Indus Towers Ltd.'s share price surged following the company's robust third-quarter results for the financial year 2025, with Citi analysts expressing optimism about its performance.

The mobile tower company reported a significant increase in its net profit, reflecting solid operational performance and positive developments in its business.

Citi analysts highlighted three key positives from Indus's Q3 results. The company saw a sharp jump in Ebitda from Rs 4,900 crore in the previous quarter to Rs 6,958 crore. This increase was primarily driven by the recovery of Rs 2,900 crore in past dues from Vodafone Idea (VI), including a Rs 1,900 crore lump sum payment received in January 2025. As a result, net income more than doubled from Rs 2,200 crore in Q2 to Rs 4,003 crore in Q3, surpassing analyst estimates.

Another positive development cited by Citi was the commencement of meaningful tenancy additions from Vodafone Idea. The company saw its tenancies jump to around 2,500-3,000, marking a significant improvement over previous quarters when tenancy additions were minimal. Indus confirmed that it had captured a dominant share of VI's rollout, which reassured analysts about its competitive position.

Citi also pointed out strong free cash flow generation, with FCF increasing sharply from Rs 1,400 crore in Q2 to Rs 2,700 crore in Q3. This growth is expected to continue in Q4, with the potential for a total FCF of Rs 20 per share in the second half of FY25, which could be paid out as dividends.

Indus Towers posted a consolidated net profit of Rs 4,003 crore for Q3FY25, more than doubling from Rs 1,540 crore in the same period the previous year. This result exceeded the analysts' estimate of Rs 1,907 crore, reflecting strong business fundamentals. Revenue for the quarter rose 4.4% year-on-year to Rs 7,547 crore, although slightly below analysts' projections of Rs 7,665 crore.

The company's operating profit, or Ebitda, saw a 94% year-on-year increase, reaching Rs 6,958 crore in Q3. This contributed to an expansion in the Ebitda margin, which rose from 49.8% to a robust 92.2%.

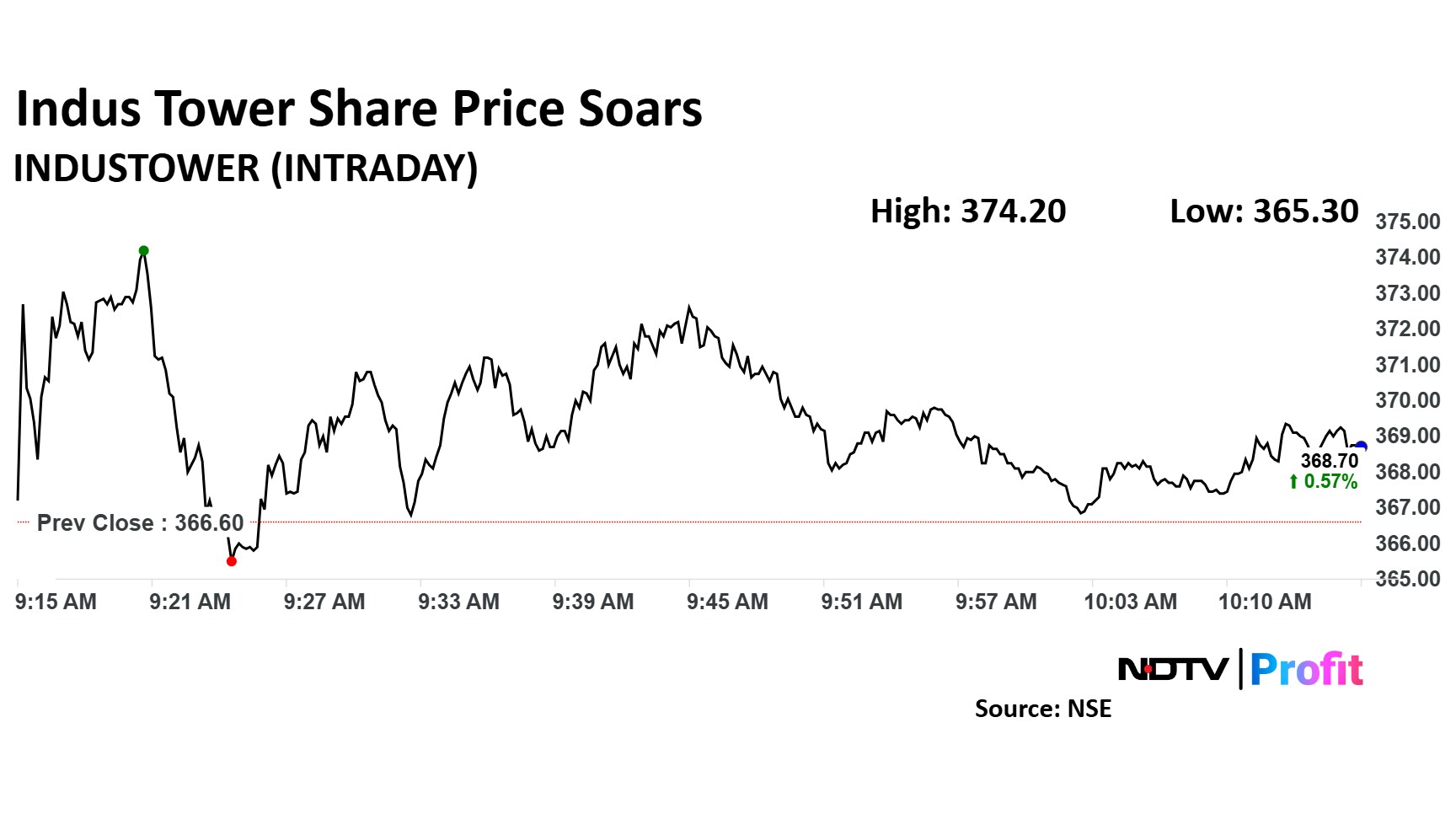

The scrip rose as much as 2.07% to Rs 374.20 apiece. It pared gains to trade 0.57% higher at Rs 368.70 apiece, as of 10:12 a.m. This compares to a 0.21% decline in the NSE Nifty 50 Index.

It has risen 60.34% in the last 12 months. Total traded volume so far in the day stood at 4.2 times its 30-day average. The relative strength index was at 61.7.

Out of 24 analysts tracking the company, 13 maintain a 'buy' rating, six recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.7%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.