IT stocks advanced on Thursday after the US Federal Reserve projected two more rate cuts this year, following its meeting. The central bank's decision to keep interest rates unchanged while signalling future cuts has boosted investor sentiment in the technology sector. In American, Nasdaq closed 1.70% higher on Wednesday.

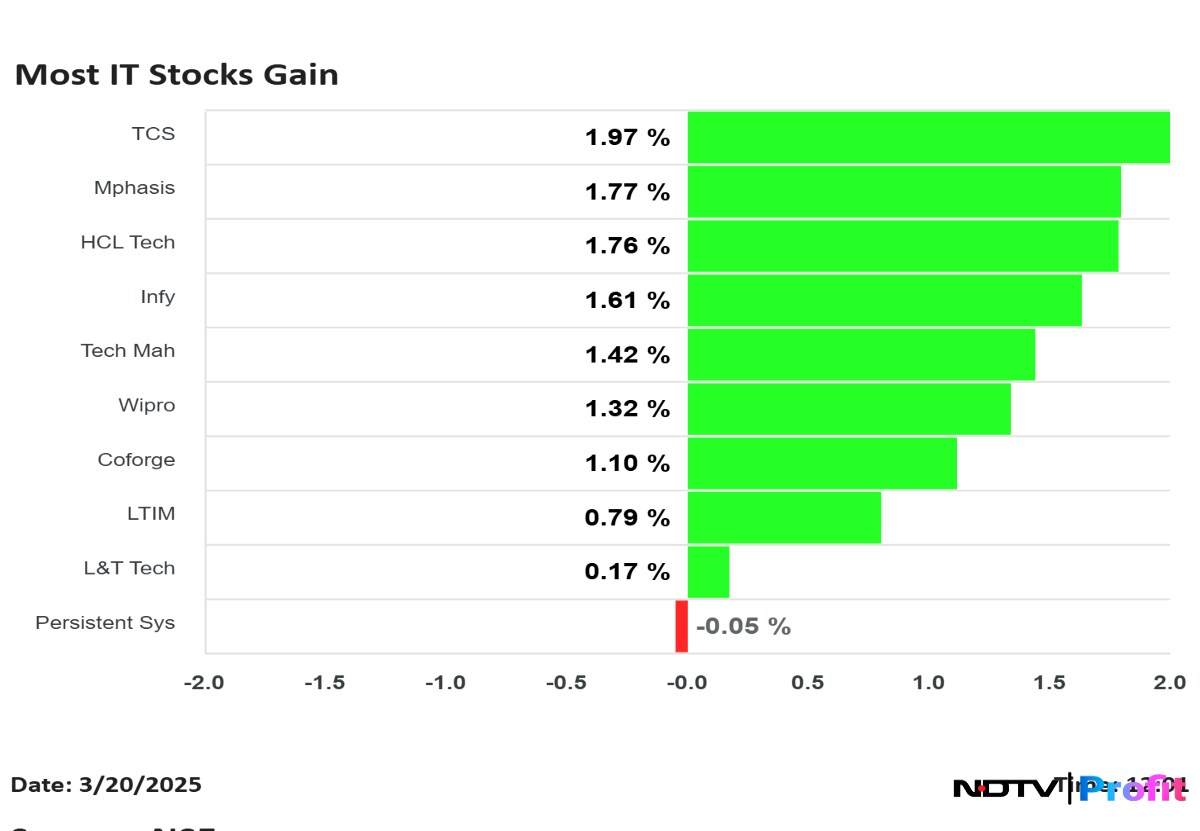

Among the top gainers, Mphasis Ltd. saw the highest increase, with its share price rising by 3.66% to Rs 2,369.60. The stock later pared gains to trade 1.89% higher at Rs 2,329.10 apiece during afternoon trade.

LTIMindtree Ltd. followed closely, climbing 3.43% to Rs 4,515 before paring gains to trade 0.82% higher. Wipro stock was up 3.11% to Rs 273.95. Coforge Ltd. and Infosys Ltd. were other notable gainers, rising by 3.04% and 2.86% respectively.

The US Federal Reserve maintained the benchmark interest rate in a target range of 4.25–4.50% during its latest policy meeting. The decision aligns with the Fed's December projections, indicating only two rate cuts this year amid increased economic uncertainty. The Fed remains prepared to adjust policy if risks emerge that could impede its goals, particularly as trade tensions rise under President Donald Trump's administration.

Fed Chair Jerome Powell noted that higher inflation expectations were partly due to tariffs imposed by Trump. The Fed has downgraded its economic growth outlook while raising its inflation projection. This cautious approach aims to balance growth and inflation concerns, providing a favourable environment for IT stocks to thrive.

A lower interest rate could reduce borrowing costs and stimulate economic activity, further supporting the technology sector's growth. Additionally, the anticipated rate cuts are expected to enhance liquidity in the market, making it easier for companies to finance their operations and expansion plans.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.