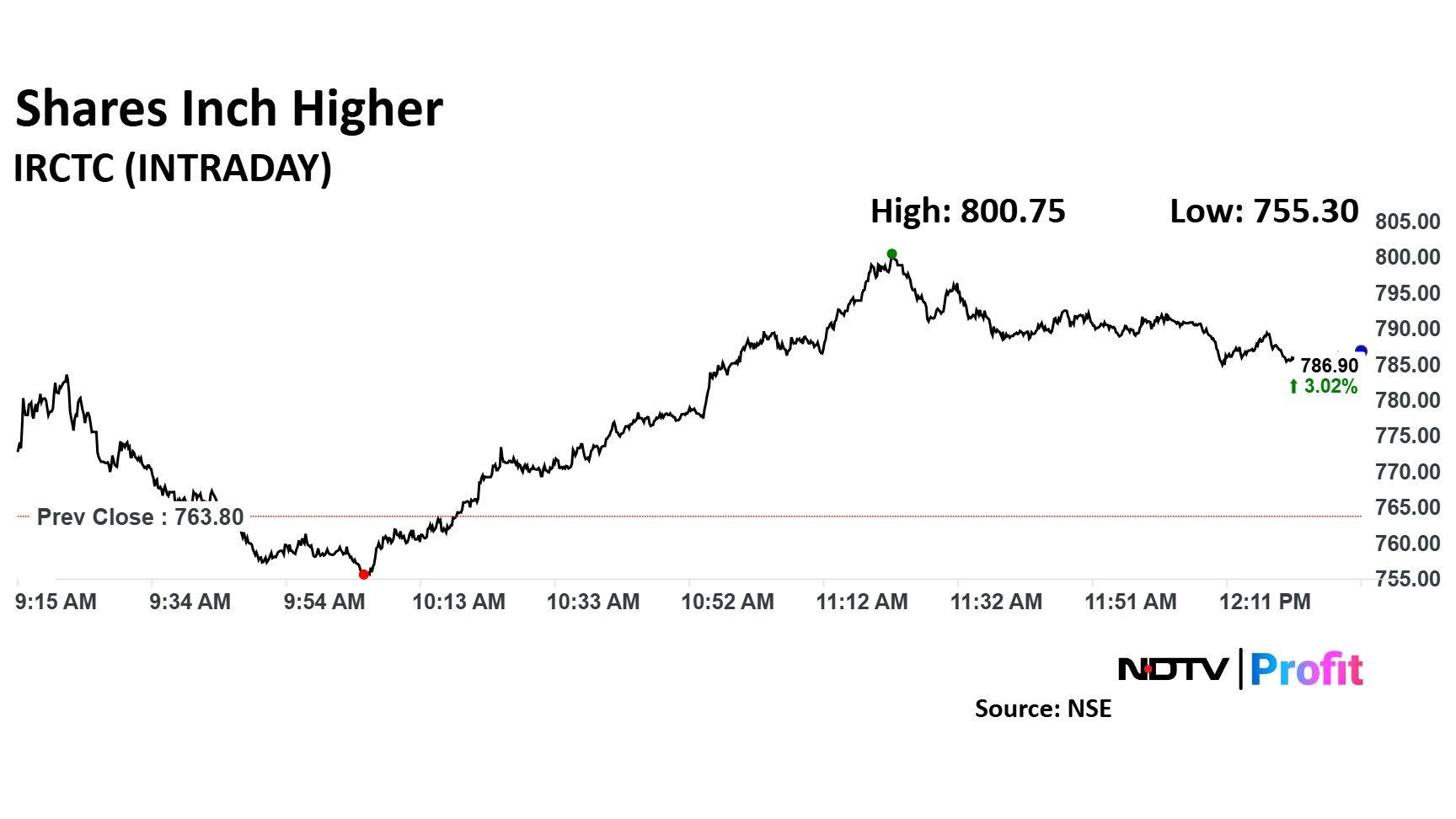

IRCTC Share Price Today

The scrip rose as much as 4.84% to Rs 800.75 apiece. It pared gains to trade 2.91% higher at Rs 786 apiece, as of 12:27 p.m. This compares to a flat in the NSE Nifty 50.

It has fallen 16.53% in the last 12 months. Total traded volume so far in the day stood at 9.2 times its 30-day average. The relative strength index was at 45.

Out of nine analysts tracking the company, four maintain a 'buy' rating, two recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 7.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.