IndusInd Bank Ltd.'s share price declined after Goldman Sachs downgraded the stock rating to 'neutral' from 'buy', citing likely pressure on profitability going forward. The brokerage cut target price to Rs 1,090 apiece from Rs 1,318 apiece.

Goldman Sachs also reduced its earning per share estimate by 5%, 16%, and 18%, respectively, for financial years 2025, 2026, and 2027. Decline in IndusInd Bank's revenue growth will continue due to rising delinquencies in the commercial retail portfolio and slower loan growth, in line with sector trend. This is expected to weigh on profitability, which will lead to an average return on asset of 1.3% over financial years 2025–27 and earning per share growth of 1% CAGR over FY24-27E.

IndusInd Bank's valuation has corrected sharply, as investors have moved from focusing on price-to-earing and price-to-book ratio multiples due to limited near-term visibility on the earnings trajectory post third quarter earnings.

Shares of the lender are currently trading at one times FY26 estimated P/B, which seems fair for the return on asset of 1.3%, loan growth of 14% and ROES of 11%, according to Goldman Sachs.

IndusInd Bank reported a sharp decline in ROAs in second quarter of the current financial year, on account of lower net interest margin and higher credit costs. Loan growth especially in the high-yield segments, such as MFIs, is unlikely to recover over the next few quarters, with deteriorating asset quality trends broad-based, according to Goldman Sachs.

The brokerage expects NIMs to bottom out due to expected rate cuts in the first half of the calendar year 2025, which should offset slower fee income and higher credit costs, according to Goldman Sachs.

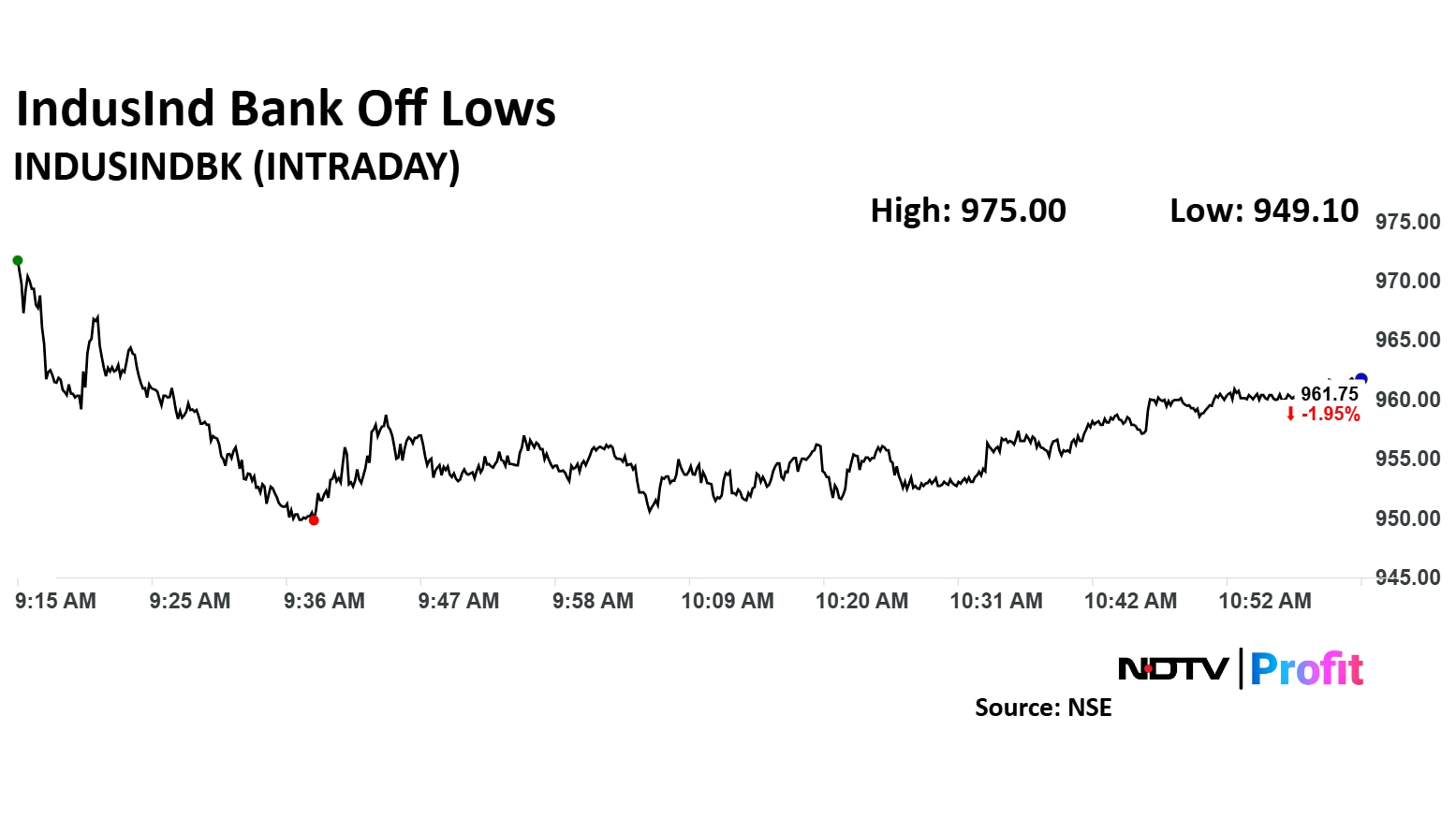

IndusInd Bank Share Price Today

IndusInd Bank's share price fell 3.24% to Rs 949.10, the lowest level since Dec. 31. It pared loss to trade 1.93% down at Rs 962.00 apiece as of 11:05 a.m., as compared to a 0.26% decline in the NSE Nifty 50.

The stock declined 41.35% in 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 42.90.

Out of 50 analysts tracking the company, 36 maintain a 'buy' rating, 12 recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 41.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.