IndusInd Bank Ltd.'s share price rose as high as 5.73% on Wednesday after Nomura Holdings upgraded its stance on the stock from 'neutral' to 'buy'. Additionally, the brokerage has also hiked the price target for IIB from Rs 700 to Rs 1,050.

"The commitment from the board to improve governance, the ongoing search for a new leadership and the clear intent to 'start FY26F on a clean slate' are crucial positive signs," the brokerage stated in its report.

The past few months have been turbulent for IndusInd Bank, owing to governance concerns and accounting lapses, it noted. However, the bank has executed a significant clean-up of its books and has taken one-time provisions to address legacy issues, added Nomura.

It compared IndusInd Bank's case with the likes of RBL Bank Ltd. (which went through a leadership change in 2021), and Yes Bank Ltd. (which went through a leadership change in 2018), and said that while leadership exits for the latter two banks were triggered mainly on account of market concerns over asset quality, the stock performance became muted for a short term, but revived over medium term as fundamentals improved.

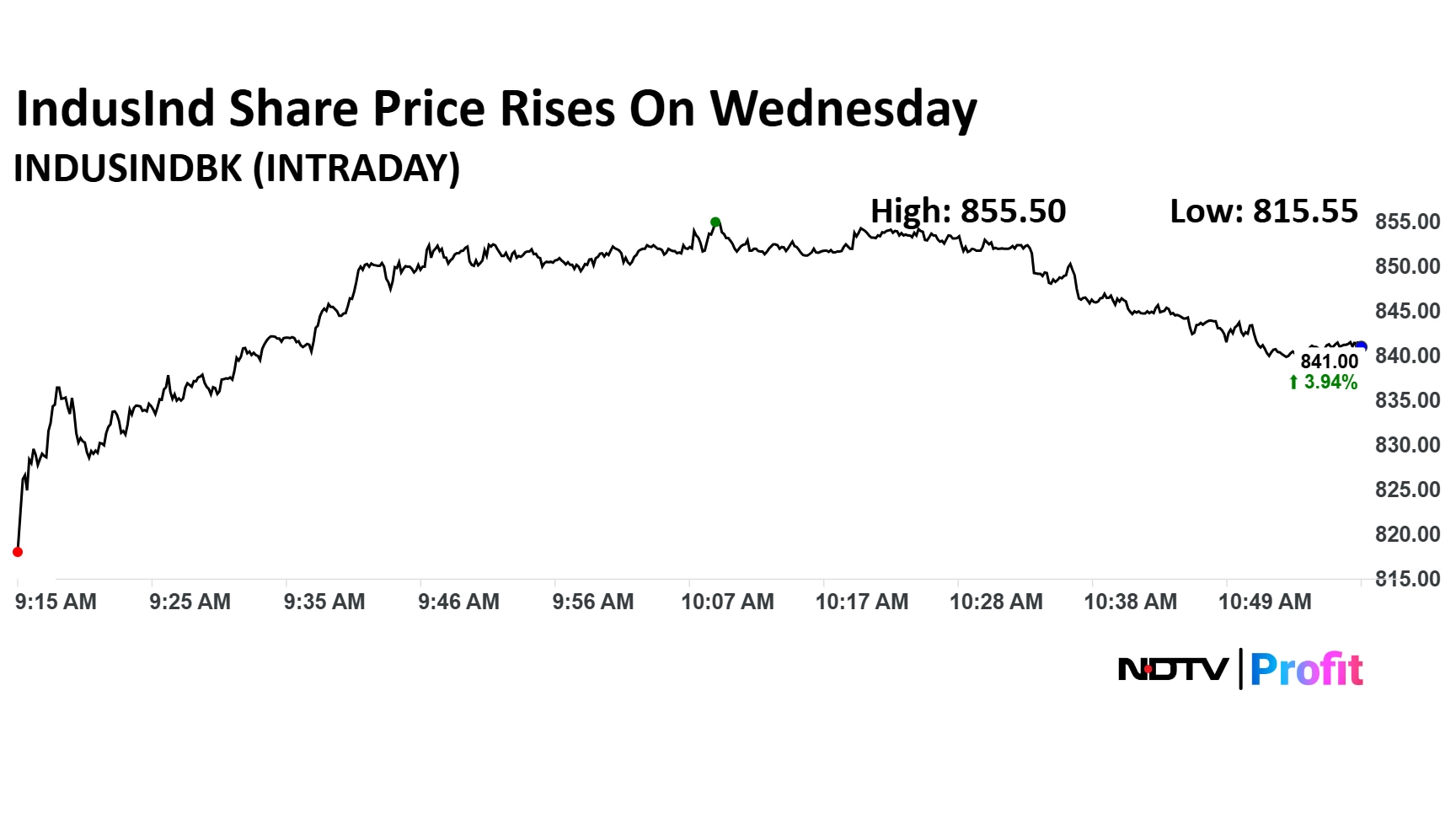

IndusInd Bank Share Price Today:

The scrip rose as much as 5.73% to Rs 855.50 apiece, the highest level since June 10, 2025. It pared gains to trade 4.03% higher at Rs 841.75 apiece, as of 11 a.m. This compares to a 0.08% decline in the NSE Nifty 50 Index.

Share price has risen 12.39% on a year-to-date basis, and is down 44.33% in the last 12 months. Total traded volume so far in the day stood at three times its 30-day average. The relative strength index was at 58.41.

Out of 46 analysts tracking the company, 10 maintain a 'buy' rating, 14 recommend a 'hold,' and 22 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 11%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.