Shares of Indian technology companies led the decline on Dalal Street on Thursday, after overnight GDP and inflation data in the US backed the Federal Reserve's cautious approach to rate cuts.

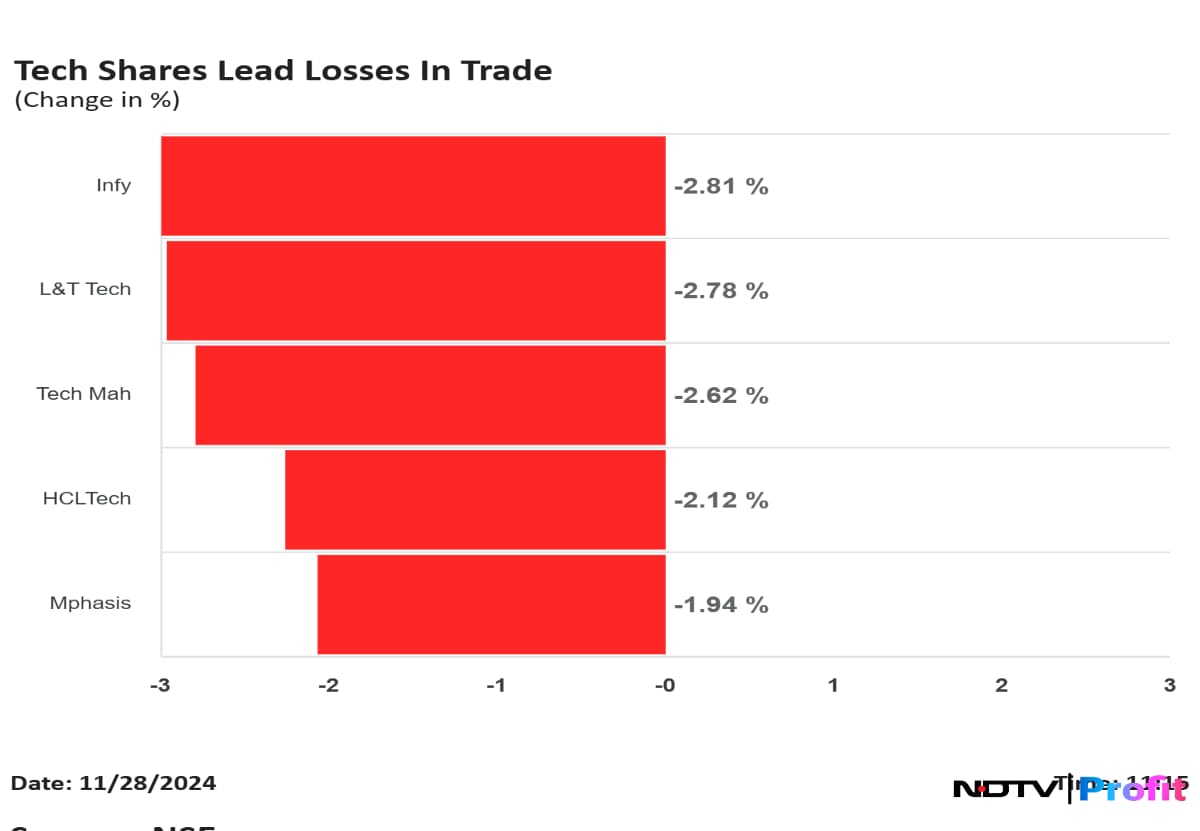

The benchmark gauge for tech shares—Nifty IT—fell as much as 2.12% during the day, led by bellwether Infosys Ltd. and Tech Mahindra Ltd. which slipped over 2.5%.

The US economy expanded at a solid pace in the third quarter driven by a broad-based advance in consumer spending. After the Fed cut interest rates in the last two FOMC meets to engineer a soft landing, the GDP rose at a 2.8% annualised pace in the third quarter, meeting estimates.

In another set of data, the Fed's preferred measure of underlying inflation picked up even when it was in line with estimates. The US core personal consumption expenditures climbed 2.8% from October last year.

These two latest data points will allow the Fed to hold its rates until inflation is completely below its threshold. Indian companies would stand to gain from rate cuts by the Fed as more orders are likely from improved business prospects in the US.

The technology sector was the top laggard in trade followed by auto and pharma stocks.

Infosys's stock fell as much as 3.05% during the day, while L&T Technology Services Ltd. and Tech Mahindra Ltd. fell by 2.33% and 2.85%, respectively. This compares to a 0.73% decline in the benchmark Nifty 50.

Excluding Coforge Ltd., all counters in the Nifty IT slipped over 1% each with market capitalisation of the index down by over Rs 73,200 crore during midday.

However, Nifty IT rose over 6.64% since the beginning of the month amid a broad-based decline, with global funds offloading domestic stocks. During the same period, the Nifty 50 declined by 0.64%. The IT space saw an inflow of $366 million from foreign investors in the first half of November, according to data from National Securities Depository Ltd.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.