The shares of IndusInd Bank Ltd. fell over 6% on Tuesday on report that the lender will conduct a second audit to probe a Rs 600 crore discrepancy in accrued interest income from its microfinance portfolio.

The lender has appointed EY to conduct an audit reported during the ongoing statutory audit for the previous year, the Economic Times reported quoting two people familiar with the matter. EY will examine whether there were any operational lapses or instances of fraud. NDTV Profit could not immediately verify this report.

This new probe will be alongside an ongoing audit of the irregularities in the accounting of IndusInd Bank's forex derivatives portfolio.

On March 10, the lender had disclosed that it had identified discrepancies in account balances within its derivative portfolio. An internal review had estimated an impact of approximately 2.35% of the bank's net worth as of December 2024. But the external agency's report, received earlier this month, revealed a financial impact of Rs 1,979 crore due to derivative accounting discrepancies. This figure represents 2.27% of the bank's net worth as of Dec. 31, 2024, and the bank plans to account for this impact in its fiscal 2025 results.

IndusInd Bank Share Price Declines

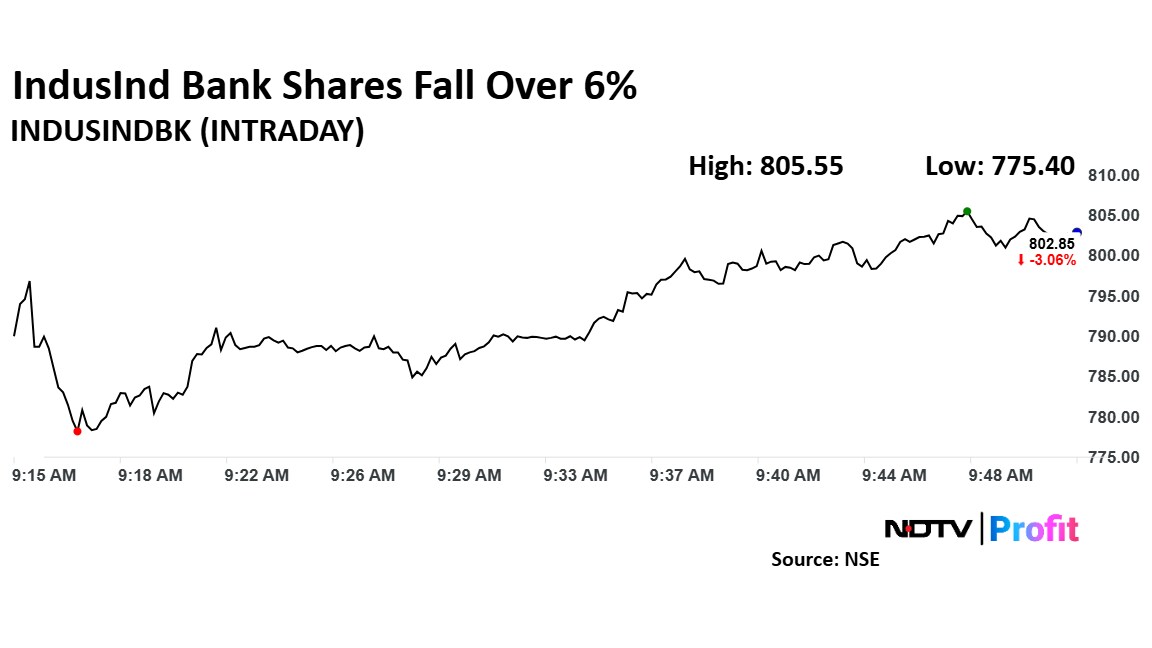

The shares of IndusInd Bank fell as much as 6.38% to Rs 775.40 apiece, the lowest level since April 16. It pared losses to trade 3.13% lower at Rs 801.35 apiece, as of 9:51 a.m. This compares to a 0.24% advance in the NSE Nifty 50 Index.

It has fallen 45.59% in the last 12 months and 16.11% year-to-date. Total traded volume so far in the day stood at 2.4 times its 30-day average. The relative strength index was at 61.33.

Out of 44 analysts tracking the company, 19 maintain a 'buy' rating, 18 recommend a 'hold,' and seven suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.